Private Money Lenders | Hard Money Loans in Georgia

Georgia’s real estate market offers many opportunities for investors aiming for growth and stability. Insula Capital Group, a leading nationwide private lender, brings its specialized hard money loan services to the Peach State, catering to the unique needs of Georgia’s varied property market.

Insula Capital Group provides the necessary financial support to transform your real estate goals into successful investments, whether a fix-and-flip project in suburban areas or a new construction in bustling urban centers.

Our hard money loans in Georgia are designed for flexibility and rapid execution, allowing investors to seize opportunities quickly and efficiently. Insula Capital Group is well-versed in the Georgia real estate sector, and our lending services are a reflection of our dedication to your investment success in this vibrant and promising market.

Partner with Georgia’s Premier Hard Money Lenders at Insula Capital Group

Insula Capital Group brings over three decades of expertise to Georgia, delivering unparalleled private lending services across the state. Our comprehensive offerings show our commitment to excellence in the real estate lending industry.

We pride ourselves on our adaptability to meet the diverse financial requirements of real estate investors in Georgia. Our personalized process ensures that each loan we provide is aligned perfectly with our client’s project goals and financial situations.

As Georgia’s dependable source for private money lending, Insula Capital Group guarantees:

- Expert Financial Guidance: Our seasoned advisors offer insights to navigate the financial aspects of your real estate matters smoothly.

- Swift Processing: We expedite the lending process to facilitate prompt and timely project commencement and progression.

- Competitive Rates: Our loan programs come with competitive interest rates, making financing your project more accessible.

- Transparent Loan Programs: We have an array of loan programs designed to meet your investment needs, all presented with full transparency.

- Track Record of Success: Our just-funded projects are a testament to our ability to execute loans that lead to successful real estate investments.

With Insula Capital Group, you gain a proactive ally in Georgia, ensuring your projects are financed and managed efficiently for optimal results and peace of mind.

The Strategic Benefits of Hard Money Loans

Hard money loans are the keys to swiftly turning real estate aspirations into profitable realities in competitive markets. These loans stand out for their rapid funding, allowing investors to seize time-sensitive opportunities without the usual wait associated with traditional financing.

Structured with consideration for the asset’s value, they offer more lenient terms, making them accessible to a wider range of investors, including those facing credit challenges.

Insula Capital Group provides these loans with a commitment to supporting the growth and success of real estate projects, solidifying its reputation as a leading financial ally. Our simple application and approval process cut through the red tape, facilitating a quicker move from acquisition to renovation and sale.

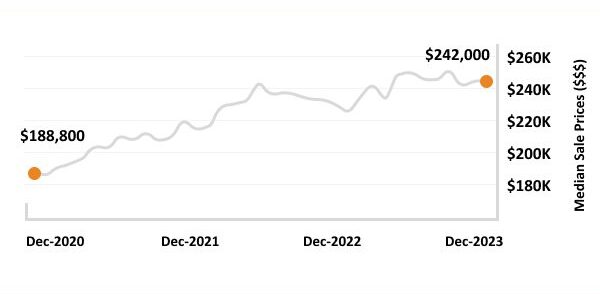

Insightful Statistics: Georgia’s Real Estate

Georgia’s real estate market presents a promising opportunity for investors, with numbers reflecting strong potential. Here are some key factors to consider:

- Population: 11.02 million

- Median Household Income: $73,000

- Average Household Income: $99,345

- Unemployment Rate: 3.4%

- Average Home Prices: $364,100

- Average Rent Prices: $1,222

- Median Days Before Sale: 38

- Median Sale Price: $319,158

- Annual Increase: 6.1%

- Homes Sold Above List Price: 21.9%

- Active Listings: 61,254

- Foreclosure Rate: 1:770

- Median Real Property Tax: $2,027 per year

- Average Effective Property Tax Rate: 0.99%

Georgia’s Real Estate Market

11.02 million

State Population

$364,100

Average Home Price

$319,158

Median Sale Price

+20.3%

1-Year Appreciation Rate

1:770

Home Foreclosure Rate

61,254

Active Listings

Just Funded Projects

March 2026

Fix & Flip

Loan Amount

$249,520

After Repair Value$420,000

Purchase Price$220,000

Renovation Budget$51,520

Loan TypeFix & Flip

- After Repair Value$420,000

- Purchase Price$220,000

- Renovation Budget$51,520

- Loan TypeFix & Flip

Atlanta, GA

February 2026

Fix & Flip

Loan Amount

$248,869

After Repair Value$409,000

Purchase Price$145,000

Renovation Budget$147,787

Loan TypeFix & Flip

- After Repair Value$409,000

- Purchase Price$145,000

- Renovation Budget$147,787

- Loan TypeFix & Flip

Decatur, GA

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Why Invest inGeorgia’s Real Estate Market?

Georgia’s real estate market beckons with its combination of affordability, economic diversity, and quality of life, making it an attractive destination for investors and families alike. A flourishing job market, driven by sectors such as logistics, film production, and technology, positions Georgia as a land of opportunity for professionals across various industries. This economic expansion leads to a growing demand for residential and commercial real estate, underpinning property value appreciation.

Georgia’s appeal is further enhanced by its favorable business climate and tax incentives, which bolster investment returns over time. The state’s commitment to education and infrastructure, including world-class institutions and transportation networks, provides a fertile ground for long-term growth in the property sector.

With its vibrant culture and dynamic growth, cities like Atlanta offer urban living that attracts a diverse population. At the same time, the serene beauty and historic charm of Savannah draw those looking for a blend of tradition and modernity. Both cities showcase neighborhoods on the rise, promising potential for development and investment.

With its strategic location as a gateway to the Southeastern market, investing in Georgia’s real estate is not just about buying into a property but into a region that continues to prosper and evolve.

Ready to apply for a Hard Money Loans?

Get in touch with our experienced team for more details about our financing services.

Frequently Asked Questions

Insula Capital Group, as your specialized hard money lender, is able to sanction and disburse funds more rapidly compared to conventional banks. We streamline the process by minimizing documentation requirements, focusing primarily on the asset’s worth and the loan-to-value ratio. Traditional banks, on the other hand, may place significant emphasis on credit scores and personal income in their assessment.

Absolutely not. Insula Capital Group’s hard money loans are structured to be flexible for our clients, and that includes having no prepayment penalties, providing you with the freedom to manage your finances as you see fit without additional costs.

Initiating a loan with us is simple. Justfill outour online application for the loan program that fits your needs. Once submitted, one of our dedicated representatives will review your details and swiftly get in touch, typically within 24 hours, to advance the process.

Top Hard Money Lenders Loan Cities in Georgia

Partner with Georgia’s Top Hard Money Lenders!

At Insula Capital Group, we’re committed to simplifying your investment experience. As a premier hard money lender in Georgia, we’re eager to equip both experienced and new investors with the tools they need for success in the Georgia real estate market.

If you’re looking for expert advice or just a bit of encouragement to go on board your investment path, don’t hesitate to reach out. Connect with Georgia’s finest private money lenders today and take a significant step towards realizing your real estate ambitions.