Private Money Lenders | Hard Money Loans in Florida

It’s no secret that real estate projects in Florida are in high demand. If you want to dive into the thriving property market, we recommend connecting with our team to get customized hard money loans. Our financing services can help you take your projects to the next level.

We know that purchasing real estate or renovating a property can be financially challenging, which is why we offer hard money loans. From fix & flip loans to construction financing, we can help you finance a wide range of real estate projects in Florida.

Here’s all you need to know about our hard money loans in Florida.

Get in Touch

Invest In The Real Estate Market In Florida With Our Hard Money Loans

Looking for exceptional hard money loan deals in Florida? Our team is here to help you! We offer competitive interest rates and flexible repayment schedules, so you can get the funding you need without paying highinterest rates. Our hard money loan deals don’t have any pre-payment penalties or junk fees.

We’ve been helping our clients in the real estate industry for over thirty years, and we hope to maintain our high-quality financing standards in the future. Our underwriting team will review your financial paperwork and provide loan approvals within twenty-four hours.

Connect with us to discuss your financing options.

The Benefits Of Acquiring In Hard Money Loans In Florida

Hard money loans offer several advantages for borrowers seeking quick and flexible financing solutions in Florida. One primary advantage is the swift approval process, which is faster than traditional lenders. Unlike banks that require extensive documentation and have lengthy approval processes, hard money lenders focus on the collateral’s value, allowing for a streamlined approval process.

Hard money lenders are also more willing to work with borrowers who may have low credit scores. It makes hard money loans an attractive option for real estate investors and entrepreneurs who are facing financial challenges.

As a borrower, you can negotiate terms with a private lender that suits your specific needs, including customized repayment schedules and interest rates. This flexibility allows for creative financing solutions that align with the unique requirements of a specific real estate project.

Exciting Facts About The Real Estate Market In Florida

Want to invest in Florida’s real estate market, but don’t know much about it? Here are some statistics that’ll help you understand the real estate landscape in Florida:

- Median Home Value: $313,217

- 1-Year Appreciation Rate: +20.1%

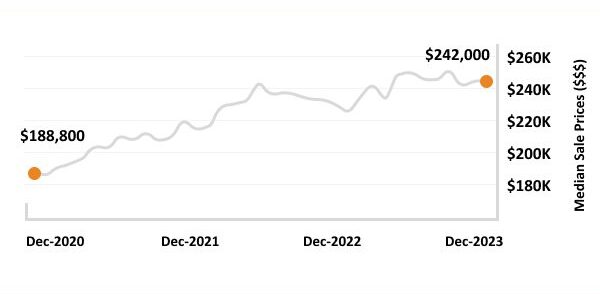

- Median Sale Price: $354,000

- Median Time To Sale: 51 Days

- Median Rent Price: $1,693

- Price-To-Rent Ratio: 41

- Foreclosure Rate: 08%

- Unemployment Rate: 0%

- Population: 21,477,737

- Median Household Income: $55,660

The Real Estate Market In Florida

21,477,773

Population

$851

Median Rent Price

$354,000

Median Sale Prices

+20.1%

1-Year Appreciation Rate

51 days

Median Time To Sale

15.41

Price-To-Rent Ratio

Just Funded Projects

February 2026

Fix & Flip

Loan Amount

$248,869

After Repair Value$409,000

Purchase Price$145,000

Renovation Budget$147,787

Loan TypeFix & Flip

- After Repair Value$409,000

- Purchase Price$145,000

- Renovation Budget$147,787

- Loan TypeFix & Flip

Decatur, GA

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

December 2025

Fix & Flip

Loan Amount

$171,250

After Repair Value$263,000

Purchase Price$125,000

Renovation Budget$65,000

Loan TypeFix & Flip

- After Repair Value$263,000

- Purchase Price$125,000

- Renovation Budget$65,000

- Loan TypeFix & Flip

Albany, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Investing In Florida's Real Estate Market Is An Excellent Idea!

Undoubtedly, purchasing properties in Florida is an excellent investment option. The state has an excellent climate, which attracts tourists and investors all year round. It increases real estate demand and presents an opportunity for you to make money.

Florida’s status as a tax-friendly state significantly influences its real estate market. With no state income tax, the state appeals to individuals and businesses looking to minimize their tax burden.

From Miami’s vibrant culture to the beautiful beaches along the Gulf Coast, numerous factors contribute to the overall appeal of the state’s real estate. Florida’s excellent job market also boosts the demand for housing.

Investors are drawn to Florida’s real estate market because of itshigh return on investment potential. The state’s growing population and diversified economy contribute to a steady appreciation of property values over time. The increasing popularity of short-term rentals in Florida provides investors with opportunities for lucrative returns.

Ready to apply for a money lenders loan?

Frequently Asked Questions

Unlike conventional bank loans, hard money loan deals don’t need a long list of requirements and you can get quick approvals because of the streamlined private lending process.

At Insula Capital Group, we want to help you manage your financing issues. This is why we offer multiple financing options, including fix and flip loans, residential rental programs, multifamily mixed-use loans, and new construction loans. You can also learn more about our hard money loan deals by visiting our just-funded project section.

You can use our online full application form to start the hard money lending process in Florida.

Top Fix and Flip Loan Cities in Arkansas

Let Us Help You!

As a private hard money lender in Florida, Insula Capital Group provides financing options to real estate developers, homeowners, and investors. Our team of professionals will work with you to develop an extensive plan from scratch to help you achieve your financial objectives.

Our team can help you reach financial freedom with our asset-based financing solutions.We understand the urgency of your investment goals and our team is committed to providing you with hassle-free funding customized to your unique needs. Our team of seasoned professionals stands ready to guide you through a seamless lending process and help you secure the capital you need without any delay.

So, what are you waiting for? Get in touch with our team for more details about our loan deals.