Cash-Out Refinance Loans in Florida

Investors are constantly seeking ways to leverage their assets for maximum growth. However, traditional financing options can often be cumbersome, time-consuming, and restrictive. That’s where Insula Capital Group steps in, offering a streamlined and strategic solution: cash-out refinance loans in Florida.

We understand that your property isn’t just a building; it’s a potential goldmine of untapped capital. Our cash-out refinance loans empower you to access that equity, transforming it into the liquid funds you need to fuel your investment ambitions. Whether you’re looking to expand your portfolio, renovate existing properties, or seize new opportunities in Florida’s thriving market, we provide the financial flexibility to make it happen.

With our deep understanding of the local landscape, competitive rates, and personalized service, we’re committed to helping you navigate the complexities of cash-out refinancing and achieve your investment goals.

Say goodbye to financial limitations and hello to a world of possibilities with Insula Capital Group!

Work with a Team of Experienced Cash-Out Refinance Lenders in Florida

At Insula Capital Group, we bring decades of expertise to the table, helping countless investors achieve their financial goals. Our team’s deep understanding of the local market’s unique nuances empowers us to navigate challenges and identify opportunities others might miss.

We believe that every investor’s situation is different, and a one-size-fits-all approach simply doesn’t cut it. That’s why we take the time to understand your specific needs, investment objectives, and risk tolerance. We structure a cash-out refinance loan that aligns perfectly with your strategy, maximizing your leverage and positioning you for success.

Are you ready for a 180-degree turnaround? Contact Insula Capital Group today and experience the difference of working with a team that truly understands your needs and is committed to your success.

Why Should You Take Out a Cash-Out Refinance Loan in Florida?

A cash-out refinance loan can be a strategic game-changer for Florida real estate investors.

Here are some key benefits:

- Access to Capital: Tap into your property’s equity to fund new investments, renovations, or debt consolidation.

- Lower Interest Rates: Potentially reduce your monthly payments and save on interest costs.

- Tax Benefits: In some cases, the interest paid on a cash-out refinance may be tax-deductible. (Consult with a tax professional for specifics.)

- Debt Consolidation:S treamline your finances by consolidating high-interest debts into a single, lower-interest loan.

- Increased Cash Flow: Access additional funds to cover operating expenses, invest in property improvements, or bolster your financial reserves.

- Flexibility: Use the funds for a wide range of purposes, tailored to your investment strategy.

Over the years, we’ve helped countless real estate investors embark on successful journeys. Take a closer look at our recently funded projects to understand what we have to offer.

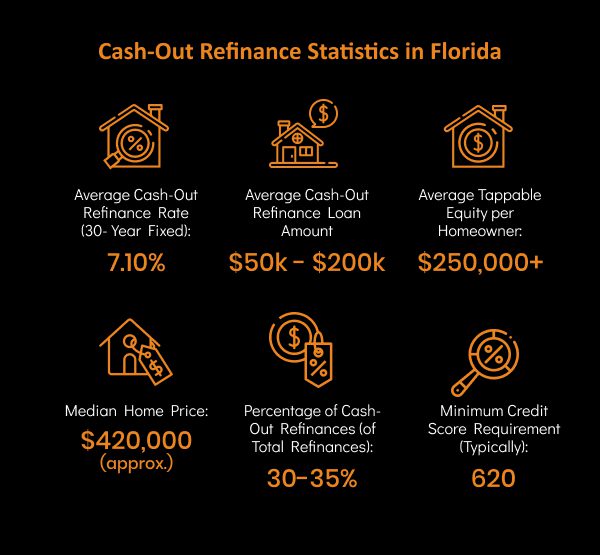

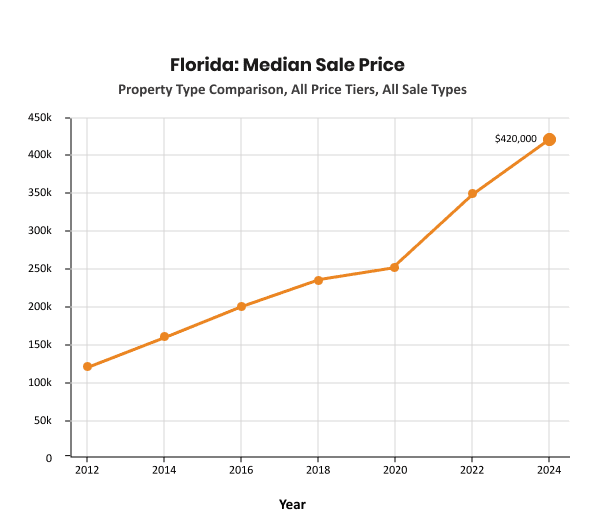

Insights into Cash-Out Refinance Loans in Florida

Before you tap into your property’s equity with a cash-out refinance loan, it’s important to understand the current landscape in Florida:

- Average Cash-Out Refinance Rates in Florida: The average interest rate for a 30-year fixed-rate cash-out refinance in Florida is around 7.10%.

- Home Equity in Florida: The average homeowner in Florida has approximately $250,000 in tappable equity.

- Florida Real Estate Market: The Florida real estate market continues to be dynamic with steady property value appreciation in many areas, particularly driven by high demand and population growth.

Just Funded Projects

We are a leading nationwide private lender & real estate investment company.

- Fix & Flip

- July 2022Washington, DC

| Purchase Price: | $255,000 |

| Renovation Budget: | $80,000 |

| Loan Amount: | $296,750 |

| After Repair Value: | $450,000 |

- Fix & Flip

- June 2022Weiser, ID

| Purchase Price: | $170,000 |

| Renovation Budget: | $59,000 |

| Loan Amount: | $207,000 |

| After Repair Value: | $309,000 |

- Fix & Flip

- July 2022Washington, DC

| Purchase Price: | $255,000 |

| Renovation Budget: | $80,000 |

| Loan Amount: | $296,750 |

| After Repair Value: | $450,000 |

- Fix & Flip

- June 2022Weiser, ID

| Purchase Price: | $170,000 |

| Renovation Budget: | $59,000 |

| Loan Amount: | $207,000 |

| After Repair Value: | $309,000 |

Multifamily/Mixed Use

Fix & Flip Calculator

Fix & Flip Financing

New Construction

Hard Money Loan

Residential Rental Program (Buy & Hold)

Private Lending Done Right.

A leading nationwide private lender & real estate investment company.

Securing Cash-Out Refinance Loans in Florida

Securing a cash-out refinance loan shouldn’t feel like deciphering a complex puzzle. At Insula Capital Group, we believe in transparency and simplicity. We’ve meticulously crafted our process to eliminate unnecessary hurdles and confusion, ensuring a smooth and stress-free experience from start to finish.

Our dedicated team will guide you every step of the way, providing clear explanations and personalized support, so you can confidently tap into your property’s equity and achieve your financial goals. We understand that your time is valuable, which is why we prioritize efficiency without compromising on thoroughness.

- Initial Consultation: We’ll start by discussing your investment goals and financial situation to determine if a cash-out refinance is the right fit for you.

- Loan Application: Complete our easy online application.

- Document Submission: We’ll guide you through the necessary documentation, ensuring a smooth and timely process.

- Underwriting and Approval: Our experienced team will carefully review your application and provide a prompt decision.

- Closing: Once approved, we’ll work closely with you to finalize the loan and disburse the funds quickly.

Are you ready to embark on a successful, profitable real estate project? Contact Insula Capital Group today to discuss your cash-out refinance needs and explore our comprehensive suite of loan programs designed to fuel your real estate investment success in the Sunshine State.

Frequently Asked Questions

At Insula Capital Group, we’ve simplified the loan application process. Fill out our online form to begin.

Partner with Insula Capital Group to Fuel Your Real Estate Ambitions in Florida

Are you ready to tap into your property’s potential and accelerate your investment journey? Insula Capital Group is your trusted partner for cash-out refinance loans in Florida.

We offer:

- Tailored Solutions:Flexible terms designed to align with your unique investment strategy and financial goals.

- Market-Leading Rates:Access the capital you need at competitive rates that maximize your returns.

- Efficient Processing:Streamlined processes ensure you seize opportunities without unnecessary delays.

- Expert Guidance:Our seasoned professionals provide personalized support, guiding you through every step of the refinancing process.

Take the Next Step Today!

Call us between 9 am and 5 pm, Monday through Friday, to schedule a consultation. Our team is ready to listen to your needs, answer your questions, and craft a cash-out refinance solution that empowers you to achieve your investment dreams.