Cash-Out Refinance Loans in California

Savvy investors know that maximizing leverage is key to unlocking growth in California. Insula Capital Group’s cash-out refinance loans empower you to tap into your property’s equity, providing the capital infusion you need to seize new opportunities and expand your portfolio.

Whether you’re looking to acquire additional properties, renovate existing holdings to increase value, or simply improve your cash flow, our flexible financing solutions are tailored to your specific investment goals.

Our team of seasoned professionals boasts deep expertise in the local market. We’ll work closely with you to structure a cash-out refinance loan that aligns with your investment strategy, providing the financial leverage you need to achieve your ambitious goals.

Are you ready to transform your real estate portfolio into a powerful engine for growth?

Choose a Team of Experienced Cash-Out Refinance Lenders in California

When it comes to cash-out refinance loans, experience matters.

At Insula Capital Group, we’ve honed our expertise through years of successfully partnering with investors across the Golden State. Our team possesses an intimate knowledge of the local landscape, allowing us to anticipate challenges and identify opportunities that others might miss.

We believe that a successful refinance strategy hinges on more than just favorable rates. It’s about aligning financial solutions with your unique investment objectives. Whether you’re a seasoned pro or just starting out, we take the time to understand your vision and craft a customized plan that maximizes your returns.

When you choose Insula Capital Group, you’re gaining a strategic advantage. Our experience, market knowledge, and dedication to personalized service set us apart.

Let us help you leverage your real estate assets to their fullest potential. Our cash-out refinance lendersare a phone call away.

How Will a Cash-Out Refinance Loan Benefit You?

Staying ahead of the curve requires strategic financial maneuvering. A cash-out refinance loan can be a powerful tool in your arsenal, offering a multitude of benefits that can propel your investment journey to new heights.

Let’s understand how this financial instrument can specifically benefit you as a California real estate investor.

- Unlocking Hidden Capital: Your California property is a reservoir of potential capital. A cash-out refinance loanallows you to tap into the equity you’ve built up in your property, essentially converting a portion of your home’s value into liquid cash. This influx of funds can be a game-changer.

- Fueling Growth and Expansion: Imagine having the resources to acquire that promising multi-family property in a burgeoning neighborhood, or to renovate your existing holdings to significantly boost their value. A cash-out refinance loancan make these aspirations a reality. By leveraging your existing property, you can secure the capital needed to fuel your growth and expansion plans without having to sell your prized assets.

- Enhancing Cash Flow and Financial Stability: Cash flow is the lifeblood of any successful real estate investment strategy. A cash-out refinance loan can be a strategic move to bolster your cash flow, providing you with a steady stream of funds to cover operating expenses, debt payments, or even unexpected contingencies.

At Insula Capital Group, we’re ready to take the reins and help you understand your cash-out refinance options in California. Let’s connect and discuss your goals.

Insights into Cash-Out Refinance Loans in California

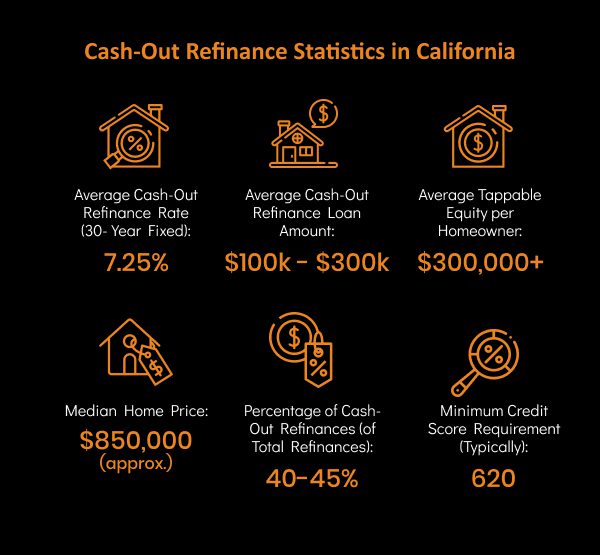

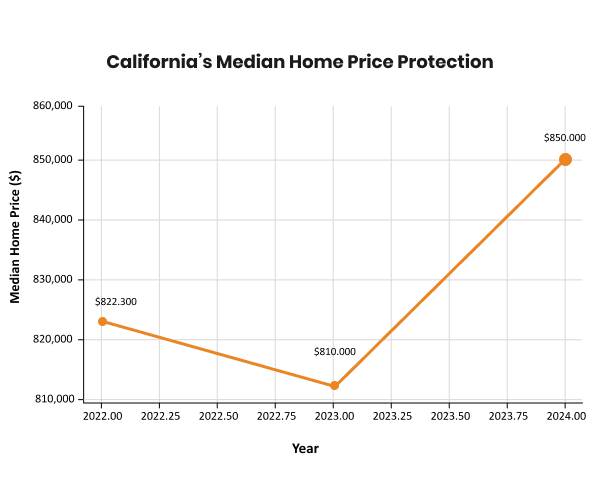

Before you tap into your property’s equity with a cash-out refinance loan, it’s wise to understand the current landscape in California:

- Average Cash-Out Refinance Rates in California: The average interest rate for a 30-year fixed-rate cash-out refinance in California hovers around 7.25%.

- Home Equity in California: The average homeowner in California has over $300,000 in tappable equity.

- California Real Estate Market: The California real estate market remains robust, with property values continuing to appreciate in many areas.

Just Funded Projects

We are a leading nationwide private lender & real estate investment company.

- Fix & Flip

- July 2022Washington, DC

| Purchase Price: | $255,000 |

| Renovation Budget: | $80,000 |

| Loan Amount: | $296,750 |

| After Repair Value: | $450,000 |

- Fix & Flip

- June 2022Weiser, ID

| Purchase Price: | $170,000 |

| Renovation Budget: | $59,000 |

| Loan Amount: | $207,000 |

| After Repair Value: | $309,000 |

- Fix & Flip

- July 2022Washington, DC

| Purchase Price: | $255,000 |

| Renovation Budget: | $80,000 |

| Loan Amount: | $296,750 |

| After Repair Value: | $450,000 |

- Fix & Flip

- June 2022Weiser, ID

| Purchase Price: | $170,000 |

| Renovation Budget: | $59,000 |

| Loan Amount: | $207,000 |

| After Repair Value: | $309,000 |

Multifamily/Mixed Use

Fix & Flip Calculator

Fix & Flip Financing

New Construction

Hard Money Loan

Residential Rental Program (Buy & Hold)

Private Lending Done Right.

A leading nationwide private lender & real estate investment company.

Securing Cash-Out Refinance Loans in California

Cash-out refinance loans offer a powerful pathway to tap into your property’s equity. But securing such a loan requires careful navigation, and that’s where our expertise comes in.

Let’s explore the key steps involved in securing cash-out refinance loans in California.

- Laying a Strong Financial Foundation: Before embarking on the refinance journey, it’s imperative to fortify your financial standing. A thorough assessment of your credit score, debt-to-income ratio, and overall financial health is essential.

- Crystallizing Your Investment Vision: Clarity of purpose is paramount. Set your investment objectives for the cash-out proceeds with precision.

- Assembling Your Documentation Arsenal: Lenders require a comprehensive set of documents to evaluate your eligibility and the viability of your investment plans. Our team at Insula Capital Group is dedicated to guiding you through this process, ensuring you have everything you need for a seamless experience.

- Fostering Open Communication: Transparent and proactive communication is the cornerstone of a successful loan process. At Insula Capital Group, we believe in building strong relationships with our clients, ensuring you feel supported and informed every step of the way.

We’re ready to be your trusted ally on this journey.

Contact us today to explore your options and embark on a path toward amplified growth and financial success! You can also explore the rest of our loan programs to understand what we have to offer.

Frequently Asked Questions

Please fill out our online form to begin the application process.

We offer a range of loans to real estate investors across California, including:

Connect with Insula Capital Group for Cash-Out Refinance Loans in California

Partner with our seasoned professionals to secure the cash-out refinance loan you need to fuel your California real estate investments.

We offer:

- Flexible Terms:Tailored solutions to fit your unique investment strategy and financial goals.

- Competitive Rates:Access the capital you need at rates that maximize your returns.

- Faster Processing:Streamlined processes to ensure you seize opportunities without delay.

Ready to Take the Next Step?

Schedule a consultation today between 9 am and 5 pm, Monday to Friday. Our team is eager to understand your specific needs and craft a cash-out refinance solution that empowers you to achieve your investment objectives. Call us now to get started. You can also explore our recently funded projects for more insights.