Development Loans in Florida

Florida is a state pulsating with energy. But in this arena of boundless opportunity, real estate investors often face a critical challenge: securing the financial resources to bring their ambitious projects to life. Traditional lenders, with their rigid structures and cautious approaches, often struggle to keep pace with the unique demands of Florida’s development landscape.

Insula Capital Group offers a different path.

We specialize in providing development loans that are as bold and innovative as the projects they fund. Whether you’re envisioning a sustainable community that reimagines urban living, a cutting-edge commercial space that attracts global attention, or a luxury residential development that sets a new standard for coastal elegance, we provide the financial foundation and expertise to turn your aspirations into concrete reality.

Are you ready to build the future of Florida?

Contact Insula Capital Group today and let’s discuss how our property development loans can help you achieve your goals.

Partner with Experienced Development Loan Providers in Florida

At Insula Capital Group, we’ve become ingrained in the fabric of Florida’s growth. We’ve witnessed firsthand the transformation of Miami’s waterfront, the rise of Orlando’s thriving communities, and the expansion of Tampa’s commercial hubs. This firsthand experience translates into an intimate knowledge of local regulations, environmental considerations, and the intricate web of permitting processes that can make or break a project.

Whether you’re a seasoned developer with a portfolio of successful projects or an entrepreneur with a groundbreaking vision, we’ll take the time to understand your goals and tailor our approach accordingly. We’ll assess your project’s feasibility, guide you through potential hurdles, and structure areal estate development loan that aligns with your specific needs and aspirations.

Think it’s time to start building your vision in the Sunshine State?

Contact Insula Capital Group today and let’s discuss how we can help bring your project to life!

Is a Development Loan the Right Call for Me in Florida?

For real estate investors, transforming a vision into a tangible development isn’t just about aesthetics and location. It’s about securing the right financial foundation to support your ambition.

Think of a development loan as the bedrock upon which your Florida project will rise. It’s a strategic tool that unlocks a world of possibilities:

- Breathing Life into Your Vision:Imagine acquiring that prime beachfront property in Miami, revitalizing a historic district in Key West, or creating a sustainable community that redefines Florida living. A development loan provides the financial fuel to turn these aspirations into concrete reality.

- Navigating the Florida Maze:Florida’s regulatory environment can be complex, with zoning ordinances, environmental considerations, and permitting processes that demand specialized knowledge. A development loan from Insula Capital Group comes with built-in expertise, guiding you through the intricacies and ensuring your project stays on track.

- Maximizing Your Leverage:Property development loansoften offer higher loan-to-value ratios than traditional financing options, allowing you to maximize your leverage and minimize your upfront investment. This can be particularly advantageous in Florida’s competitive real estate market.

Contact Insula Capital Group today and explore how a development loan can provide the foundation for your success. You can also review our recently funded projectsfor a glimpse into our expertise and our clients’ vision.

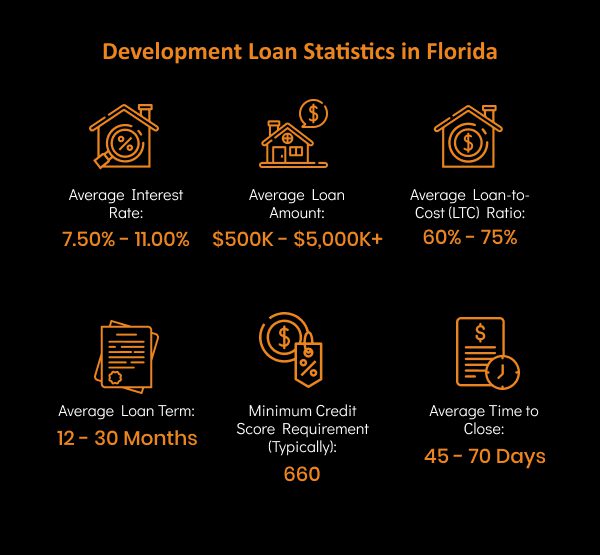

Insights into Development Loans in Florida

Before breaking ground on your Florida development project, it’s essential to grasp the financial landscape and key factors that can influence your success in the Sunshine State:

- Average Development Loan Interest Rates in Florida: Interest rates for development loans in n Florida generally fall between 7.5% to 11%.

- Loan-to-Cost (LTC) Ratios: Florida lenders typically offer LTC ratios between 60% and 75% for development projects.

- Florida Construction Costs: Construction costs in Florida can fluctuate significantly due to factors like hurricane-resistant building codes, material availability, and labor expenses.

Just Funded Projects

We are a leading nationwide private lender & real estate investment company.

- Fix & Flip

- July 2022Washington, DC

| Purchase Price: | $255,000 |

| Renovation Budget: | $80,000 |

| Loan Amount: | $296,750 |

| After Repair Value: | $450,000 |

- Fix & Flip

- June 2022Weiser, ID

| Purchase Price: | $170,000 |

| Renovation Budget: | $59,000 |

| Loan Amount: | $207,000 |

| After Repair Value: | $309,000 |

- Fix & Flip

- July 2022Washington, DC

| Purchase Price: | $255,000 |

| Renovation Budget: | $80,000 |

| Loan Amount: | $296,750 |

| After Repair Value: | $450,000 |

- Fix & Flip

- June 2022Weiser, ID

| Purchase Price: | $170,000 |

| Renovation Budget: | $59,000 |

| Loan Amount: | $207,000 |

| After Repair Value: | $309,000 |

Multifamily/Mixed Use

Fix & Flip Calculator

Fix & Flip Financing

New Construction

Hard Money Loan

Residential Rental Program (Buy & Hold)

Private Lending Done Right.

A leading nationwide private lender & real estate investment company.

Building with Confidence: Securing a Development Loan in Florida

Securing a development loan in Florida doesn’t have to be an overwhelming process. At Insula Capital Group, we’ve refined our approach to ensure a smooth and efficient experience for our clients.

Here’s how it works:

- Florida-Focused Project Evaluation:We begin by thoroughly evaluating your development project, considering its feasibility, market potential, and financial projections within the context of the Florida market.

- Tailored Solutions for the Sunshine State:We’ll work closely with you to structure a loan that meets your specific needs, considering factors like loan amount, repayment terms, and draw schedules, all while navigating Florida’s unique regulatory environment.

- Streamlined Application:Our application process is designed for efficiency, minimizing paperwork and maximizing transparency.

- Expert Guidance, Every Step of the Way:Our team of experienced professionals will guide you through every step of the process, providing clear explanations and personalized support.

- Timely Funding for Florida’s Fast-Paced Market:Once approved, we’ll work diligently to ensure timely funding, keeping your project on schedule and allowing you to capitalize on Florida’s dynamic opportunities.

Ready to turn your Florida development vision into reality?

Contact Insula Capital Group today and let’s discuss how we can help you secure the development financing you need. You can also explore the rest of our loan programs to understand what’s right for you.

Partner with Insula Capital Group to Build Your Vision in Florida

It’s time to transform your development dreams into thriving Florida realities. Insula Capital Group is your trusted partner for securing the capital and expertise you need to succeed in the Sunshine State.

Call us between 9 am and 5 pm, Monday through Friday, to schedule a consultation. Our team is eager to discuss your project, answer your questions, and guide you towards securing the development financing you need to thrive in Florida’s dynamic real estate market.

Frequently Asked Questions

Our development loan application process is simple, straightforward, and quick. Fill out our online form to begin.

Our real estate loans include:

- Fix and Flip Loans

- Residential Rental Programs

- New Construction Loans

- Hard Money Loans

- Multifamily Mixed-Use Loans

- Cash-Out Refinance Loans

- Development Loans