Private Money Lenders | Hard Money Loans in Boston, MA

Don’t want to miss out on Boston’s booming real estate market?

Boston, Massachusetts, has a solid reputation as one of the best cities in the U.S. This makes it a hot spot for real estate investors aiming to make big profits. If you’re one of these investors in Boston, you likely know how important it is to get quick and flexible financing for your projects.

Traditional banks usually have strict rules and take a long time to approve loans, which can slow down your investment plans. But here’s a solution: hard money lenders!

Insula Capital Group stands out as a reliable partner, providing hard money lending solutions that fuel the growth of real estate ventures. Established with a mission to bridge the gap between traditional lending institutions and the dynamic needs of modern real estate projects, Insula stands as a beacon for those seeking alternative funding solutions.

Reach out to discover the diverse range of hard money loans we offer for investors and developers in Boston, MA.

Get in Touch

The Insula Capital Group Difference

- Quick Approval Process: Insula Capital Group is known for its rapid approval process, allowing borrowers to access funds promptly and capitalize on time-sensitive opportunities.

- Flexible Terms: Recognizing the diverse needs of real estate investors, Insula Capital Group offers flexible loan terms, enabling borrowers to customize their financing solutions according to the unique requirements of their projects.

- Asset-Based Lending: Insula Capital Group focuses on the value and potential of the underlying property, providing asset-based loans that are not solely dependent on the borrower’s credit history.

- Expert Guidance: The team at Insula Capital Group consists of industry experts with in-depth knowledge of the Boston real estate market. Borrowers benefit from their expertise, receiving valuable advice and insights throughout the financing process.

- Local Expertise: Our team possesses a deep understanding of Boston’s neighborhoods, market trends, and regulatory nuances. This local expertise allows us to offer tailored financial solutions aligned with the specific dynamics of each area, whether it’s the historic charm of Beacon Hill, the bustling developments in the Seaport District, or the residential appeal of neighborhoods like Jamaica Plain.

Diverse Project Support: Whether it’s a fix-and-flip, ground-up construction, residential rental, or multifamily/mixed-use investment, Insula Capital Group caters to a wide range of real estate projects, supporting the growth and success of the local real estate community. Tap to apply for pre-qualification.

Our Hard Money Loan Programs

Capitalize on Boston’s Potential with Fix-and-Flip Financing

Revitalize overlooked properties in Boston with our fix-and-flip financing. Our specialized loans are designed to breathe new life into overlooked properties across the city.

By turning distressed properties into profitable assets, you not only enhance the vibrancy of local communities but also contribute significantly to the ongoing real estate revitalization in Boston.

With flexible terms and efficient processes, our fix-and-flip financing empowers you to uncover hidden treasures and make a lasting impact on the city’s diverse neighborhoods.

Shape Skylines with Ground-Up Construction Loans in Boston, MA

Whether you’re envisioning residential, commercial, or mixed-use developments, our hard money lenders are here to turn your ambitious blueprints into tangible realities.

Our customizable hard money loans cater to your unique vision, providing the necessary support for groundbreaking construction projects that define the future of the city.

Seize Residential Rental Opportunities in Boston, MA

Our streamlined hard money loan process prioritizes property value over rigid credit checks, enabling you to expand your rental portfolio and establish sustainable revenue streams in one of the nation’s most dynamic cities.

With competitive rates and flexible terms, our hard money loans for residential rentalsw empower you to navigate Boston’s rental landscape and build a resilient investment portfolio for long-term success.

Multifamily/Mixed-Use Investments in Boston, MA

Stay ahead of the curve in Boston’s bustling multifamily and mixed-use property market with our investment loans. The multifamily bridge hard money loan program provides the critical financial flexibility required during short-term financing needs or transitional periods.

Whether you’re acquiring, renovating, or refinancing properties, our solutions are tailored to help you navigate the complexities of multifamily and mixed-use investments effectively.

By choosing Insula Capital Group, you’re ensuring agility and success in Boston’s competitive real estate environment. With over 30 years of experience, our team can now provide curated contracts to each client within no time.

Submit an online application now to start your journey toward realizing your real estate goals in Boston.

Investing in the Real Estate Market of the Cradle of Liberty

- Population: 6,977,624

- Median Home Value: $565,091

- Annual Appreciation Rate: +15.5%

- Average Days On Market: 32

- Median Price: $874,500

- Price-To-Rent Ratio: 27.2

Just Funded Projects

February 2026

Fix & Flip

Loan Amount

$248,869

After Repair Value$409,000

Purchase Price$145,000

Renovation Budget$147,787

Loan TypeFix & Flip

- After Repair Value$409,000

- Purchase Price$145,000

- Renovation Budget$147,787

- Loan TypeFix & Flip

Decatur, GA

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

December 2025

Fix & Flip

Loan Amount

$171,250

After Repair Value$263,000

Purchase Price$125,000

Renovation Budget$65,000

Loan TypeFix & Flip

- After Repair Value$263,000

- Purchase Price$125,000

- Renovation Budget$65,000

- Loan TypeFix & Flip

Albany, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Anticipated Trends Shaping Boston's Real Estate Market

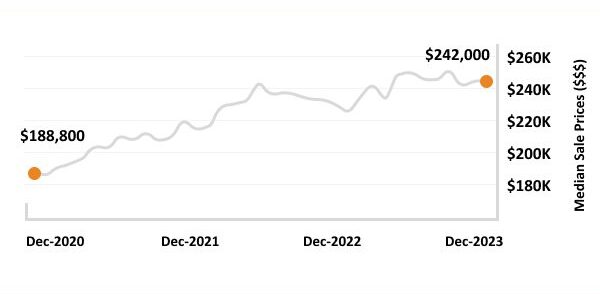

Price Appreciation

The supply and demand dynamics have driven home values significantly higher over the past year.

Prices are expected to continue their upward trajectory, albeit at a more moderated pace.

While the extent of this appreciation remains uncertain, forecasts suggest a continued increase in home prices, driven partly by the looming threat of rising interest rates.

Rising Interest Rates

Mortgage rates have surged to multi-year highs, spurred by the Federal Reserve’s decision to increase benchmark rates. This initial uptick is expected to be followed by further rate hikes, leading to higher acquisition costs.

As interest rates climb, homes in Boston may become even less affordable, impacting buyers and investors alike.

Passive Income Portfolios

Massachusetts, including Boston, has witnessed a rapid escalation in rental prices, creating favorable conditions for landlords.

The robust demand for rental properties, fueled by the region’s soaring home prices, has positioned passive income portfolios as resilient investments.

With many prospective buyers turning to renting due to the exorbitant costs of homeownership, the rental market in Boston is poised to thrive, offering lucrative opportunities for investors.

Need inspiration to benefit from the positive trajectory? Check out our just-funded projects!

Ready to apply for a money lenders loan?

Frequently Asked Questions

Yes! As your trusted hard money lenders, we are primarily concerned with the value of the property being used as collateral. If you satisfy the other qualification requirements, you can still get approved for our hard money loan programs even with poor credit.

We typically approve loan applications within twenty-four hours of submitting and fund loans within five business days of approval.

Yes! Our application process is simple. You can pre-qualify or submit a full online application through our website for quick and convenient financing. Click here to apply for pre-qualification.

Insula Capital Group – Your Strategic Partner in Boston

At Insula Capital Group, we go beyond being just hard money lenders; we are your strategic partners in real estate success. Boston’s real estate market is diverse and presents unique opportunities and challenges. Our local expertise, commitment to efficiency, and personalized service set us apart in the competitive landscape of Boston’s real estate market.

Whether you’re a seasoned real estate professional or a first-time investor, Insula Capital Group is ready. See for yourself how our commitment transforms into action—explore our recently funded projects that exemplify our devotion to propelling investor success.

Start your journey by filling out our simple pre-qualification form, or delve deeper into your investment potential with our comprehensive full loan application. If you have any queries or want to have an insightful discussion about your real estate ambitions, don’t hesitate to schedule a consultation with our team of seasoned experts.

Let’s turn those investment dreams into reality, one property at a time!