Commercial Property Loans in Florida

Ranked #1 for commercial real estate investment, Florida has a thriving commercial real estate market, which is why it’s the ultimate hotbed for businesses and investors. Whether you’re looking to acquire a new property, refinance existing debt, or fund renovations, Insula Capital Group offers tailored commercial real estate loans in Florida to meet your specific needs.

Our team of experienced commercial mortgage brokers in Florida understands the vast array of opportunities in this market. Our team members are up to date on regulations, property values, and market trends, allowing us to provide informed guidance and competitive financing solutions.

At Insula Capital Group, we offer a wide range of commercial real estate loan products, including:

- Acquisition loans: Financing for the purchase of commercial properties.

- Refinancing loans: Helping you lower your interest rate or consolidate existing debt.

- Construction loans: Funding for new construction or renovation projects.

- Bridge loans: Short-term financing to bridge the gap between the sale of one property and the purchase of another.

Contact us today to learn more about how Insula Capital Group can help you achieve your commercial real estate goals in Florida.

Work with Expert Commercial Mortgage Brokers in Florida

Choosing commercial real estate loans and financing in Florida means it’s crucial to partner with a reputable and experienced mortgage broker. A knowledgeable, professional broker can provide consistent guidance, negotiate favorable terms, and successfully work on lending and borrowing.

Insula Capital Group is a trusted commercial mortgage broker in Florida, offering unmatched experience and expertise. We’re deeply immersed in Florida’s commercial real estate market, industry trends, and lender requirements, understanding the demands of investors. We work to provide the most beneficial financing options for our clients, taking into account their individual needs and financial goals.

Here’s why you should choose Insula Capital Group:

- Our team has a proven track record of successfully closing commercial real estate loans in Florida.We stay up-to-date on industry trends and regulatory changes to ensure that our clients receive the most informed advice.

- We believe in providing personalized attention to each of our clients, creating a unique financing strategy that reflects your goals as a commercial real estate investor or business owner.

- Our experienced commercial real estate mortgage brokers in Florida are skilled negotiators who can help you secure favorable terms on your commercial loan. We’ll work tirelessly to get you the best possible deal.

- By partnering with us, you can increase your chances of securing the financing you need to achieve your commercial real estate goals in Florida.

Reach out to our experienced professionals for more information.

The Advantages of Private Commercial Loans in Florida

Given how Florida’s vibrant commercial real estate market offers numerous opportunities for businesses and investors, securing the right financing is crucial to capitalizing on these opportunities. Private business property loans in Florida can be a valuable option.

Greater Flexibility with Terms

Unlike traditional bank financing, which often adheres to rigid guidelines, private commercial loans offer greater flexibility. Commercial mortgage brokers in Florida such as our company, can tailor loan terms to meet the specific needs of a borrower, accommodating unique financial situations or complex projects.

Faster Approvals and Turnaround

One of the significant advantages of private commercial loans is their speed. Private lenders may have faster decision-making processes compared to banks, allowing borrowers to access funds more quickly. This can be crucial for time-sensitive projects or when capital is needed urgently, such as refinancing, bridging, or securing an in-demand property quickly.

Cutting-Edge Rates and Terms

Furthermore, private commercial real estate loans in Florida can often offer more competitive interest rates than traditional bank financing.

Easily Personalized and Customized

In addition to these benefits, private commercial loans can provide a more personalized experience. Private lenders typically have smaller teams and may be more responsive to the needs of their borrowers. This can lead to a more collaborative and supportive relationship.

Accessible to a Variety of Borrowers

Finally, private commercial loans can be a good option for borrowers who may not qualify for traditional bank financing due to factors such as a shorter credit history or a less-than-perfect credit score. Private lenders may be more willing to consider factors beyond credit scores when evaluating loan applications, which is the ideal option for 3.1 million small businesses operating in Florida.

Overall, private commercial loans offer a range of advantages for businesses and investors seeking commercial real estate loans in Florida. Contact us if you’re looking to fund real estate ventures in the Sunshine State.

Insights into Commercial Property Loans in Florida

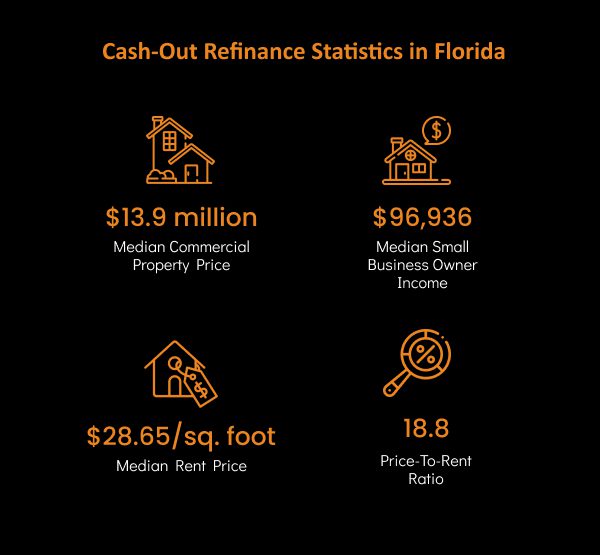

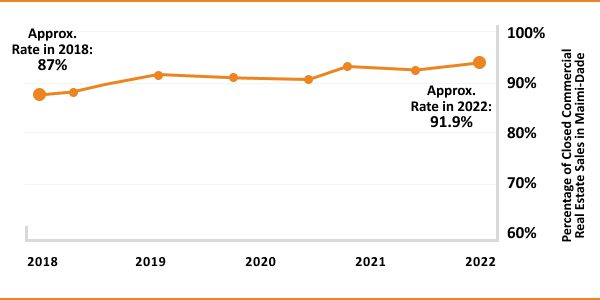

It’s vital for businesses and investors to understand the lay of the land when it comes to commercial property loans in Florida. Here’s an overview:

- Median Commercial loan rates in Florida: 5.87-10%

- Annual Commercial Property Revenue in 2020 Across the US: $992 billion

- Median ROI on Commercial Real Estate in the US: 9.5%

Just Funded Projects

We are a leading nationwide private lender & real estate investment company.

- Fix & Flip

- July 2022Washington, DC

| Purchase Price: | $255,000 |

| Renovation Budget: | $80,000 |

| Loan Amount: | $296,750 |

| After Repair Value: | $450,000 |

- Fix & Flip

- June 2022Weiser, ID

| Purchase Price: | $170,000 |

| Renovation Budget: | $59,000 |

| Loan Amount: | $207,000 |

| After Repair Value: | $309,000 |

- Fix & Flip

- July 2022Washington, DC

| Purchase Price: | $255,000 |

| Renovation Budget: | $80,000 |

| Loan Amount: | $296,750 |

| After Repair Value: | $450,000 |

- Fix & Flip

- June 2022Weiser, ID

| Purchase Price: | $170,000 |

| Renovation Budget: | $59,000 |

| Loan Amount: | $207,000 |

| After Repair Value: | $309,000 |

Multifamily/Mixed Use

Fix & Flip Calculator

Fix & Flip Financing

New Construction

Hard Money Loan

Residential Rental Program (Buy & Hold)

Private Lending Done Right.

A leading nationwide private lender & real estate investment company.

Partnering with Reliable Commercial Real Estate Brokers in Florida

Insula Capital Group is a trusted name in Florida’s commercial real estate scene, offering a wealth of experience and personalized service. Our goal is to offer flexible business property loans and the best commercial loan rates in Florida.

Before deciding to work with us as your commercial real estate brokers, consider the fact that Insula Capital Group excels in various facets of this role. Our team of experienced professionals has a deep understanding of the Florida market and a strong network of lenders. We are committed to providing personalized service and helping our clients achieve their commercial real estate objectives.

By partnering with Insula Capital Group, you can increase your chances of finding the right commercial property and securing the financing you need to succeed in Florida’s dynamic market.

Contact us today to schedule a consultation and explore your financing options.

Frequently Asked Questions

You can fill out our company’sonline application form to get started on commercial real estate loans in Florida.

Insula Capital Group provides loans for the following projects:

Contact Insula Capital Group for Flexible Commercial Loan Rates in Florida

Ready to invest in Florida’s booming commercial real estate market? Insula Capital Group is your trusted partner for expert guidance and tailored financing solutions. Our experienced team offers competitive rates, personalized service, and a deep understanding of the Florida market.

Contact us between 9 am and 5 pm from Monday to Friday to schedule a consultation and explore how we can help you achieve your real estate goals through commercial property loans in Florida.

Visit our website if you would like further information about our financing deals.