Why Hard Money Loans Are the Go-To Financing Option for 2026 Fix & Flip Projects

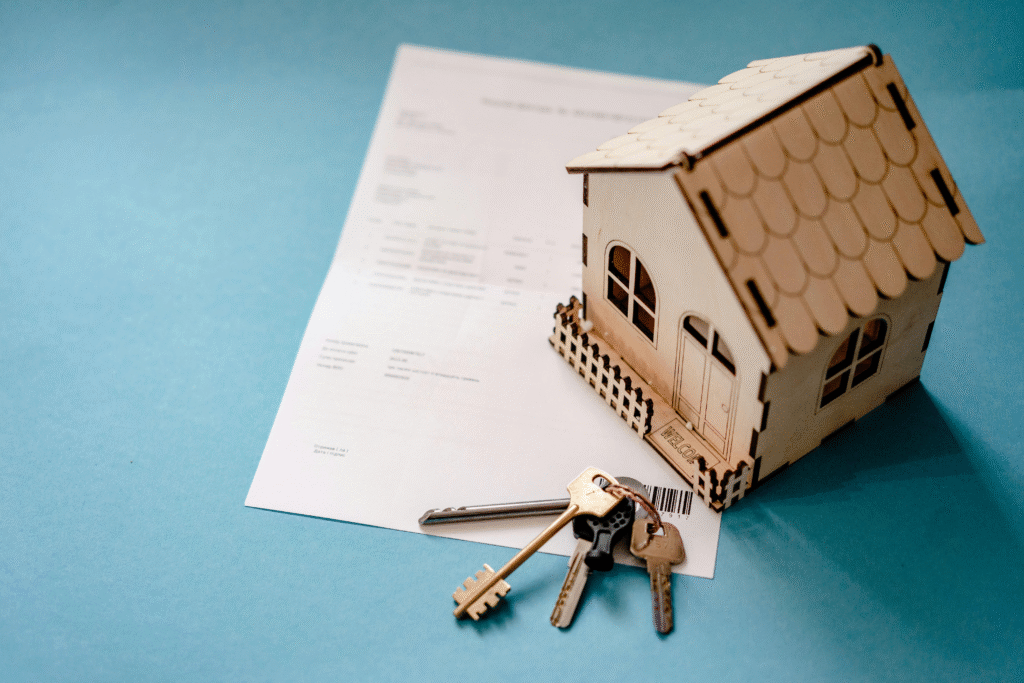

The U.S. fix-and-flip market in 2026 is shaped by intense competition, fluctuating interest rates, and tighter bank lending standards. Traditional lenders remain cautious due to economic uncertainty, regulatory pressure, and stricter underwriting requirements. As a result, investors increasingly rely on private capital to acquire and renovate properties quickly. Hard money loans have become the preferred financing option […]

Why Hard Money Loans Are the Go-To Financing Option for 2026 Fix & Flip Projects Read More »