Private Money Lenders | Hard Money Loans in Connecticut

If you want to leverage real estate projects in the northeast, Connecticut is the best place to do it!

Connecticut brings excellent living standards and vibrant lifestyles to its residents. It’s no wonder that scores of new homeowners and property developers flock to this state every year. Unfortunately, real estate investment costs can still run high in Connecticut.

Investors struggling to finance their property investment projects can benefit from Insula Capital Group’sprivate money loans. Learn how our private hard money lenders in Connecticut can help you!

Get in Touch

Expedite Your Next Project with Our Hard Money Loans in Connecticut

Investing in real estate shouldn’t be complicated. Acquiring sufficient funds is often the main concern for investors across the nation. If you want to kick-start a project but can’t afford to, your best bet is to apply for a hard or private loan in Connecticut!

Insula Capital Group offers curated loan programs to help investors finance every aspect of their real estate projects. Our services include new construction loans,fix & flip loans, residential rental loans, and multifamily/mixed-use loans. You can discuss your unique project needs with our in-house underwriters and obtain a customized contract quickly.

Why Are Hard Money Loans The Best Way To Finance Real Estate Projects

Hard money loans are a popular financing option for various reasons in Connecticut. These loans provide quick access to funds to individuals looking to purchase properties. It’s no surprise that traditional loan processes can be time-consuming since they need extensive documentation. Fortunately, hard money lenders prioritize quick approvals by analyzing your collateral’s value.

Hard money loans are also accessible to individuals with low credit scores. Conventional lenders heavily rely on credit scores, making it challenging for those with poor credit histories to secure loans. Hard money lenders prioritize the asset’s value and help borrowers with lower credit scores to still access financing.

Hard money loans are versatile, and you can use them for various purposes like real estate investments and business ventures. You can use these loans to get your hands on profitable opportunities or address urgent financial needs.

Hard money loans also provide flexibility in repayment terms. You can negotiate terms directly with the lender and customize the loan agreement according to your specific financial situation.

All You Need To Know About Connecticut's Real Estate Market

Purchasing a property is always a big decision, and you might make the wrong decision if you don’t research thoroughly. We want to help our clients make informed investment decisions in Connecticut and this is why we’re listing some statistics that’ll help you decide:

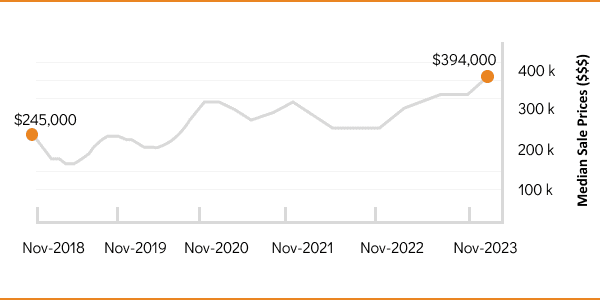

- Median Home Value:$326,124

- 1-Year Appreciation Rate:+20.7%

- Average Sales Price:$513,113

- Median Rent Price:$1,486

- Price-To-Rent Ratio:28

- Unemployment Rate:2%

- Population:3,605,944

- Median Household Income: $73,781

The Real Estate Market In Connecticut

3,605,944

Population

$513,113

Average Sales Price

$1486

Medium Rent Price

$73,781

Median Household Income

18.28

Price-To-Rent Ratio

+20.7%

1-Year Appreciation Rate

Just Funded Projects

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

December 2025

Fix & Flip

Loan Amount

$171,250

After Repair Value$263,000

Purchase Price$125,000

Renovation Budget$65,000

Loan TypeFix & Flip

- After Repair Value$263,000

- Purchase Price$125,000

- Renovation Budget$65,000

- Loan TypeFix & Flip

Albany, NY

December 2025

New Construction

Loan Amount

$650,000

After Repair Value$1,200,000

Purchase Price$500,000

Renovation Budget$606,950

Loan TypeNew Construction

- After Repair Value$1,200,000

- Purchase Price$500,000

- Renovation Budget$606,950

- Loan TypeNew Construction

Fulton, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Why Is Connecticut's Real Estate Market Booming

Connecticut’s real estate market presents a unique landscape for buyers and sellers. The state is close to major urban centers, whichhas made it a desirable location for commuters looking to escape the hustle and bustle of the city while maintaining convenient access.

The state’s top-notch job market is another significant aspect that increases the strength of its real estate market. With a diverse economy that includes finance, and technology sectors, Connecticut attracts professionals seeking career opportunities.

Connecticut’s commitment to education also increases the real estate demand. With renowned universities and excellent public schools, families are attracted to neighborhoods that prioritize education. The focus on academic excellence contributes to the growth of the housing market in the state.

If you want to become a part of the thriving real estate market in Connecticut, we recommend using our hard money loans to purchase your favorite property in no time.

Ready to apply for a hard money loan?

Frequently Asked Questions

The Insula Capital Group team has been in business for over 30 years, making us one of the US’s most experienced and reputable lending firms. You can view our just-funded projects portfolio to see our recent cases.

No. Insula Capital Group offers long and short-term loans per borrower requirements. You can visit our website for details about our hard money loan terms.

Our loan disbursement process is safe. We release your funds into a direct private fund for convenience and security.

Top Hard Money Lenders Loan Cities in Connecticut

Get Funded In A Week With Insula Capital Group

With decades of experience and an extensive portfolio, Insula Capital Group is the go-to private and hard money lender for Connecticut investors. Applying for our programs is simpler than you think, with only a full application being the initial requirement. Feel free to access and download all the required forms through our website at your convenience.

We’re aware of the challenges of acquiring funds for real estate projects in Connecticut. We strive to streamline the hard money financing process for our clients. Our team can examine your financial situation and provide a personalized financing plan.

Our team is available every business day from 9 am to 5 pm. Contact us via phone or email if you have any queries before applying. We will approve your loan once we review your application within a day! So, let’s get started right away.