The Complete Playbook for Hard Money Lending: Fast, Flexible Capital for Every Real Estate Strategy

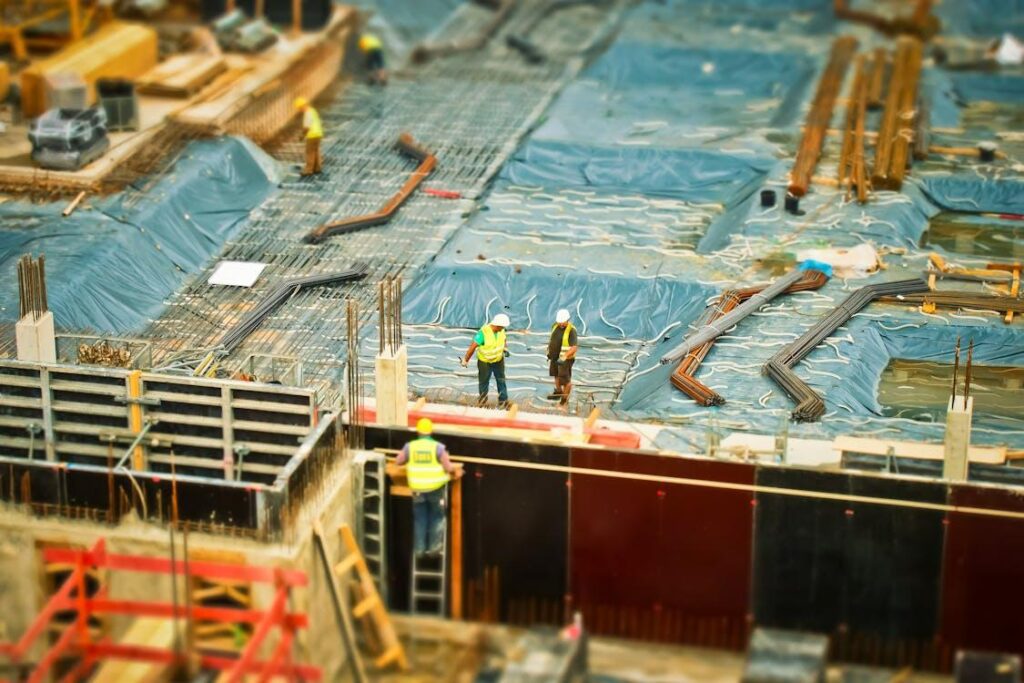

In today’s competitive real estate market, speed and flexibility can make the difference between a profitable investment and a missed opportunity. For investors looking to fund fix-and-flip projects, rental properties, multifamily developments, or ground-up construction, traditional bank financing often moves too slowly. This is where hard money lenders for real estate come in, offering fast, tailored […]