Private Money Lenders | Hard Money Loans in Idaho

Idaho is called the Gem State for many reasons!

The northwestern state has a rich history, making it one of the most unique US states. One industry that is unexpectedly benefitting from Idaho’s local economy is real estate. Property developers and investors nationwide can yield significant profits by investing in Idaho’s real estate market.

Generating or securing sufficient funding is one of the biggest challenges that Idaho investors face. If you are one of them, getting a private or hard money loan might be your best bet! Learn how the experienced Insula Capital Group hard money lenders can help.

Get in Touch

Expedite Your Real Estate Projects by Getting a Hard Money Loan in Idaho

Securing a hard/private money loan ahead of time can allow you to expedite your real estate ventures. You can benefit from this quick financial solution whether you want to rent residential properties or build properties from the ground up.

Insula Capital Group offers curated loan programs to help investors find the most suitable solutions. Explore our new construction loans, fix & flip loans, residential rental loans, and multifamily/mixed-use loans online today! You can apply for any program by submitting a complete online application.

Why Real Estate Investors Prefer Hard Money Loans in Idaho for Fix and Flip Projects and New Construction

Hard money loans offer distinct advantages for real estate investors, particularly those engaged in fix and flip projects or new constructions. For fix and flip projects, hard money loans provide quick access to capital, enabling investors to purchase distressed properties and fund renovations promptly. Unlike traditional bank loans, hard money lenders typically focus less on borrower creditworthiness and more on the value of the underlying property, facilitating faster approval processes.

Hard money loans offer flexibility in terms of repayment structures, which is advantageous for investors undertaking fix and flip projects. Investors can negotiate terms such as interest-only payments or balloon payments, aligning with the short-term nature of these projects and allowing for more efficient management of cash flow.

Similarly, hard money loans are beneficial for financing new construction projects. They provide developers with the necessary capital to acquire land, cover construction costs, and navigate through the development process. The speed of approval and flexibility in repayment terms make hard money loans an attractive option for developers seeking to capitalize on opportunities in the real estate market.

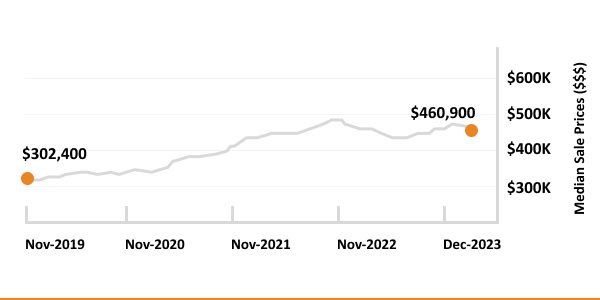

The Crucial Stats and Figures About Idaho’s Real Estate Market

Despite the growing infrastructure and economy of Idaho, investors are advised to do their due diligence when investing in the region. Insula Capital Group believes that investors should dedicate a lot of time to accumulating as much data as they can before putting money into any venture. Here are some must-know pieces of information about Idaho’s real estate scene

- Median Home Value:$436,922

- 1-Year Appreciation Rate:+37.2%

- Foreclosure Rate:One in every 8,155

- Median Rent Price:$1,164

- Price-To-Rent Ratio:28

- Unemployment Rate:9%

- Population:1,787,065

- Median Household Income: $55,785

Idaho Real Estate Statistics To Know

1,787,065

Population

$1,164

Median Rent Price

$436,922

Median Home Value

+37.2%

1-Year Appreciation Rate

$55,785

Median Household Income

31.28

Price-To-Rent Ratio

Just Funded Projects

February 2026

Fix & Flip

Loan Amount

$248,869

After Repair Value$409,000

Purchase Price$145,000

Renovation Budget$147,787

Loan TypeFix & Flip

- After Repair Value$409,000

- Purchase Price$145,000

- Renovation Budget$147,787

- Loan TypeFix & Flip

Decatur, GA

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

December 2025

Fix & Flip

Loan Amount

$171,250

After Repair Value$263,000

Purchase Price$125,000

Renovation Budget$65,000

Loan TypeFix & Flip

- After Repair Value$263,000

- Purchase Price$125,000

- Renovation Budget$65,000

- Loan TypeFix & Flip

Albany, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Why Investors Are Considering Hard Money Loans in Idaho For Real Estate

Real estate investors tend to focus on education, business, healthcare, and population trends when assessing a new area for business ventures. These numbers are often indicators regarding the viability of certain investments. Idaho’s education system has shown notable improvements, with initiatives aimed at enhancing academic performance and graduation rates. The state offers various educational institutions, including universities and community colleges, providing a skilled workforce for prospective employers. Because of this, investors can expect an influx of people in the region.

Idaho fosters a favorable environment for businesses, boasting a diverse economy with agriculture, technology, manufacturing, and tourism sectors. The state’s business-friendly policies, including tax incentives and regulatory support, attract entrepreneurs and corporations alike.

Healthcare infrastructure in Idaho is robust, with numerous hospitals and healthcare facilities serving residents across the state. Efforts to expand access to healthcare services continue, addressing the needs of both urban and rural populations.

Population trends in Idaho reflect steady growth, driven by domestic migration from other states seeking a high quality of life, outdoor recreational opportunities, and affordable living. This influx of newcomers contributes to the demand for housing, making Idaho an attractive destination for real estate investment.

Ready to apply for a Hard Money loan?

Frequently Asked Questions

We lend on 1-4 family, 5+ multifamily, condominiums, townhouses, and planned unit development properties. Each program has different terms, so ensure your requirements align with the loan terms you want to apply for. Click here to learn more.

We determine the interest rates for our hard money loans based on factors like the borrower’s credit rating, payment history, and overall economic conditions.

No! Insula Capital Group does not charge prepayment penalties on any loan.

Top Hard Money Lenders Loan Cities in Idaho

Get Approvals in 24 Hours with Insula Capital Group

The Insula Capital Group team values your time. Our in-house underwriters work around the clock, ensuring your application gets approved within a day. From then onwards, funding your loan will only take another five business days.

If you want to explore our portfolio, you can visit our just-funded projects page. Many investors trust our hard and private money lenders in Idaho, so start applying today! You can click here to download the required forms before pre-qualifying. Feel free to contact us if you have further queries.