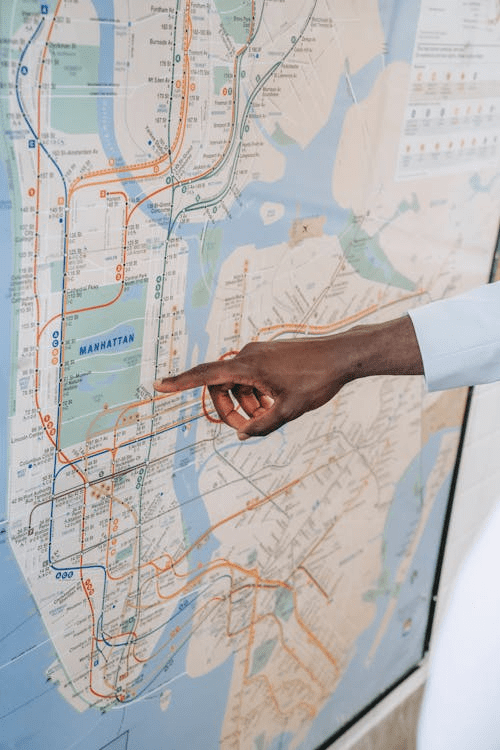

State-by-State Breakdown: Best Single Family Rental Loan Options in California, Florida, New York & Texas

Have you ever lost a promising single-family rental deal because the financing just didn’t come through fast enough—or worse, came with terms that didn’t match your project’s scale or timeline? You’re not alone. Across California, Florida, New York, and Texas, demand for single-family rentals (SFRs) continues to surge. In fact, 44 million U.S. households are now renters—an all-time […]