Commercial Property Loans in New York

New York City’s commercial real estate market continues to thrive, driven by strong economic growth, a vibrant business environment, and a steady influx of investors. The city’s diverse range of commercial properties, from iconic skyscrapers to bustling retail spaces, offers numerous investment opportunities at a time when real estate is increasingly harder to access and is becoming a high-value asset.

Insula Capital Group is well-positioned to help you capitalize on the New York City commercial real estate market through loans. We offer a variety of financing solutions, including acquisition loans, refinancing, construction loans, and bridge loans. Our team of experienced professionals understands the unique dynamics of the New York market and can provide tailored guidance to help you achieve your investment goals. Whether you’re a business owner looking to purchase your own workspace or a budding investor, our commercial mortgage brokers in New York know how to change the game.

Navigating the New York Commercial Real Estate Landscape with a Broker

New York City’s commercial real estate market is a labyrinth of opportunities and challenges. To find your way, you need an experienced commercial mortgage brokeralongside you.

An expert broker can provide invaluable insights into the unique characteristics of the New York market. From zoning regulations to neighborhood trends, their knowledge can help you make informed decisions about whether or not your month is going to the right place while also helping you secure commercial real estate loans in New York.

With their extensive network, brokers can connect you to the best lenders for your specific needs, whether you’re looking for a small business loan or a major acquisition.

Your broker will tailor their advice to your unique goals, ensuring you make informed decisions.

Ready to embark on your New York commercial real estate journey? Let Insula Capital Group be your trusted partner.

Contact our talented team for more information.

The Advantages of Working with Commercial Mortgage Brokers in New York

Navigating the complex and competitive commercial real estate market in New York requires the expertise of a reputable mortgage broker. A skilled broker can provide invaluable guidance, negotiate favorable terms, and help you secure the financing you need to achieve your investment goals.

Here are some of the key benefits of working with a commercial mortgage broker in New York:

Local Expertise and Market Insights

A New York-based broker has a deep understanding of the state’s unique market dynamics, including local regulations, property values, and market trends.

Commercial mortgage brokers in New York have strong relationships with a wide range of lenders, allowing them to access competitive rates and flexible terms. This means you’ll have more options to choose from and a greater chance of securing the best possible financing for your project.

Excellent Negotiators and Communicators

Experienced brokers are skilled negotiators who can help you secure favorable loan terms. They can negotiate lower interest rates, longer terms, or other beneficial provisions.

A reputable broker will take the time to understand your unique financial situation and investment goals. They can provide tailored advice and support throughout the loan process.

Greater Investments and Savings

Working with a broker can save you time and effort. They can handle much of the paperwork and administrative tasks associated with the loan application process.

By partnering with a reputable commercial property loan company in New York, you can increase your chances of securing the financing you need to succeed in the city’s dynamic commercial real estate market.

Ready to explore the best commercial loan rates for your New York project? Get in touch with us!

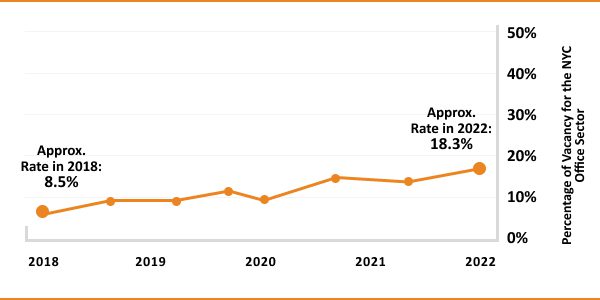

Data About Commercial Property Loans in New York

It helps to learn more about the current landscape for the commercial real estate market in New York:

- Median Commercial loan rates in New York: 5.87%-10%

- Annual Commercial Property Revenue in 2020 Across the US: $992 billion

- Median ROI on Commercial Real Estate in the US: 6%-12%

Just Funded Projects

We are a leading nationwide private lender & real estate investment company.

- Fix & Flip

- July 2022Washington, DC

| Purchase Price: | $255,000 |

| Renovation Budget: | $80,000 |

| Loan Amount: | $296,750 |

| After Repair Value: | $450,000 |

- Fix & Flip

- June 2022Weiser, ID

| Purchase Price: | $170,000 |

| Renovation Budget: | $59,000 |

| Loan Amount: | $207,000 |

| After Repair Value: | $309,000 |

- Fix & Flip

- July 2022Washington, DC

| Purchase Price: | $255,000 |

| Renovation Budget: | $80,000 |

| Loan Amount: | $296,750 |

| After Repair Value: | $450,000 |

- Fix & Flip

- June 2022Weiser, ID

| Purchase Price: | $170,000 |

| Renovation Budget: | $59,000 |

| Loan Amount: | $207,000 |

| After Repair Value: | $309,000 |

Multifamily/Mixed Use

Fix & Flip Calculator

Fix & Flip Financing

New Construction

Hard Money Loan

Residential Rental Program (Buy & Hold)

Private Lending Done Right.

A leading nationwide private lender & real estate investment company.

Choose Us to Be Your Partner in New York Commercial Real Estate Loans and Financing

Seeking out commercial real estate financing and loans in New York City can be challenging due to the competitive market and stringent lending requirements. With such a densely competitive market across the state, from NYC to Rochester, it’s crucial to find the right service provider.

However, with the right partner, you can navigate this complex landscape and secure the funding you need to achieve your investment goals seamlessly.

Insula Capital Group is a trusted name in New York commercial real estate financing. Our team of experienced commercial real estate brokers in New York has a deep understanding of the local market and a strong network of lenders. We are committed to providing personalized service and helping our clients secure competitive rates and flexible terms.

Why choose Insula Capital Group?

- Local Expertise:Our commercial real estate brokers in New York are always up to date on the local market, ensuring that they provide you with the most relevant advice.

- Personalized Service:We work closely with you to understand your unique financial situation and project goals. This allows us to tailor financing solutions that align with your needs.

- Competitive Rates:We have strong relationships with a variety of lenders, enabling us to offer competitive commercial loan rates in New York and flexible terms.

By partnering with Insula Capital Group, you can benefit from our expertise and competitive rates. We will work diligently to secure the best possible financing for your commercial real estate project in New York City.

Frequently Asked Questions

We’ve simplified the process of applying for a loan. You can fill out our online application form for commercial real estate loans in New York.

Our company offers financing for the following:

Reach Out to Insula Capital Group for Competitive Commercial Loan Rates in New York

Get in touch with Insula Capital Group for the most flexible, comprehensive commercial property loans in New York.

Reach out to us between 9 am and 5 pm on Monday to Friday to set up a consultation where you can share your needs and requirements and create a proposition to provide you with commercial property loans in New York.

Visit our websitefor more service details, insights, and details.