Private Money Lenders | Hard Money Loans in Milwaukee, WI

Milwaukee is one of the hotspots for real estate investment. Presently, its rental market is booming due to the number of renters rising to 40%. Although the market is recovering from a recession, the prices are temptingly low, meaning you can look for distressed properties to renovate and resell and earn more profit later.

Whether you’re looking for a maladapted property, purchasing land for ground-up construction, or looking to generate passive income via residential rental projects, we’re here to help you realize your dreams.

Our loan programs are available for residential rental, fix and flip, and new constructions. We also offer a multifamily bridge loan program. Work with our private money lenders in Milwaukee, WI, for great success in your ventures.

Get in Touch

Unlocking the Power of Hard Money Loans in Milwaukee, WI

When it comes to funding your real estate investment ventures, Insula Capital Group offers the ultimate solution with our adaptable hard money loans. With competitive rates and no prepayment penalties, we showcase an unwavering commitment to ensure the success of your investment project.

Our experienced team in Milwaukee understands the nuances of real estate development. We go above and beyond to alleviate your financial woes, without any hidden fees. Count on us to deliver the funding that keeps your project on track and on time.

Our in-house team of underwriters will curate a personalized loan program tailored to your specific project requirements, ensuring swift loan approvals and terms that align with your goals. We’re committed to helping your project thrive in the competitive real estate market. Take the first step and apply now!

Why Hard Money Loans in Milwaukee Make A Big Difference

Hard money loans offer distinct advantages for real estate investors seeking quick and flexible financing solutions. You get expedited access to capital, as hard money lenders typically have shorter approval processes compared to traditional banks. This aspect makes them ideal for time-sensitive opportunities.

Hard money loans are asset-based, focusing on the property’s value rather than the borrower’s credit history. The loan-to-value ratio in hard money lending is generally higher, allowing investors to borrow a larger percentage of the property’s appraised value.

You can also work with the hard money lender to set negotiable repayment schedules with private money lenders in Milwaukee, WI.

All You Need to Know About Milwaukee’s Real Estate Market

Get a detailed look into the real estate market of Milwaukee to make sure you make the right investment call. These are vital statistics that every investor needs to be aware of

- Population: 599,164

- GDP: $371.3 billion

- Average employment growth: 3.6%

- Unemployment rate: 5.4%

- Median income: $51,957

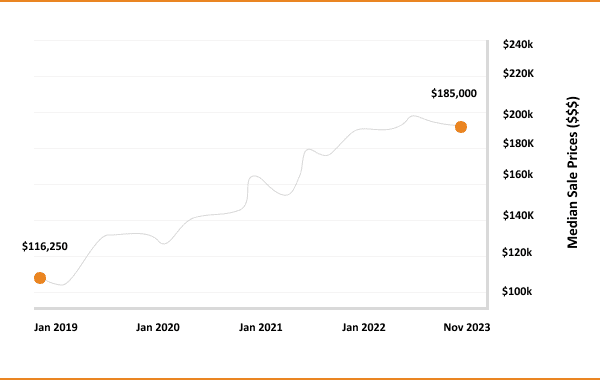

- Median sale price: $175,700

- Average home prices: $185,052

- 1-year appreciation rate: + 8.4%

The Real Estate Market in Milwaukee

599,164

Population

$175,700

Median Sale Price

$180,000

Average Home Price

+ 8.4%

1-Year Appreciation Rate

$51,957

Median Household Income

13.79

Price-To-Rent Ratio

Just Funded Projects

July 2025

Fix & Flip

Loan Amount

$1,456,100

After Repair Value$2,700,000

Purchase Price$1,200,000

Renovation Budget$376,100

Loan TypeFix & Flip

- After Repair Value$2,700,000

- Purchase Price$1,200,000

- Renovation Budget$376,100

- Loan TypeFix & Flip

Destin, FL

July 2025

Fix & Flip

Loan Amount

$400,899

After Repair Value$595,000

Purchase Price$42,500

Renovation Budget$429,147

Loan TypeFix & Flip

- After Repair Value$595,000

- Purchase Price$42,500

- Renovation Budget$429,147

- Loan TypeFix & Flip

Lawrenceville, GA

July 2025

Fix & Flip

Loan Amount

$435,260

After Repair Value$710,000

Purchase Price$62,500

Renovation Budget$397,760

Loan TypeFix & Flip

- After Repair Value$710,000

- Purchase Price$62,500

- Renovation Budget$397,760

- Loan TypeFix & Flip

Snellville, GA

June 2025

Fix & Flip

Loan Amount

$137,200

After Repair Value$231,000

Purchase Price$120,000

Renovation Budget$40,000

Loan TypeFix & Flip

- After Repair Value$231,000

- Purchase Price$120,000

- Renovation Budget$40,000

- Loan TypeFix & Flip

Albany, NY

June 2025

Fix & Flip

Loan Amount

$257,750

After Repair Value$410,000

Purchase Price$215,000

Renovation Budget$75,000

Loan TypeFix & Flip

- After Repair Value$410,000

- Purchase Price$215,000

- Renovation Budget$75,000

- Loan TypeFix & Flip

Albany, NY

June 2025

Residential Rental Program (Buy & Hold)

Loan Amount

$502,500

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Fitchburg, MA

June 2025

Fix & Flip

Loan Amount

$825,000

After Repair Value$1,100,000

Purchase Price$870,000

Renovation Budget$46,500

Loan TypeFix & Flip

- After Repair Value$1,100,000

- Purchase Price$870,000

- Renovation Budget$46,500

- Loan TypeFix & Flip

Suffolk County, NY

November 2021

Fix & Flip

Loan Amount

$209,300

After Repair Value$335,000

Purchase Price$130,000

Renovation Budget$105,300

Loan TypeFix & Flip

- After Repair Value$335,000

- Purchase Price$130,000

- Renovation Budget$105,300

- Loan TypeFix & Flip

Philidelphia, PA

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Commercial Property Loans

Commercial Property Loans

Why Should You Invest in Milwaukee’s Real Estate Market?

Milwaukee’s real estate industry has seen a steady but certain rise, thanks to the developments in the fields of manufacturing, healthcare, and technology. Historically, these swings of economic stability lead to a reliable real estate market, allowing investors to get a long-term value out of their options.

The cost of living and property prices in Milwaukee are relatively lower, which combined with the growing infrastructure, has led to an influx of people from other areas. The market’s affordability also attracts a diverse range of tenants, fostering a stable rental market.

With the city’s efforts to improve transportation, public spaces, and amenities contribute to the overall desirability of the city, it’s expected that increasing property values will only go up with time.

Those looking to invest in rental properties will find Milwaukee to be a great candidate, especially considering the employment growth. Working with hard money lenders that understand the neighborhood dynamics and local economic trends, investors can identify pockets of opportunity within the Milwaukee real estate landscape. Aligning your investment strategy with lenders that provide you with the necessary resources while having insight on the city’s growth potential can help you invest smartly in the region.

Ready to apply for a Hard Money loan?

Frequently Asked Questions

Absolutely! Our hard money loans in Milwaukee cater to a wide range of projects, including commercial, residential, mixed-use, and multifamily developments. Schedule a consultation to explore our residential rental programs, new construction loans, fix & flip financing, and multifamily & mixed-use loan options.

Our hard money loan terms may vary based on the project’s nature and borrower’s qualifications. Contact us to learn about our loan terms.