Private Money Lenders | Hard Money Loans in Baltimore, MD

Baltimore, Maryland, a city rich in history and culture, stands as a vibrant tapestry of urban life along the Chesapeake Bay. The city boasts a diverse arts scene, lively waterfront attractions, and a resilient spirit.

From the cobblestone streets of Federal Hill to the cultural hubs of Mount Vernon, Baltimore’s neighborhoods offer a unique charm. As a hub for commerce, education, and cultural exploration, Baltimore continues to captivate residents and visitors alike.

However, the Charm City is no less for investors looking to expand their portfolios. Insula Capital Group invites you to benefit from the beaming real estate market in Baltimore, MD. Reach out to our expert hard money lenders to learn how we help clients who want to start their projects from scratch or complete existing projects without any financial hassle.

Get in Touch

Why Insula Capital Group in Baltimore, MD?

Local Expertise

Our team at Insula Capital Group possesses a deep understanding of the Baltimore real estate market.

With years of experience navigating the intricacies of the local landscape, we bring invaluable insights to our clients.

Whether you’re eyeing residential properties in Federal Hill, commercial spaces in the Inner Harbor, or redevelopment opportunities in Fells Point, our local expertise ensures that you make informed decisions aligned with the unique characteristics of Baltimore.

Swift and Reliable Funding

In a city where real estate opportunities can emerge rapidly, time is of the essence. Insula Capital Group takes pride in its ability to provide swift and reliable funding solutions.

Our streamlined processes and commitment to efficiency mean that you can seize time-sensitive opportunities without unnecessary delays, giving you a competitive edge in the Baltimore market.

Flexible Loan Programs

Recognizing the diverse needs of real estate projects, we offer a range of flexible loan programs tailored to different investment strategies.

Whether you’re embarking on a fix-and-flip venture in Canton, undertaking ground-up construction in Hampden, or acquiring commercial space in Mount Vernon, our customizable loan programs can be adapted to suit the specific requirements of your project.

Apply Now for Personalized Hard Money Loans

With our effective hard money lending processes, minimal interest rates, and customized approach, we are your trusted partner in real estate financing.

We’ve got over thirty years of industry experience and a team of financial consultants that possess the expertise to help you understand the complexities of real estate financing.

We value your time and strive to provide quick approvals, ensuring that you can grab exceptional investment opportunities without wasting any time.

Our hard money loan programs are designed to offer low interest rates, ensuring you receive the best possible terms for your real estate financing requirements.

Apply now for zero junk fees or pre-payment penalties!

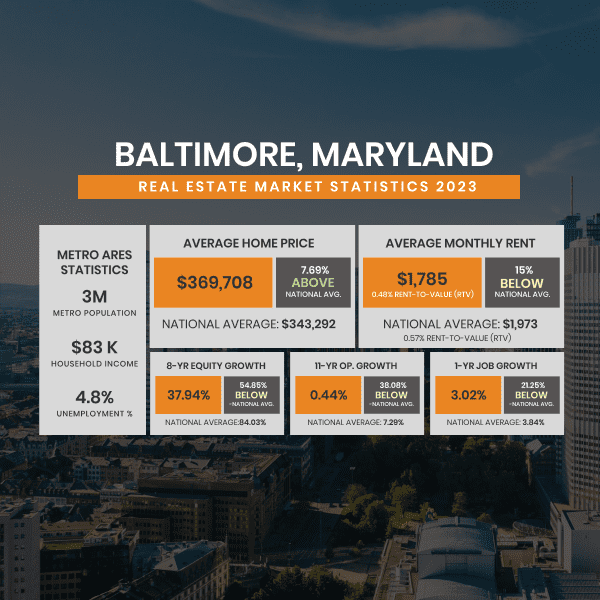

Insights For Investing in the Charm City’s Real Estate Market

- Population: 6,165,129

- Median Home Value: $399,331

- Annual Appreciation Rate: +12 %

- Average Sales Price: $407,698

- Median Rent Price: $1,698

- Price-To-Rent Ratio: 19%

- Average Days On Market: 36

- Active Inventory: 5,570

- New Listings: 6,409

Just Funded Projects

June 2022

Fix & Flip

- Weiser, ID

Purchase Price

170,000

Renovation Budget

59,000

Loan Amount

207,000

After Repair Value

309,000

July 2022

Fix & Flip

- Washington, DC

Purchase Price

255,000

Renovation Budget

80,000

Loan Amount

296,750

After Repair Value

450,000

December 2021

Fix & Flip

- Centerreach, NY

Purchase Price

340,000

Renovation Budget

46,050

Loan Amount

321,300

After Repair Value

459,000

November 2021

Fix & Flip

- Hartford, CT

Purchase Price

149,000

Renovation Budget

70,000

Loan Amount

196,650

After Repair Value

290,000

November 2021

Fix & Flip

- Philidelphia, PA

Purchase Price

130,000

Renovation Budget

105,300

Loan Amount

209,300

After Repair Value

335,000

November 2021

Fix & Flip

- Philidelphia, PA

Purchase Price

62,000

Renovation Budget

60,000

Loan Amount

106,500

After Repair Value

176,000

November 2021

Fix & Flip

- North Babylon, NY

Purchase Price

310,000

Renovation Budget

32,750

Loan Amount

311,750

After Repair Value

495,000

November 2021

Fix & Flip

- East Hampton, NY

Purchase Price

1,250,000

Renovation Budget

577,465

Loan Amount

1,577,465

After Repair Value

2,487,500

November 2021

Fix & Flip

- Jersey City, NJ

Purchase Price

525,000

Renovation Budget

240,650

Loan Amount

848,800

After Repair Value

831,000

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Commercial Property Loans

Commercial Property Loans

Why Are Hard Money Loans The Best Way To Finance Real Estate Projects in Baltimore, MD

Speed and Agility

Baltimore’s real estate market is fast-paced, demanding swift actions to capitalize on emerging opportunities.

Hard money loans provide rapid approval and funding, enabling investors to act promptly and secure properties in a timely manner, crucial in a city where timing is often a decisive factor.

Competitive Real Estate Market

Baltimore’s real estate market is known for its competitiveness. Hard money loans offer a competitive edge, allowing investors to make strong, all-cash offers that are often favored in multiple-offer situations, increasing the likelihood of winning desirable properties.

Property Renovations and Fix-and-Flip Projects

The city’s diverse neighborhoods, from historic areas like Mount Vernon to up-and-coming regions like Hampden, present ample opportunities for property renovations and fix-and-flip projects.

Hard money loans can be tailor-made for these ventures, providing the necessary funds for acquisitions and renovations.

Flexibility in Project Types

Baltimore’s real estate market encompasses a range of project types, from residential rehabs to commercial developments.

Our hard money loans offer the flexibility needed to adapt to the diverse needs of different projects, whether it’s revitalizing row houses in Canton or developing commercial spaces in the Inner Harbor.

Asset-Based Lending

Hard money loans are primarily asset-based, focusing on the property’s value rather than the borrower’s credit history.

This characteristic makes hard money lending accessible to investors with varying credit profiles, enhancing inclusivity in Baltimore’s real estate investment landscape.

Seamless Financing Process

The streamlined and straightforward nature of hard money loan processes complements Baltimore’s fast-moving real estate environment. Investors can navigate through applications, approvals, and funding with efficiency, minimizing delays and capitalizing on opportunities.

Whether you’re a seasoned real estate professional or a first-time investor, Insula Capital Group is ready to support your financial needs.

Contact us today to explore how our hard money lending solutions can elevate your real estate ventures in Baltimore.

Discover real-life success stories through our recently funded projects.

Ready to apply for a money lenders loan?

Frequently Asked Questions

You can get a hard money loan deal by completing our online full application form and submitting the relevant documents.

You can use our hard money loans to finance residential and commercial property deals. Here’s a list of our loan programs you can use to finance your real estate projects:

You can get flexible loan terms with minimal interest rates at Insula Capital Group. Check out our just-funded project section for more details.

Navigate Your Real Estate Projects To Success By Connecting With Us

At Insula Capital Group, we understand that real estate investments require timely and flexible financing solutions. As a leading private money lender, we specialize in providing a range of loan programs tailored to meet the needs of real estate investors, homeowners, and property developers.

You can connect with our team to learn more about our hard money loan deals.