Investment Property Loans in Texas

Are you thinking about investment property loans in Texas? Here’s how Insula Capital Group can offer diverse and market competitive loans for your next business endeavor!

Get in Touch

Hire Seasoned Investment Property Loan Brokers in Texas!

When it comes to navigating the competitive Texas real estate market, working with experienced professionals can make all the difference. At Insula Capital Group, our Texas investment property loan brokersbring years of expertise in securing the best loan options for investors. We specialize in simplifying the lending process, offering tailored solutions that match your financial goals, whether you’re expanding your portfolio or purchasing your first investment property.

Our brokers have an in-depth understanding of the local market and current trends, giving you access to the most competitive Texas investment property loan rates available. We take pride in offering personalized guidance, ensuring you have the right loan structure in place to maximize profitability. From investment property mortgagesto flexible financing terms, our team can connect you with a wide range of loan products designed to suit your investment strategy.

As a trusted investment property loan lender in Texas, Insula Capital Group is committed to providing seamless, efficient service from start to finish. Our goal is to empower you with the best financing options, making your investment journey as smooth and profitable as possible.

Choose Insula Capital Group and work with seasoned brokers who are dedicated to your success.Contact us now!

Enjoy Fruitful Benefits of Acquiring Investment Property Financing in Texas!

Acquiring investment property financing in Texas through Insula Capital Group offers numerous advantages for investors. By leveraging our flexible loan options and market expertise, you can unlock powerful opportunities to grow your real estate portfolio. Here are some key benefits:

Competitive Loan Rates

With access to some of the most attractive Texas investment property loan rates, Insula Capital Group helps investors reduce borrowing costs, maximizing profitability on every investment. Our team negotiates terms that align with your long-term financial strategy.

Flexible Financing Solutions

We offer a wide range of loan products, from short-term bridge loans to long-term investment property mortgages in Texas. Whether you need fast financing for a property acquisition or a traditional mortgage, we tailor financing solutions to meet your needs.

Increase Cash Flow Potential

Investing in Texas real estate, especially with favorable loan terms, can boost your cash flow. Our customized loan structures help ensure your property generates steady income, putting you on the path to financial freedom.

Expert Guidance from Local Brokers

With Insula Capital Group’s investment property loan brokers on your side, you benefit from expert advice and market insights. Our team knows the Texas real estate market inside and out, giving you a competitive edge.

Secure your financial future with Insula Capital Group’s comprehensive investment financing solutions!

Explore the Texas Real Estate Scene

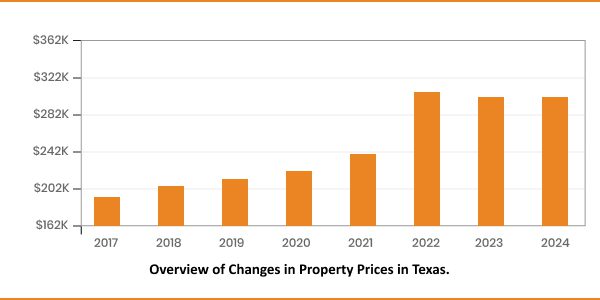

Investing in real estate takes a lot of commitment and insights. Here’s a look at the market insights for Texas properites:

- The Price to Rent Ratio is 17.0.

- The Median Rent Price is $1904.

- The appreciation on properties in the last year was 2.79%

- The home foreclosure rate for Florida is 1.1%.

Property Investment Statistics for Texas

30.03 million

State Population

$1904

Median Rent Price

$379,000

Median Property Price

2.79%

1-year Property Appreciation

1.1%

Home Foreclosure Rate

17.0

Price-To-Rent Ratio

Just Funded Projects

February 2026

Fix & Flip

Loan Amount

$248,869

After Repair Value$409,000

Purchase Price$145,000

Renovation Budget$147,787

Loan TypeFix & Flip

- After Repair Value$409,000

- Purchase Price$145,000

- Renovation Budget$147,787

- Loan TypeFix & Flip

Decatur, GA

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

December 2025

Fix & Flip

Loan Amount

$171,250

After Repair Value$263,000

Purchase Price$125,000

Renovation Budget$65,000

Loan TypeFix & Flip

- After Repair Value$263,000

- Purchase Price$125,000

- Renovation Budget$65,000

- Loan TypeFix & Flip

Albany, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Future of Real Estate with Investment Property Loans in Texas!

The Texas real estate market is constantly evolving, offering countless opportunities for various investors. Here’s how investment property loans in Texas can help maximize your investments in this growing market:

Strong Market Growth

Texas remains one of the fastest-growing states, driven by job creation, population increases, and business development. This continuous growth fuels demand for residential and commercial properties, making it an ideal time for real estate investments. This is where Insula Capital Group and their professional money lenders ensure that you get the best rates at easy borrowing plans!

Competitive Loan Rates

With Texas investment property loan rates currently favorable, there is an opportunity for investors to secure cost-effective financing. Insula Capital Group offers competitive rates, allowing you to maximize profitability and expand your portfolio with confidence.

Tailored Long-Term Investment Strategies

Our investment property mortgages are designed for long-term success. Whether you’re purchasing rental properties or commercial buildings, our financing solutions are flexible, helping you adapt to market changes while achieving consistent returns.

Maximize Future Opportunities

As the market evolves, Insula Capital Group ensures that you remain ahead of trends with innovative loan options. By working with our expert investment property loan lenders, you’ll be well-positioned to capitalize on future real estate opportunities.

Invest in Texas real estate today and build a prosperous future with Insula Capital Group’s comprehensive financing options!

The first step to getting the right funding is finding a trusted and experienced investment property loan lenderto guide you through the process. If you’re trying to figure out theinvestment property mortgages, you need someone who understands the local market and can offer customized solutions according to your financial standing and goals.

At Insula Capital Group, our mission is to simplify the financing process for you. Our investment property loan lenders are bent on offering personalized solutions and insightful advice that ensure you have the right financing to meet your investment goals.

What sets us apart? Here’s how we can redefine your experience with investment property financing in New York:

- In-Depth Knowledge of the New York Market

- Tailored Financial Strategies

- Competitive Loan Rates

Contact us today and let our experts help you navigate the world of investment property mortgages with confidence.

Ready to apply for a investment property loan?

Frequently Asked Questions

All you need to do is fill out our online application or get in touch with our representatives to get started!

Unlike traditional banks, Insula Capital Group offers more flexible lending terms, faster approvals, and a simplified application process. We focus on the value and potential of the property rather than relying solely on personal credit scores. This makes us ideal for real estate investors who need quick, tailored financing solutions.

Contact Insula Capital Group for Profitable Investment Property Loans in Texas!

Making a financial commitment is a huge leap to take and therefore requires professional assistance when doing so. Insula Capital Group works with a team of investment property loan lenders in Texas that work with streamlined procedures and offer customized financial solutions for our clientele.

We offer a vast range of financial services, these include the following:

- Fix & flip loans

- Residential rental programs

- New construction loans

- Multifamily mixed-use loans

- Commercial Property Loans

- Investment Property Loans

So, what are you waiting for? Make sure you get in touch with the professional team at Insula Capital Group and get the expert advice you need before starting your investment journey!