Private Money Lenders | Hard Money Loans in Michigan

Are you thinking about investing in Michigan? It’s definitely a great option!

Michigan’s diverse economy, consisting of automotive, technology, manufacturing, and healthcare sectors, provides a solid foundation for investment growth. With vibrant cities like Detroit, Grand Rapids, and Ann Arbor, Michigan offers a mix of urban development and natural beauty, attracting both residents and businesses.

As the leading private money lender in Michigan, Insula Capital Group understands the local market inside out and offers tailored financial solutions to meet the needs of investors. Our extensive network, expertise, and flexible loan options can help you capitalize on the state’s unique investment potential.

Get in Touch

Fast Track Your Real Estate Investments with Trusted Private Money Lenders in Michigan

Insula Capital Group stands out as the leading hard money lender in Michigan, delivering unparalleled service and expertise to investors in the state.

With our extensive experience and deep knowledge of the local market, we are committed to helping our clients achieve their financial goals and maximize their real estate investments.

Our approach is centered around providing tailored solutions that cater to the unique needs of each individual client. We offer a diverse range of flexible loan options, competitive interest rates, and a streamlined approval process to ensure a seamless experience. Our team of industry experts conducts thorough evaluations of investment opportunities, ensuring that we provide the most suitable financing solutions.

You can count on Insula Capital Group to be your trusted partner, providing the financial backing and guidance necessary to deal with the complexities of the Michigan real estate market so that you can make the most of your investments with our comprehensive support and expertise.

Benefits Of Hard Money Loans

Hard money loans offer several potential benefits to borrowers. For starters, they provide faster funding, especially when compared to traditional bank loans. This is because hard money loans have faster closing processes and do not have very stringent requirements.

Hard money loans are also great if you have a less-than-perfect credit score because they’re secured against collaterals and not necessarily your financial position. This is also great because hard money lenders typically offer loans for unconventional projects that traditional money loans may not fund.

And, of course, one also can’t ignore the fact that hard money loans are private transactions. This leads to more flexibility and less scrutiny!

Michigan’s Market Insights

- Population: 10.07 million

- Median Household Income: $60,122

- Unemployment Rate: 4.2%

- Homes for Sale: 28,154

- New Listings: 5,028

- Average Home Prices: $319,762

- Median Home Value: $331,000

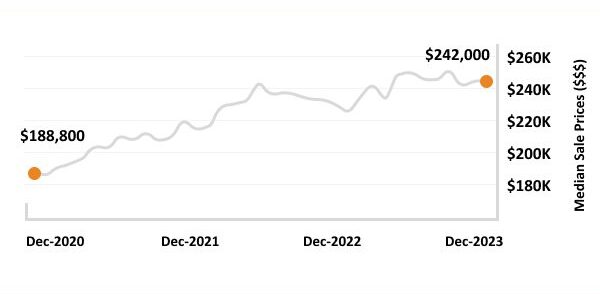

- Median Sale Price: $305,000

- 1-Year Appreciate Rate: 6.3%

- Median Rent Price: $1,200

- Price-to-rent ratio: 26.2%

- Median Days on Market: 35 days

- Home Sold Above List Price: 33.5%

- Foreclosure Rate: 0.42%

- Median Property Tax: 1.09%

- Projected Growth Of The Real Estate Market: Moderate 3-4%

- Average ROI for Hard Money Loans: 8-10%

- Best Cities To Invest In: Detroit, Grand Rapids, Ann Arbor, Lansing, Traverse City

Michigan’s Real Estate Market

10.07 million

Population

$60,122

Median Household Income

$331,000

Median Home Value

6.3%

1-Year Appreciate Rate:

$305,000

Median Sale Price

$1,200

Median Rent Price

Just Funded Projects

July 2025

Fix & Flip

Loan Amount

$1,456,100

After Repair Value$2,700,000

Purchase Price$1,200,000

Renovation Budget$376,100

Loan TypeFix & Flip

- After Repair Value$2,700,000

- Purchase Price$1,200,000

- Renovation Budget$376,100

- Loan TypeFix & Flip

Destin, FL

July 2025

Fix & Flip

Loan Amount

$400,899

After Repair Value$595,000

Purchase Price$42,500

Renovation Budget$429,147

Loan TypeFix & Flip

- After Repair Value$595,000

- Purchase Price$42,500

- Renovation Budget$429,147

- Loan TypeFix & Flip

Lawrenceville, GA

July 2025

Fix & Flip

Loan Amount

$435,260

After Repair Value$710,000

Purchase Price$62,500

Renovation Budget$397,760

Loan TypeFix & Flip

- After Repair Value$710,000

- Purchase Price$62,500

- Renovation Budget$397,760

- Loan TypeFix & Flip

Snellville, GA

June 2025

Fix & Flip

Loan Amount

$137,200

After Repair Value$231,000

Purchase Price$120,000

Renovation Budget$40,000

Loan TypeFix & Flip

- After Repair Value$231,000

- Purchase Price$120,000

- Renovation Budget$40,000

- Loan TypeFix & Flip

Albany, NY

June 2025

Fix & Flip

Loan Amount

$257,750

After Repair Value$410,000

Purchase Price$215,000

Renovation Budget$75,000

Loan TypeFix & Flip

- After Repair Value$410,000

- Purchase Price$215,000

- Renovation Budget$75,000

- Loan TypeFix & Flip

Albany, NY

June 2025

Residential Rental Program (Buy & Hold)

Loan Amount

$502,500

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Fitchburg, MA

June 2025

Fix & Flip

Loan Amount

$825,000

After Repair Value$1,100,000

Purchase Price$870,000

Renovation Budget$46,500

Loan TypeFix & Flip

- After Repair Value$1,100,000

- Purchase Price$870,000

- Renovation Budget$46,500

- Loan TypeFix & Flip

Suffolk County, NY

November 2021

Fix & Flip

Loan Amount

$209,300

After Repair Value$335,000

Purchase Price$130,000

Renovation Budget$105,300

Loan TypeFix & Flip

- After Repair Value$335,000

- Purchase Price$130,000

- Renovation Budget$105,300

- Loan TypeFix & Flip

Philidelphia, PA

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Commercial Property Loans

Commercial Property Loans

Why Is Michigan Worth Investing In

Michigan’s real estate market has been gaining traction recently for several reasons. This has a lot to do with its thriving tech industry, where major companies like General Motors, Ford, and Stellantis are creating many opportunities for job seekers and bringing state-wide economic stability.

Of course, Michigan also offers a very attractive lifestyle. Not only is it a beautiful state, given its Great Lakes and outdoor recreation opportunities, but it’s also great for higher education and for those looking for an affordable cost of living and new job opportunities.

Moreover, it’s worth noting that Michigan’s population has been growing steadily over the past few years, and this has led to a bit of a housing shortage, particularly in areas like Grand Rapids and Detroit. Needless to say, this shortage has been driving up property values, creating favorable opportunities for investors like you!

Also, most cities in Michigan have a great deal of growth potential because they’re currently undergoing revitalization projects. This is a great time to invest in these areas!

Ready to apply for a money lenders loan?

Frequently Asked Questions

Yes, Insula Capital Group provides hard money loans specifically designed to facilitate the purchase of investment properties in Michigan.

Whether you’re interested in residential, commercial, or multi-unit properties, our loan programs are structured to meet the needs of real estate investors. With our financing support, you can seize opportunities in the Michigan market, expand your portfolio, and maximize your potential returns.

Our team is committed to helping you achieve your investment goals and providing the financial resources to make it happen!

Absolutely! Insula Capital Group’s hard money loans can be used for property renovations in Michigan. Whether you’re planning minor repairs or a complete flip, our loan programs are designed to provide the necessary funds to finance your fix and flip projects.

We understand the potential for value creation through renovations, and we are here to support your efforts by offering flexible financing options and personalized guidance throughout the renovation process.

As one of the leading private money lenders in the US, Insula Capital Group offers its services across the country. In Michigan, we’re currently working with clients in:

Ann Arbor, MI Detroit, MI Grand Rapids, MI Sterling Heights, MI Warren, MI

If your city isn’t listed above, feel free to reach out to us to discuss a hard money loan further. As one of the most reliable hard money lenders in Michigan, we’re more than happy to help you out!

Top Hard Money Lenders Loan Cities in Michigan

Let’s Get Started!

Whether it’s fix-and-flip projects, rental properties, or commercial ventures, Insula Capital Group provides the necessary funding and support to fuel your success in Michigan’s real estate market. Trust us to be your strategic partner as you explore the wealth of opportunities that Michigan has to offer.

Check out our loan programs and just-funded projects for better insights.