Private Money Lenders | Hard Money Loans in Hawaii

Investing in the real estate market in Hawaii is an excellent financial decision. However, purchasing or renovating properties can become a financial hassle if you’ve got a tight budget. This is why we recommend working with our private hard money lenders in Hawaii to prevent potential financial issues.

Find out more about our hard money lending solutions.

Insula Capital Group provides loan programs for residential rental, fix and flip, and new construction projects for people looking to invest with hard money loans in Hawaii. We also provide a multifamily bridge loan program that investors need for competitive permanent financing and to bridge the gap between current and future needs.

Kickstart Your Real Estate Projects with Our Private Money Lenders in Hawaii

Do you want to give your real estate projects in Hawaii a financial boost? Our team can help you! We’ve been working in the real estate industry for over thirty years and we can provide customized hard money loan deals. Our streamlined approval process means you can receive funding quickly, enabling you to acquire profitable opportunities in the dynamic Hawaii real estate market.

Check out the following list to examine our excellent loan features:

- No pre-payment penalties

- Swift approval process

- No junk fees

- Minimal interest rates

Contact us now to discuss your financing needs and start your journey toward real estate success with our hard money lenders.

The Advantage of Using Hard Money Loans in Hawaii for Real Estate Projects

Hard money loans are secured by the value of real estate, making them attractive for those who may not qualify for traditional bank financing. Private hard money lenders in Hawaii provide some of the fastest approval and funding options, allowing you to acquire the required capital within a few days. Traditional loan processes can be lengthy, involving extensive paperwork and credit checks. In contrast, hard money lenders focus primarily on the property’s value and the borrower’s equity, allowing for quicker decision-making and funding.

Hard money lenders are more interested in the collateral’s value than the borrower’s credit history, making these loans accessible to individuals with less-than-perfect credit. This flexibility is particularly advantageous for real estate investors, fix and flip loans, or those facing time-sensitive opportunities in competitive markets.

Additionally, hard money loans can be a solution for borrowers facing foreclosure or bankruptcy, providing a lifeline when conventional lenders may turn them away. The short-term nature of these loans allows borrowers to address immediate financial needs and then refinance or sell the property to repay the loan.

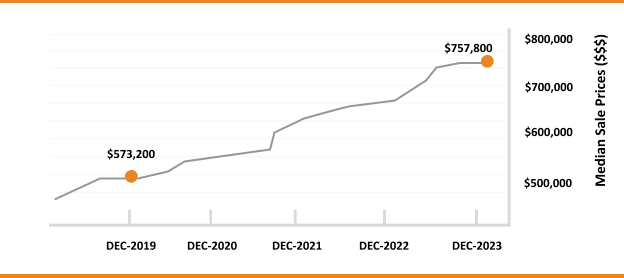

The Numbers to Know About the Hawaii Real Estate Market

At Insula Capital Group, we consider financial education and research to be the first pillar of success. We advise all our clients to get the most intel possible in order to make the best financial decisions. To provide investors with a head start, we’ve collected some essential numbers and facts that our readers should be aware of when looking into investing in Hawaii’s real estate:

- Median Home Value:$777,762

- 1-Year Appreciation Rate:+16.6%

- Median Sales Price:$929,500

- Median Rent Price:$2,146

- Price-To-Rent Ratio:20

- Unemployment Rate:6%

- Population:1,415,872

- Median Household Income: $81,275

Key Real Estate Statistics for Hawaii

1,415,872

Population

$2,146

Median Rent Price

$777,762

Median Home Value

+16.6%

1-Year Appreciation Rate

$81,275

Median Household Income

30.20

Price-To-Rent Ratio

Just Funded Projects

February 2026

Fix & Flip

Loan Amount

$248,869

After Repair Value$409,000

Purchase Price$145,000

Renovation Budget$147,787

Loan TypeFix & Flip

- After Repair Value$409,000

- Purchase Price$145,000

- Renovation Budget$147,787

- Loan TypeFix & Flip

Decatur, GA

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

December 2025

Fix & Flip

Loan Amount

$171,250

After Repair Value$263,000

Purchase Price$125,000

Renovation Budget$65,000

Loan TypeFix & Flip

- After Repair Value$263,000

- Purchase Price$125,000

- Renovation Budget$65,000

- Loan TypeFix & Flip

Albany, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

How Hawaii Established Itself as A Great Market for Real Estate Investment

Real estate investment in Hawaii has flourished over the years thanks to the state’s economic stability, natural beauty, and diverse industries. Many people have moved to the area for education, which is always welcome as it helps provide long-term stability due to the need for jobs and a greater workforce. The university system, with campuses across the islands, has done an excellent job in that aspect.

While historically reliant on tourism, Hawaii’s economy has diversified in recent years. The state is investing more in renewable energy, technology, and agriculture sectors. The clean energy sector has seen notable expansion, with the state aiming for 100% renewable energy by 2045.

The healthcare landscape in Hawaii is robust, with renowned medical facilities such as the Queen’s Medical Center and the Straub Clinic & Hospital. The state’s commitment to healthcare is reflected in its efforts to address public health challenges and enhance medical infrastructure.

While the cost of living in Hawaii is relatively high, the real estate market remains resilient, driven by demand from both residents and tourists. Many people consider it one of the best locations to retire in, thanks to its beautiful beaches, landscape, and flourishing economy.

For all these reasons, private hard money lenders in Hawaii are providing competitive and flexible fix and flop loans, new construction loans, and more to facilitate investors looking to operate in the region.

Ready to apply for a Hard Money Loans?

Get in touch with our experienced team for more details about our financing services.

Frequently Asked Questions

Yes, it’s possible! In a bid to make financing accessible to a wide range of clients, we evaluate every loan application extensively. Our team examines factors like project potential and the borrowers’ financial qualifications to provide loan approval. You can learn more about our loan deals by visiting our just-funded project section.

After you submit the online application form, our team will take twenty-four hours to provide loan approvals and five days to deliver the funds.

You can get a wide range of loan programs at Insula Capital Group to fund your projects. We’ve got fix and flip loans, residential rental programs, multifamily mixed-use loans, and new construction loans to assist you.

Top Hard Money Lenders Loan Cities in Hawaii

Join Hands with A Reputable Private Hard Money Lender

At Insula Capital Group, we go beyond just providing financial solutions. We strive to build lasting partnerships with our clients, offering exceptional customer service throughout the loan process. We’ll thoroughly analyze your financial requirements and project plan before providing a loan deal that’s tailored to your budget.

Our experienced professionals will also guide you on various aspects to make the most out of your hard money loans in Hawaii. Ready to take the next step in financing your real estate projects in Hawaii? Connect with us today!