Private Money Lenders | Hard Money Loans in Maryland

Maryland, a state known for its high living standards and vibrant lifestyle, attracts millions of Americans looking for opportunities each year. Why is that important? It’s because real estate investors are part of the demographic that can leverage the thriving local markets in Maryland!

If you’re an investor looking for real estate development projects, you’ve come to the right place! Obtaining private and hard money loans in Maryland has become a swift and accessible option with Insula Capital Group. Read on to learn more about our exciting loan programs.

Get in Touch

Ensure Timely Deal Closures with Private Money Loans in Maryland

Insula Capital Group understands the urgency and unique requirements of real estate investments in bustling states like Maryland.

Our private money loans provide a quick and flexible financing solution, allowing investors to close deals promptly and capitalize on time-sensitive opportunities.

Whether you’re involved in residential or commercial real estate, our streamlined loan process is designed to meet your specific needs.

Our offerings include new construction loans, fix & flip loans, residential rental loans, and multifamily/mixed-use loans for a variety of projects.

You can expect a simplified application process, faster approval timelines, and a high level of flexibility in terms when you apply for a hard money loan with us.

We prioritize efficiency without compromising reliability, ensuring that you can move swiftly in a competitive market environment.

Why Are Hard Money Loans The Best Way To Finance Real Estate Projects in Maryland

Hard money loans emerge as an ideal financing solution for real estate investors in Maryland due to their swift approval, flexible qualification criteria, and asset-centric approach.

Unlike traditional loans, hard money lenders value collateral over credit history, which makes the loans accessible to those with less-than-ideal credit scores.

Reach out to our experts to learn how our hard money loans cater to specialized funding needs and provide a valuable tool for investors navigating time-sensitive situations or projects that may not align with traditional lending criteria.

Make Sure to Keep the Following Insights in Mind When Investing in Maryland's Real Estate Market

- Population: 6,165,129

- Median Household Income:$87,063

- Unemployment Rate: 4%

- Average Home Prices: $389,341

- Average Rent Prices: $1,697

- Median Days Before Sale: 29

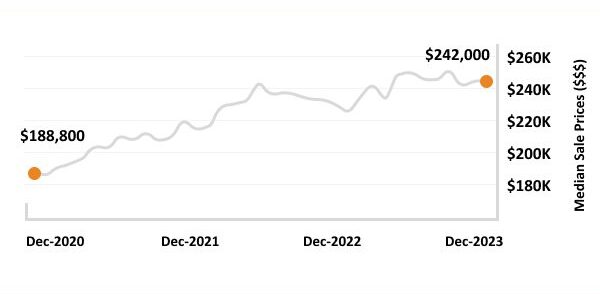

- Median Sale Price: $410,499

- Annual Increase: +12.3%

- Active Listings: 5,480

- Price-To-Rent Ratio: 19.11

Hard Money Loan Timeline in Oregon

6,165,129

Population

$389,341

Average Home Prices

$410,499

Median Sale Price

12.3%

Annual Increase:

$1,697

Average Rent Prices

19.11

Price-To-Rent Ratio

Just Funded Projects

March 2026

Fix & Flip

Loan Amount

$249,520

After Repair Value$420,000

Purchase Price$220,000

Renovation Budget$51,520

Loan TypeFix & Flip

- After Repair Value$420,000

- Purchase Price$220,000

- Renovation Budget$51,520

- Loan TypeFix & Flip

Atlanta, GA

February 2026

Fix & Flip

Loan Amount

$248,869

After Repair Value$409,000

Purchase Price$145,000

Renovation Budget$147,787

Loan TypeFix & Flip

- After Repair Value$409,000

- Purchase Price$145,000

- Renovation Budget$147,787

- Loan TypeFix & Flip

Decatur, GA

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Maryland Housing Market Predictions

The Maryland housing market is anticipated to display characteristics such as price increases, low inventory levels, and market confidence.

Forecasts for the near future include expectations of rising mortgage rates, driven by the Federal Reserve’s decision to increase benchmark rates.

This rise is predicted to impact acquisition costs, potentially reducing the affordability of homes.

Despite a decade of consecutive appreciation, there is continued optimism among Maryland residents to purchase homes, leading to expectations of sustained market activity and further price increases.

However, the persistent challenge lies in the tight inventory, with only limited months of available homes, indicating a scarcity that may persist for the foreseeable future, even with new builds in progress and potential market adjustments due to higher interest rates.

If you want to become a part of the thriving real estate market in Maryland, we recommend using our hard money loans to purchase your favorite property in no time.

Ready to apply for a money lenders loan?

Frequently Asked Questions

At Insula Capital Group, we’ve devised an extremely efficient and streamlined funding process that we’re incredibly proud of. The process is designed to help our clients meet their financial needs with speed.

All you really need to do is reach out to our experienced team, which will work closely with you on the application and approval stages.

Once you complete the online application form, our team will analyze your documents and provide loan approval within twenty-four hours. After the approval process is complete, you can expect to get the funds in five days or less.

The interest rate on your hard money loan is calculated while taking many factors into account. At Insula Capital Group, we have a very holistic approach to this; we assess everything from your credit score to payment history and other essentials. This results in a very comprehensive evaluation that reflects your unique financial profile while keeping the interest rate competitive.

We also believe in complete transparency during this process, keeping you aware of how each factor contributes to the resulting interest rate.

No! You won’t have to pay any extra charges since our loan deals don’t have any pre-payment penalties. You can find out more about our innovative hard money deals by visiting our just-funded project section.

Top Hard Money Lenders Loan Cities in Maryland

Join Hands With Us Today!

Finding it difficult to connect with a trustworthy private lender in Maryland? It’s time to join hands with Insula Capital Group.

With decades of expertise and an extensive portfolio, Insula Capital Group is the preferred private and hard money lender for investors in Maryland. The application process for our programs is straightforward, requiring only a complete application as the initial step.

Access and download all necessary forms conveniently from our website. Contact us via phone or email for any inquiries before applying. Let’s make your real estate goals a reality—get started now!

Let’s Partner Up!

At Insula Capital Group, we strive to make investments easier for our clients. As the leading hard money lending company in the region, we want to give seasoned and rookie investors their best shot when it comes to investments in Maryland.