Private Money Lenders | Hard Money Loans in Kentucky

Kentucky is known for some of the most unique things in the US. From the Kentucky Derby to bourbon production, bluegrass music, and, of course, the perpetually popular Kentucky fried chicken, Kentucky has been the birthplace of some of this nation’s finest offerings—maybe it could be the birthplace of your successful real estate career as well!

Whether you want to purchase properties or renovate them in Kentucky, you can rely on us for financial backing for your projects. We offer hard money loans to help you complete your projects without any hurdles.

Learn more about our hard money financing options in Kentucky.

Get in Touch

Enhance Your Real Estate Ventures with Our Hard Money Loans In Kentucky

If you need extensive hard money financing for your real estate ventures, our team can help you at every step. We offer customized asset-based loans to homeowners, real estate investors, and property developers in Kentucky.

Our commitment to client satisfaction is apparent in our transparent communication, minimal interest rates, and top-class loan terms. We are here to support you throughout your real estate journey, offering financial guidance to ensure your projects are successful.With our straightforward application and prompt decision-making, you can count on us to deliver the funds before it’s too late.

Get in touch with us for more information about our loan deals.

What Makes Hard Money Loans an Excellent Choice

Hard money loans can be an excellent choice for various reasons. First, they offer quick access to capital compared to traditional bank loans, making them ideal for immediate funds for time-sensitive opportunities like real estate purchases or renovations.

Additionally, hard money lenders are typically less stringent regarding credit scores and financial history, prioritizing the collateral’s value instead. This aspect makes them suitable in case you have less-than-perfect credit or unconventional income sources.

Furthermore, hard money loans can be flexible in terms of repayment structures, allowing you to negotiate terms that align with your financial goals and project timelines.

And, of course, hard money loans often cater to niche markets or specialized properties that traditional lenders might overlook, providing you with access to financing for unique ventures that wouldn’t be feasible otherwise.

Kentucky’s Real Estate Market Insights to Keep an Eye On

Projected Growth Of The Real Estate Market: Moderate, with higher appreciation in specific areas

Average ROI for Hard Money Loans: 8-12%

Best Cities To Invest In:

- Louisville

- Lexington

- Covington

- Bowling Green

- Owensboro

- Population:4,468,402

- Median Household Income: $46,535

- Unemployment Rate: 4.4%

- Homes for Sale: 12,200

- New Listings: 2,576

- Average Home Prices: $249,800

- Median Home Value: $147,300

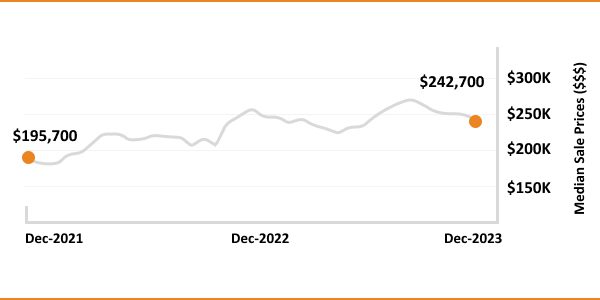

- Median Sale Price:$240,000

- 1-Year Appreciate Rate: +4.7%

- Median Rent Price: $1125

- Price-To-Rent Ratio: 10.91

- Median Days on Market: 40 days

- Home Sold Above List Price: 28.8%

- Foreclosure Rate: 1 in every 4,549

- Median Property Tax: 0.64%

Alabama’s Real Estate Market

4,468,402

Population

12,200

Homes for Sale

$249,800

Average Home Prices

28.8%

Home Sold Above List Price

$46,535

Median Household Income

2,576

New Listings

Just Funded Projects

February 2026

Fix & Flip

Loan Amount

$248,869

After Repair Value$409,000

Purchase Price$145,000

Renovation Budget$147,787

Loan TypeFix & Flip

- After Repair Value$409,000

- Purchase Price$145,000

- Renovation Budget$147,787

- Loan TypeFix & Flip

Decatur, GA

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

December 2025

Fix & Flip

Loan Amount

$171,250

After Repair Value$263,000

Purchase Price$125,000

Renovation Budget$65,000

Loan TypeFix & Flip

- After Repair Value$263,000

- Purchase Price$125,000

- Renovation Budget$65,000

- Loan TypeFix & Flip

Albany, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Why Invest In Kentucky?

There are several factors that make Kentucky an excellent fit for your real estate investments. The most important factor that beginner investors should consider is affordability. Compared to national averages, Kentucky has significantly lower property prices; this makes it very easy for you to enter the market while you are still able to anticipate higher returns on investment.

Also, it’s worth noting that Kentucky’s economy is known for being stable. It’s not exactly booming, but there is a lot of stability, and this contributes to steady job growth and, therefore, a consistent rental demand.

Additionally, Kentucky offers diverse opportunities for real estate investors. You can choose to invest in urban centers like Lexington or Louisville or choose small scenic towns. Kentucky is the perfect place to add diversity to your portfolio.

Another great thing about investing in Kentucky, especially if you’ve got rental properties on your mind, is that the state has very landlord-friendly laws, so this will make it very easy for you to manage rental properties, should you choose to invest in them.

Ready to apply for a Hard Money loan?

Frequently Asked Questions

At Insula Capital Group, we have a holistic criterion for loan approvals. Unlike traditional lenders, we focus more on the loan collateral’s value and project potential to offer loan approvals. This essentially means that we will be assessing everything from the property’s value and condition to its profitability potential with very little focus on your creditworthiness.

Generally, we’re fairly lenient, and if your collateral property has the potential to appreciate in value and is marketable, you can rest assured that your loan will be approved.

You can check out our just-funded project section to learn more about our innovative hard money loan deals.

To initiate your hard money loan application with Insula Capital Group, simply go to the”Apply Now” section on our website. There, you’ll find user-friendly application forms that gather essential information about your project and financial situation. These include complete application forms, quick applications, and prequalification forms.

Fill out the form of your choice accurately, providing details about the property you’re looking to finance, your intended use of the loan, and your personal financial background.

Once submitted, our experienced team will review your application promptly and reach out to discuss the next steps. We’re committed to streamlining the process and helping you secure the financing you need efficiently.

At Insula Capital Group, we offer four loan programs for our real estate clients in Kentucky. Here’s the list of our hard money financing options you can choose from:

Top Hard Money Lenders Loan Cities in Kentucky

Collaborate With A Private Hard Money Lender!

Undoubtedly, Insula Capital Group is your trusted partner for private hard money lending in Kentucky. We’re dedicated to helping our clients achieve their real estate objectives with our hard money loan deals.

We use our thirty years of experience in the lending industry to provide loan deals that are tailored to your project needs and budget. Our team will take the time to understand your project objectives and make suggestions accordingly to guarantee project success!

Connect with us for more information.