Private Money Lenders | Hard Money Loans in Kansas

If you need fast and reliable financing options for your real estate investments, look no further than Insula Capital Group. Our private money lending services are tailored to meet the unique needs of our clients, providing quick access to capital without the hassle of long procedures.

Find out more about our private money lenders in Orlando, FL.

Our loan programs are available for residential rental, fix and flip, and new constructions. We also offer a multifamily bridge loan program. Keeping the blooming economy of Orlando, Florida, we enable an expedited process for our clients to acquire the necessary capital to work on their ventures with our dedicated resources.

Get in Touch

Why Hard Money Loans Are An Attractive Option For Investments In Kansas

Speed and Efficiency

Hard money lenders like Insula Capital Group can provide expedited funding, allowing investors to capitalize on time-sensitive opportunities quickly.

Unlike traditional lenders, who may take weeks or even months to approve a loan, hard money lenders can often provide funding in a matter of days, enabling investors to act swiftly and secure lucrative deals.

Tap to apply for quick pre-qualification.

Flexible Approval Criteria

Traditional lenders typically require borrowers to meet stringent eligibility criteria, including high credit scores, stable income, and extensive documentation.

In contrast, hard money lenders focus primarily on the value of the underlying property rather than the borrower’s creditworthiness. This makes hard money loans an ideal option for investors who may not qualify for traditional financing due to credit issues or other factors.

Accessibility

Whether you’re a seasoned investor or a newcomer to the real estate market, hard money loans offer accessibility and flexibility for a wide range of investment scenarios.

From Fix and Flip projects to ground-up developments, our hard money lenders can tailor loan products to meet the specific needs of individual investors, providing the capital necessary to fuel growth and success.

Asset-Based Lending

Hard money loans are typically secured by the underlying property, providing investors with an opportunity to leverage their existing real estate assets to access additional capital.

This collateral-based lending approach mitigates risk for lenders and allows investors to secure financing without putting their personal assets on the line.

Additionally, the ability to leverage collateral can enable investors to undertake larger and more profitable investment projects than would otherwise be possible.

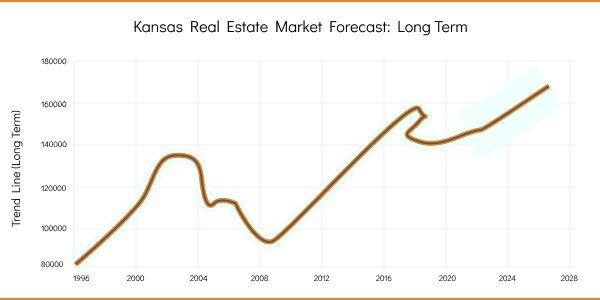

Adaptability to Market Conditions

The real estate market in Kansas, like any market, is subject to fluctuations and cyclical trends. Hard money loans offer investors the flexibility to adapt to changing market conditions and capitalize on opportunities as they arise.

Whether it’s acquiring distressed properties at a discount, purchasing foreclosure properties at auction, or taking advantage of seller financing opportunities, hard money loans provide the financial flexibility needed to navigate the complexities of the real estate market with confidence.

Check out our just-funded projects for more information.

Why Invest in Kansas Real Estate

Kansas, often referred to as the Heart of America, offers a wealth of opportunities for real estate investors seeking stable returns and long-term growth prospects.

Affordability: Compared to many other states, Kansas offers relatively affordable real estate prices, making it an attractive destination for investors looking to maximize their purchasing power.

Whether you’re interested in residential properties, commercial developments, or agricultural land, Kansas offers a diverse range of investment options at affordable price points.

Stability and Resilience: Kansas boasts a stable and resilient real estate market that has weathered economic downturns and market fluctuations with resilience.

The state’s diverse economy, which includes robust agricultural, manufacturing, aerospace, and energy sectors, provides a solid foundation for sustained growth and stability in the real estate market.

Strong Rental Market: With a growing population and a steady influx of residents, Kansas offers a strong rental market for investors interested in income-producing properties.

Whether you’re investing in single-family homes, multifamily complexes, or student housing near universities and colleges, there is ample demand for rental properties across the state.

Kansas City Real Estate Market Overview

- Population: 508,394

- Median Home Value: $236,657

- Median List Price: $418,646

- Annual Appreciation Rate: +15.6%

- Median Days On Market: 33

- Median Rent: $1,302

- Price-To-Rent Ratio: 16

Kansas Real Estate Landscape

2,937,150

Population

$281,800

Median Sale Price

$215,642

Average Home Price

9.2%

1-Year Appreciation Rate

1/8,714

Home Foreclosure Rate

8,330

Number of homes for sale

Just Funded Projects

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

December 2025

Fix & Flip

Loan Amount

$171,250

After Repair Value$263,000

Purchase Price$125,000

Renovation Budget$65,000

Loan TypeFix & Flip

- After Repair Value$263,000

- Purchase Price$125,000

- Renovation Budget$65,000

- Loan TypeFix & Flip

Albany, NY

December 2025

New Construction

Loan Amount

$650,000

After Repair Value$1,200,000

Purchase Price$500,000

Renovation Budget$606,950

Loan TypeNew Construction

- After Repair Value$1,200,000

- Purchase Price$500,000

- Renovation Budget$606,950

- Loan TypeNew Construction

Fulton, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Ready to apply for a Hard Money loan?

Frequently Asked Questions

With our aim to assist our real estate clients, we provide various asset-based financing options likefix and flip loans, residential rental programs, multifamily mixed-use loans, and new construction loans to help you finish your projects. You can also visit our just-funded project section to learn more about our financing options.

You can get funding for your project in Kansas within five days after you submit our online full application form.

Yes! Even if you have a low credit score, you can expect a loan approval if your project plan and collateral fulfill our loan requirements. In a bid to make hard money financing more accessible, we’re proud to inform you that we offer hard money loans with minimal requirements.

Top Hard Money Lenders Loan Cities in Kansas

Get In Touch With A Private Hard Money Lender In Kansas To Finance Your Real Estate Projects

Consider connecting with a reputable hard money lender to finance your projects without any hassle. If you need customized loan deals with flexible repayment options, you’re at the right place. We offer asset-based loans with minimal documentation, no junk fees, low interest rates, and no pre-payment penalties.

Our commitment to exceptional customer service extends beyond the loan deal itself. We are always available to address your questions, provide ongoing support, and explore future financing opportunities as your needs evolve. We are invested in your success and will go the extra mile to help you achieve your financial goals.

So, what are you waiting for? Schedule an appointment with our team for more information.