Land Loans in Pennsylvania

From the rolling hills of rural Pennsylvania to the bustling cityscapes of Philadelphia and Pittsburgh, the state offers numerous opportunities for real estate development. Whether you’re looking to purchase land for personal use, commercial ventures, or investment purposes, securing the right financing is crucial to achieving your goals.

At Insula Capital Group, we specialize in providing tailored land loans in Pennsylvania that include a ground-up construction holdback, ensuring your funding aligns with the property’s development needs. With a deep understanding of the local market and a commitment to personalized service, we help you navigate the complexities of land financing and secure the funding you need.

What Are Land Loans?

Pennsylvania is a state rich in diverse landscapes, economic opportunities, and vibrant communities, making it an attractive location for land investment.

Investing in land in Pennsylvania opens the door to a wealth of opportunities, and with the right financing from Insula Capital Group, you can take advantage of this thriving market.

Land loans are a type of financing specifically designed for purchasing land. Unlike traditional mortgages, which are meant for buying properties with existing structures, land loans cater to those looking to buy undeveloped or partially developed land.

At Insula Capital Group, our land loans require a ground-up construction holdback, ensuring that the property is developed in alignment with its intended purpose.

Benefits of Land Loans with Insula Capital Group in Pennsylvania

Choosing to secure a land loan with Insula Capital Group comes with several key benefits:

- Fast Approvals: In Pennsylvania’s competitive real estate market, quick access to financing is essential. We provide fast loan approvals to help you capitalize on opportunities without delay.

- Flexible Loan Terms: We offer flexible loan structures, tailoring the terms to fit your unique project, whether you’re purchasing land for personal use or large-scale development.

- Competitive Interest Rates: Our relationships with multiple lenders allow us to secure competitive interest rates, helping you minimize your financing costs and maximize your investment.

- Local Expertise: With years of experience in the Pennsylvania real estate market, we provide expert guidance on zoning regulations, land use, and market trends, ensuring a smooth loan process.

Common Uses for Land Loans in Pennsylvania

- Residential Development: Purchase land to build a custom home or a residential community.

- Commercial Development: Invest in land for commercial properties, including office buildings, retail spaces, or industrial developments.

- Agricultural Use: Pennsylvania’s expansive rural areas make it ideal for purchasing farmland or investing in agricultural ventures.

- Investment Properties: Secure land as an investment, capitalizing on Pennsylvania’s growing real estate market for future resale or development.

Just Funded Projects

We are a leading nationwide private lender & real estate investment company.

- Fix & Flip

- July 2022Washington, DC

| Purchase Price: | $255,000 |

| Renovation Budget: | $80,000 |

| Loan Amount: | $296,750 |

| After Repair Value: | $450,000 |

- Fix & Flip

- June 2022Weiser, ID

| Purchase Price: | $170,000 |

| Renovation Budget: | $59,000 |

| Loan Amount: | $207,000 |

| After Repair Value: | $309,000 |

- Fix & Flip

- July 2022Washington, DC

| Purchase Price: | $255,000 |

| Renovation Budget: | $80,000 |

| Loan Amount: | $296,750 |

| After Repair Value: | $450,000 |

- Fix & Flip

- June 2022Weiser, ID

| Purchase Price: | $170,000 |

| Renovation Budget: | $59,000 |

| Loan Amount: | $207,000 |

| After Repair Value: | $309,000 |

Multifamily/Mixed Use

Fix & Flip Calculator

Fix & Flip Financing

New Construction

Hard Money Loan

Residential Rental Program (Buy & Hold)

Private Lending Done Right.

A leading nationwide private lender & real estate investment company.

Types of Land Loans Available in Pennsylvania

We offer a range of land loan options designed to meet the diverse needs of borrowers in Pennsylvania:

- Raw Land Loans: For undeveloped land with no existing infrastructure, raw land loans are ideal for long-term investments or future development. They often require higher down payments due to the inherent risks but are perfect for those looking to secure land for future use.

- Improved Land Loans: If you’re purchasing land with access to utilities like water, electricity, and roads, an improved land loan offers more favorable terms and can be a great option for immediate development.

- Construction Loans: When you plan to build on your land, our construction loans include a ground-up construction holdback, combining financing for both the land acquisition and the construction costs. This approach simplifies the process and ensures your project’s success.

FAQs: Land Loans in Pennsylvania

A land loan is used specifically for purchasing land, while a mortgage is typically used for financing developed properties with structures. Land loans offer more flexibility but may have higher interest rates based on the land type and borrower’s credit profile.

Yes, construction loans with a ground-up construction holdback are available, combining financing for both land acquisition and building costs. This streamlines the process for those planning immediate development.

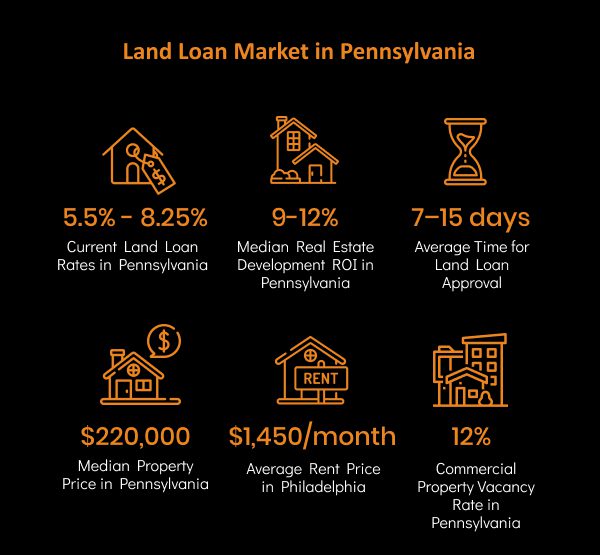

We aim to provide loan approval within 7-15 days, ensuring you can move forward with your land purchase as quickly as possible.

Yes, we offer refinancing options for existing land loans, helping you secure better terms or rates as your project develops.

No, land loans can be used to purchase a variety of land types, including residential, commercial, agricultural, or investment properties.

Contact Us for Your Land Loan Needs in Pennsylvania

Are you ready to secure financing for your land purchase in Pennsylvania? Insula Capital Group is here to help. Our team of experienced professionals will guide you through the process, offering personalized service and expert advice to ensure a smooth transaction.

Turn your land investment into a reality with Insula Capital Group. Contact us to get started.