Commercial Property Loans in Texas

Texas, with its robust economy, growing population, and business-friendly environment, has become a highly attractive market for commercial real estate investment. The state’s diverse industries, including energy, technology, healthcare, and manufacturing, have fueled demand for office space, retail properties, industrial facilities, and logistics centers. It’s unsurprising that many business owners and investors are excited to explore the commercial real estate market in the region, whether it’s buying multifamily properties or office and retail spaces.

Major cities like Dallas, Houston, Austin, and San Antonio offer a variety of commercial real estate opportunities, catering to different investment preferences and risk tolerances. The state’s strong economic fundamentals, coupled with its affordable cost of living and favorable business climate, have made it a top destination for both domestic and international investors.

If you’re interested in investing, work with Insula Capital Group for commercial real estate loans in Texas.

Choose Seasoned Commercial Mortgage Brokers in Texas

Navigating the complex and competitive commercial real estate market in Texas requires the expertise of a reputable mortgage broker. The right broker will help you secure the ideal commercial real estate loan in Texas, allowing you to make decisions with confidence and clarity.

OurTexas-based commercial mortgage brokers hold a deep understanding of the state’s unique market dynamics, including local regulations, property values, and market trends. We know what Texans are looking for and can help you make smarter strategic decisions.

Alongside flexible commercial loan rates in Texas, our brokers will take the time to understand your unique financial situation and investment goals. They can provide tailored advice and support throughout the loan process.

Insula Capital Group offers comprehensive commercial real estate loans in Texas, providing personalized service and helping clients secure competitive rates and flexible terms.

By partnering with Insula Capital Group, you can increase your chances of securing the financing you need to succeed in the dynamic Texas commercial real estate market.

Reach out to us for more information.

Advantages of Commercial Real Estate Loans in Texas

Texas, with its robust economy, growing population, and business-friendly environment, offers numerous opportunities for commercial real estate investment. Obtaining a commercial real estate loan can provide the necessary capital to capitalize on these opportunities. Here are some of the key advantages of securing a commercial real estate loan in Texas:

Capitalization and Flexibility

Commercial property loans can provide the necessary funds for property acquisition, renovation, or expansion. They’re quicker and easier to access and don’t require a lengthy waiting period.

Strategic Leverage

By using borrowed funds, you can increase your potential return on investment and enjoy other benefits. Commercial real estate loans in Texas often come with tax benefits, such as depreciation deductions.

Increased Cash Flow and Benefits

Rental income from commercial properties can generate stable cash flow. Commercial real estate values tend to appreciate over time, offering potential for capital gains.

Investing in commercial real estate through loans in Texas can diversify your investment portfolio, reducing overall risk.

Insula Capital Group is a trusted partner for commercial real estate financing in Texas. You can contact us for commercial loans for your Texas project and kickstart your journey.

An Overview of Commercial Property Loans in Texas

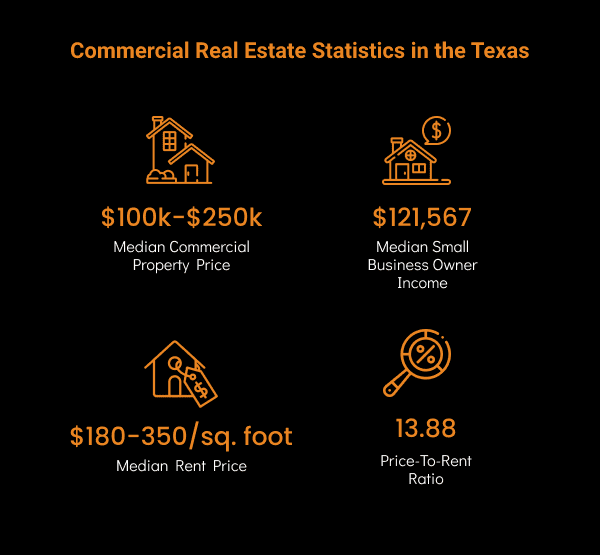

As you prepare for this venture, it’s crucial to understand what the market looks like:

- Median Commercial loan rates in Texas: 5.87%-10%

- Annual Commercial Property Revenue in 2020 Across the US: $992 billion

- Median ROI on Commercial Real Estate in the US: 9.5%

Just Funded Projects

We are a leading nationwide private lender & real estate investment company.

- Fix & Flip

- July 2022Washington, DC

| Purchase Price: | $255,000 |

| Renovation Budget: | $80,000 |

| Loan Amount: | $296,750 |

| After Repair Value: | $450,000 |

- Fix & Flip

- June 2022Weiser, ID

| Purchase Price: | $170,000 |

| Renovation Budget: | $59,000 |

| Loan Amount: | $207,000 |

| After Repair Value: | $309,000 |

- Fix & Flip

- July 2022Washington, DC

| Purchase Price: | $255,000 |

| Renovation Budget: | $80,000 |

| Loan Amount: | $296,750 |

| After Repair Value: | $450,000 |

- Fix & Flip

- June 2022Weiser, ID

| Purchase Price: | $170,000 |

| Renovation Budget: | $59,000 |

| Loan Amount: | $207,000 |

| After Repair Value: | $309,000 |

Multifamily/Mixed Use

Fix & Flip Calculator

Fix & Flip Financing

New Construction

Hard Money Loan

Residential Rental Program (Buy & Hold)

Private Lending Done Right.

A leading nationwide private lender & real estate investment company.

Guaranteeing Commercial Property Loans in Texas

When seeking commercial propertyloans in Texas, partnering with a reputable lender like Insula Capital Group is essential. Here are some valuable tips to help you secure a loan through our company:

- Prepare Thoroughly:Gather all necessary documentation, including financial statements, property appraisals, and business plans. This will demonstrate your financial stability and commitment to the project.

- Understand Your Creditworthiness:Your credit score plays a significant role in determining loan eligibility and interest rates. Work on improving your credit if necessary.

- Choose the Right Loan Type:Different loan types have varying terms and requirements. Consult with our commercial mortgage brokers in Texasto select the most suitable option for your needs.

- Build a Strong Relationship:Establishing a positive relationship with your lender can increase your chances of loan approval. Be transparent, communicate effectively, and provide all requested information promptly.

- Be Patient:The loan application process can take time. Be patient and prepared to provide additional information as needed.

Insula Capital Group’s experienced team of commercial mortgage lenders in Texascan guide you through the loan application process, negotiate favorable terms, and help you secure the financing you need.

Frequently Asked Questions

Complete ouronline application formto invest in commercial real estate loans in Texas.

We provide hard money financing for the following services:

Contact Insula Capital Group for Flexible Commercial Loan Rates in Texas

Reach out to thecommercial property loan experts in Texas at Insula Capital Group for a wide range of services and benefits. When you work with us you get:

- Flexible terms

- Incredible rates

- Quicker processing

- Customizedplans and recommendations

Our team members are available between 9 am and5 pm from Monday to Friday. Contact us via phone call or visit our website if you would like further information about our financing deals.