New Construction Loans in Baton Rouge, LA

We can help you finance your new property-building project in Baton Rouge, LA!

As the capital city of Louisiana, Baton Rouge is a great prospect for property developers and investors across the state. It offers many opportunities to find land that is up for grabs in great locations. However, the process of buying land in Baton Rouge and building a 1-4 property on it can incur some significant costs for developers and investors.

You can finance such a project with the help of new construction loans offered by Insula Capital Group. Learn more about them below.

Get in Touch

Secure the Funding You Need with OurNew Construction Loans in Baton Rouge, LA

Private money lenders offer new construction loans to lessen the financial burden on real estate investors everywhere. The great thing about this type of loan is its flexible disbursement terms. Instead of providing you with a one-time lump sum loan, lenders release funds as per your draw requests. This means that you can easily withdraw funds in sync with the different phases of your construction project.

Finding a private money lender that you can trust can be tricky. You must ensure your lender has verified credentials, reliable services, and valuable experience. Luckily, Insula Capital Group excels in all of these aspects.

We have been curating specialized financial solutions for real estate investors across the US for more than 30 years. Our experience with all types of clients helps us make our quality of service worth your time and energy.

We offer other loan programs like fix & flip financing, mixed-use property loans, and residential rental loans. You can prequalify for any of them by clicking here.

All of our contracts are underwritten in-house as per your unique project needs. Click here to view our just-funded projects.

The Advantages Of Using Hard Money Construction Loans In Baton Rouge, LA

Constructing a new property from scratch or renovating an existing one can be challenging because of the rising construction costs. In such situations, you’ll need to opt for financial support to ensure your project is completed smoothly.

However, acquiring loans for construction projects isn’t as easy as it sounds. If you try to connect with conventional banks for construction loans, you’ll have to manage the lengthy process and the strict criteria.

This is why we recommend using hard money construction financing services to complete your real estate projects. Whether you need money for residential construction or commercial renovation, a hard money construction loan can be used for a wide range of projects.

If you’ve got a construction project with a tight deadline, you can use hard money construction loans to get quick financing. Renowned private lenders have a streamlined loan application process that helps investors and property developers get cash quickly. Hard money lenders also have top-class underwriting teams that can thoroughly evaluate financial paperwork and provide customized loan deals.

Understand The Real Estate Market In Baton Rouge

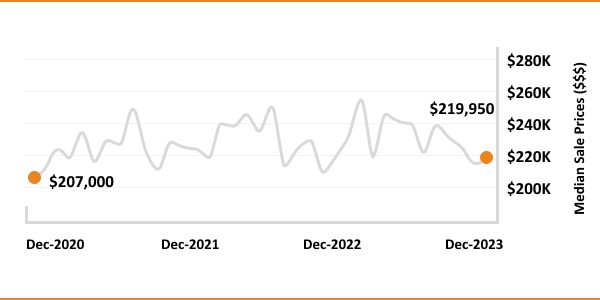

Examining Baton Rogue’s real estate market is crucial before you start any real estate project. As an investor or property developer, you must conduct comprehensive research to ensure your project is viable. If you want to learn more about the real estate market in Baton Rouge, here are some statistics that’ll help you:

- Current Median Home Price: $176,600

- 1-Year Appreciation Rate: 2.0%

- Unemployment Rate: 5.6%

- 1-Year Job Growth Rate: 3.0%

- Median Rent Price: $1,250

- Population: 229,426

- Average Days on the Market: 18

- Median Household Income: $51,134

The Real Estate Landscape In Baton Rouge

229,426

Population

$1,250

Median Rent Price

$176,600

Median Home Value

+2.0%

1-Year Appreciation Rate

$51,134

Median Household Income

18

Average Days On Market

Just Funded Projects

June 2022

Fix & Flip

- Weiser, ID

Purchase Price

170,000

Renovation Budget

59,000

Loan Amount

207,000

After Repair Value

309,000

July 2022

Fix & Flip

- Washington, DC

Purchase Price

255,000

Renovation Budget

80,000

Loan Amount

296,750

After Repair Value

450,000

December 2021

Fix & Flip

- Centerreach, NY

Purchase Price

340,000

Renovation Budget

46,050

Loan Amount

321,300

After Repair Value

459,000

November 2021

Fix & Flip

- Hartford, CT

Purchase Price

149,000

Renovation Budget

70,000

Loan Amount

196,650

After Repair Value

290,000

November 2021

Fix & Flip

- Philidelphia, PA

Purchase Price

130,000

Renovation Budget

105,300

Loan Amount

209,300

After Repair Value

335,000

November 2021

Fix & Flip

- Philidelphia, PA

Purchase Price

62,000

Renovation Budget

60,000

Loan Amount

106,500

After Repair Value

176,000

November 2021

Fix & Flip

- North Babylon, NY

Purchase Price

310,000

Renovation Budget

32,750

Loan Amount

311,750

After Repair Value

495,000

November 2021

Fix & Flip

- East Hampton, NY

Purchase Price

1,250,000

Renovation Budget

577,465

Loan Amount

1,577,465

After Repair Value

2,487,500

November 2021

Fix & Flip

- Jersey City, NJ

Purchase Price

525,000

Renovation Budget

240,650

Loan Amount

848,800

After Repair Value

831,000

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Commercial Property Loans

Commercial Property Loans

Is Investing In Baton Rouge’s Real Estate Market A Good Idea?

As an investor, if you’re seeking viable investment opportunities, the real estate market in Baton Rouge is an excellent option. With a diverse economy that supports a wide range of industries, the city offers a stable foundation for real estate investment. As property prices show positive growth, investors can expect to get a high return on their investment by starting construction projects. The combination of affordability and favorable market conditions can help you make money in Baton Rouge with minimal investment.

Navigating Baton Rouge’s real estate market without financial support can become a nightmare. If you need financial assistance at every step, the team at Insula Capital Group has got your back. We can provide hard money construction financing services to help you get the capital you need without hassle. You can reach out to us for more details.

Ready to apply for a New Construction loan?

Frequently Asked Questions

We will decide your interest rate after we conduct an initial interview and receive your submitted official documents. It will depend on factors like your credit score and payment history.

We typically approve loans within 24 hours.

The minimal documentation we require includes your project plan, credit history details, personal financial statement, and real estate experience documents. Go through our application forms to get a complete list.

Contact Our Team

If you are ready to get started, contact our team in LA and schedule an initial interview today. You can also fill out our online application forms to have a representative reach out to you.