Private Money Lenders | Hard Money Loans in Cincinnati, OH

Home to famous Fortune 500 companies, Cincinnati offers a diverse and healthy sense of community and job market. The city brims with young, aspiring professionals in manufacturing, healthcare, retail, and finance.

Cincinnati is a seller’s market through and through. The property rollout is 9 days, and sellers can make bigger bucks by listing their properties. Whether you’re looking to refurnish a fixer-upper property or want to build a new one from the ground up, you’ll need funding and budgeting to ensure a successful venture.

That’s where Insula Capital Group’s hard money lenders come in. We understand the changing market dynamics and offer solutions tailored to the fast-paced nature of Ohio’s real estate market.

Leverage Opportunities with Quick Hard Money Loans in Cincinnati

You can find permits for property flipping and new construction projects. However, you also need to plan project funding in time to eliminate any financial stress during the process. Our private money lenders are well-accustomed to the local real estate market. Hence, we offer you speedy approvals and funds, competitive rates, and customized loan programs.

We have a diverse suite of financial solutions for various real estate projects. Learn about our residential rental program, multifamily/mixed-used loans, new construction loans and fix & flip loans.

Leveraging the Benefits of Hard Money Loans in Cincinnati, Ohio

you’ve worked with lenders offering traditional loans, you’ll be aware of the long approval processes, thorough background checks, documentation, and verification. In many cases, this can be a pitfall as you might lose a potential opportunity in the market. Instead, opting for hard money loans allows you faster project capital access. A larger pool of applicants can apply for it since they’re based on the property in question’s value rather than focusing heavily on credit history.

Hard money loans are also flexible with respect to the terms and conditions of the loan. For example, private hard money lenders may offer interest-only payments during the construction phase, easing the financial burden on investors until the property is completed and income generated.

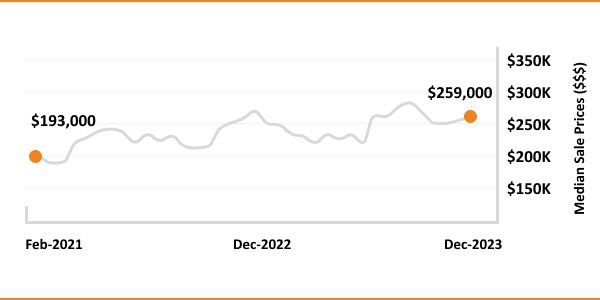

Key Details About the Cincinnati, Ohio Real Estate Market

Investors engaging in new construction projects within real estate must conduct thorough research to mitigate risks and maximize returns. It involves analyzing various factors such as market demand, location dynamics, zoning regulations, and construction costs. Understanding local market trends and demand drivers ensures that the project aligns with the needs of potential buyers or tenants. Investors must research zoning regulations and obtain necessary permits that are essential to avoid legal hurdles during the construction process. These are some essential statistics to keep in mind:

- Median Home Value:$ 215,066

- 1-Year Appreciation Rate:+ 4.6%

- Median Sales Price:$229,250

- Median Rent Price:$1,349

- Price-To-Rent Ratio:15

- Unemployment Rate:10%

- Population:1,775,000

- Median Household Income: $49,191

Key Real Estate Statistics for Cincinnati, Ohio

1,775,000

Population

$1,349

Median Rent Price

$215,066

Median Home Value

+16.6%

1-Year Appreciation Rate

$49,191

Median Household Income

15

Price-To-Rent Ratio

Just Funded Projects

February 2026

Fix & Flip

Loan Amount

$248,869

After Repair Value$409,000

Purchase Price$145,000

Renovation Budget$147,787

Loan TypeFix & Flip

- After Repair Value$409,000

- Purchase Price$145,000

- Renovation Budget$147,787

- Loan TypeFix & Flip

Decatur, GA

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

December 2025

Fix & Flip

Loan Amount

$171,250

After Repair Value$263,000

Purchase Price$125,000

Renovation Budget$65,000

Loan TypeFix & Flip

- After Repair Value$263,000

- Purchase Price$125,000

- Renovation Budget$65,000

- Loan TypeFix & Flip

Albany, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Reasons Why the Cincinnati, Ohio Real Estate Market Appeals To Investors

Investing in new construction real estate in any area requires the place in question to show a lot of promise and development, and Cincinnati, Ohio, provides it. The city’s educational sector is strong thanks to a number of institutions, such as the University of Cincinnati and Xavier University. Cincinnati’s public school system emphasizes quality education, enhancing the overall educational environment. These are aspects that matter heavily to concerned parents, which has led to people moving to the area.

When it comes to businesses, Cincinnati provides diversity as well as strength. Many industries, such as manufacturing, healthcare, finance, and technology, are thriving in the area. Larger organizations like Procter & Gamble, Kroger, and Fifth Third Bancorp elevate the city’s economic vitality and potential for real estate investment.

Healthcare is a major concern for Americans, and Cincinnati has several renowned hospitals and medical centers. Noteworthy inclusions are the Cincinnati Children’s Hospital Medical Center and the University of Cincinnati Medical Center.

Population trends also favor investment in Cincinnati. While experiencing modest growth, the city attracts newcomers seeking affordable living costs, a vibrant cultural scene, and ample employment opportunities. This steady influx of residents contributes to sustained demand for housing, particularly new construction properties.

Ready to apply for a Hard Money Loans?

Get in touch with our experienced team for more details about our financing services.

Frequently Asked Questions

Fill out the online loan application form available on our website to start your application. Submit all the required forms and documents with your application.

We have a simple and straightforward process. Unlike conventional lenders with rigid requirements such as income verification and strong credit score, we prioritize your exit strategy, property value, and project. Connect with our hard money lenders to discuss your eligibility.

Insula Capital Group’s private money lenders focus on credit history when considering loan approvals. Each case is looked at individually. Aspects like equity, property value, and loan requirement are more important aspects for consideration. Get in touch with our team for further information.

At Insula Capital Group, we’re poised to assist everyone regardless of their experience in the real estate market. Whether you’re a first-time investor or a seasoned borrower, our team guides you in making the right decisions.

Here’s what sets us apart:

- Approval within a day

- Funding within three to five business days

- No prepayment penalties

- No hidden fees

Prequalify for a loan today to have our team assess your project and application.

Make an Informed Investment Choice!

Insula Capital Group is all about building long-term relations and helping you maximize returns. Discover our previous projects for more inspiration and insight. Contact our private money lenders today!