Build Now, Profit Later: Why Speedy Development Loans Are Changing the Game in High-Growth States

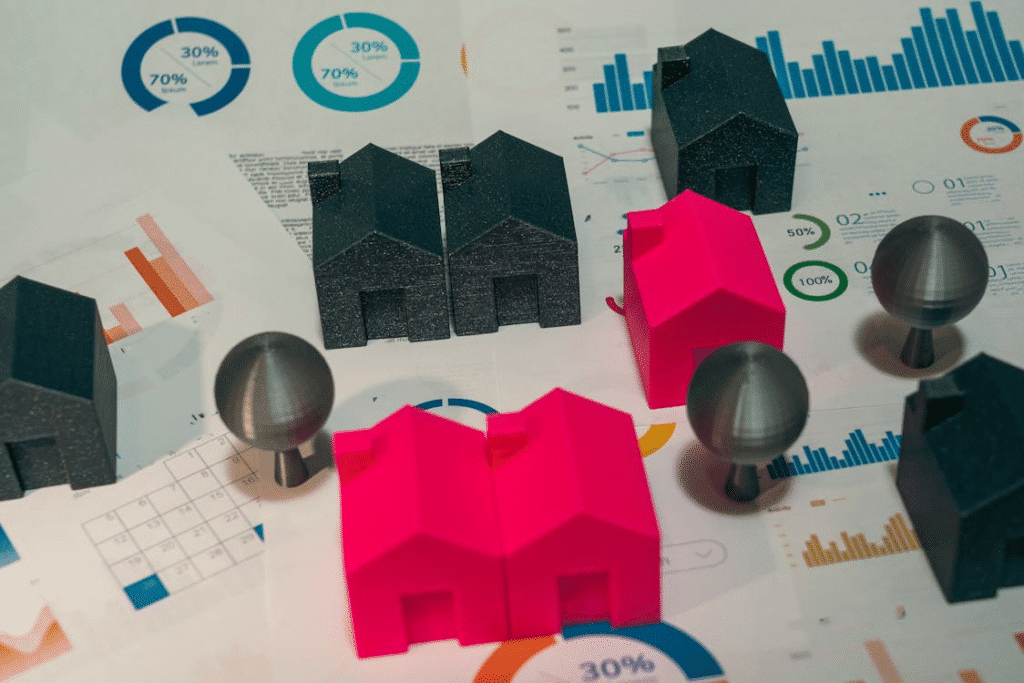

In real estate, time isn’t just money—it’s leverage. Across high-growth states like Texas, Florida, and California, builders and investors face fierce competition to secure land, break ground, and complete projects before market conditions shift. In such fast-paced environments, traditional lending timelines can quickly become roadblocks. That’s where construction and development loans make the difference. These short- […]