Private Money Lenders | Hard Money Loans in Mississippi

Are you a real estate investor looking for profitable opportunities in Mississippi? Our hard money lenders at Insula Capital Group are here to help. As a money lending group, we offer loans tailored to your needs and project requirements – be it fix & flip loans, new construction loans, multifamily & mixed-used loans and residential rental loans.

Our comprehensive suite of financing solutions can cater to all types of funding needs for real estate ventures. Insula Capital Group offers our clients dedicated resources that will guide them through the loan process so that you’re always assured about the details you need to know. Get on a quick call with us today!

Foster Long-Term Partnership with Insula Capital Group in Mississippi

Finding a private money lender whom you can count on for your financing needs isn’t exactly an easy feat. You can choose to go for conventional bank mortgages but the approval, flurry of paperwork and long-term commitments make these loans unappealing.

Instead, our hard money lenders offer flexible loans with quick approvals keeping in mind your best interest. There’s minimal paperwork, efficient approval and fund delivery process and competitive rates so you can focus on other core aspects of your projects.

By partnering with us, you get a trustworthy private money lender in Mississippi assisting you to render better returns on your investment with minimum risks. Get customized solutions without having to worry about prepayment penalties.

How Private Money Lenders in Mississippi Provide the Most Benefits

In the real estate industry, hard money loans are commonly acquired by investors and are considered the preferred option. The biggest reasons for this is due to their accessibility and flexibility. These loans offer rapid access to capital, often crucial in competitive real estate markets where swift action needs to be taken. Unlike traditional bank loans that entail lengthy approval processes, hard money loans typically feature expedited approval timelines, allowing investors to capitalize on time-sensitive opportunities.

Hard money lenders prioritize the value of the underlying property rather than focusing solely on borrower creditworthiness. This makes hard money loans accessible to investors with less-than-ideal credit scores or those lacking an extensive financial history.

In terms of flexibility, hard money loans offer tailored repayment structures. Investors can negotiate terms that align with their investment strategies, such as interest-only payments or balloon payments at the end of the loan term. This adaptability enables investors to manage cash flow effectively and optimize returns on their investments.

Private hard money lenders in Mississippi offer loan options for numerous real estate investment purposes, including fix and flip loans, new construction loans among others.

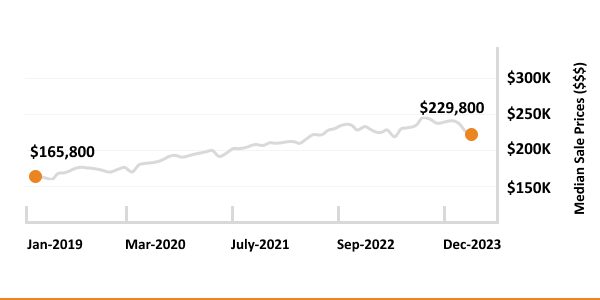

Vital Facts and Figures About the Mississippi Real Estate Market

For real estate investors, facts and numbers play a huge role in their decisions. Insula Capital Group urges its clients to do their due diligence when investing, getting all the information that they can about the market they’re getting into. For people acquiring hard money loans in Mississippi, these are some crucial figures that they would want to know:

- Median Home Value:$161,162

- 1-Year Appreciation Rate:+15.3%

- Median Sales Price:$254,110

- Median Rent Price:$1,006

- Price-To-Rent Ratio:35

- Unemployment Rate:2%

- Population:2,949,965

- Median Household Income:$46,511

Essential Statistics About Mississippi Real Estate

2,949,965

Population

$1,006

Median Rent Price

$254,110

Median Home Value

+15.3%

1-Year Appreciation Rate

$46,511

Median Household Income

13.35

Price-To-Rent Ratio

Just Funded Projects

February 2026

Fix & Flip

Loan Amount

$248,869

After Repair Value$409,000

Purchase Price$145,000

Renovation Budget$147,787

Loan TypeFix & Flip

- After Repair Value$409,000

- Purchase Price$145,000

- Renovation Budget$147,787

- Loan TypeFix & Flip

Decatur, GA

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

December 2025

Fix & Flip

Loan Amount

$171,250

After Repair Value$263,000

Purchase Price$125,000

Renovation Budget$65,000

Loan TypeFix & Flip

- After Repair Value$263,000

- Purchase Price$125,000

- Renovation Budget$65,000

- Loan TypeFix & Flip

Albany, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Considering Mississippi For Real Estate Investments

Despite its rural character, Mississippi has made strides in education in recent years with initiatives aimed at improving graduation rates and academic performance. The state has established various educational institutions, including public universities and community colleges, which are always welcomed as they help foster stronger communities and strengthen the workforce.

In order to attract more businesses to operate in the state, Mississippi has cultivated a favorable environment for investment. This includes tax breaks and assistance programs for businesses, incentivizing many large businesses to branch out to the state. The state’s strategic location along the Mississippi River and Gulf of Mexico enhances its appeal for industries like manufacturing, agriculture, and transportation.

Healthcare infrastructure in Mississippi is substantial, with numerous hospitals and healthcare facilities serving residents across the state. While healthcare access remains a concern in some rural areas, ongoing efforts aim to address these disparities.

Population trends in Mississippi show moderate growth, driven in part by domestic migration from other states. While the pace of growth may be slower compared to other regions, steady population increases contribute to demand for housing and real estate investment opportunities, particularly in urban centers like Jackson and Gulfport.

Ready to apply for a Hard Money Loans?

Get in touch with our experienced team for more details about our financing services.

Frequently Asked Questions

We offer approvals within 24 hours after your loan application. Be sure to submit a complete application along with the form and documents to expedite the process.

Although our private money lenders consider credit history when determining loan approvals, we treat each application based on a case-by-case approach. We also consider equity, property value, loan requirement and your experience as an investor or developer. You can reach out to our team to discuss your specific situation.

We offer a safe loan disbursement process. You will receive your funds via a direct private fund.

Top Hard Money Lenders Loan Cities in Mississippi

Grow Your Portfolio in Mississippi!

With three decades of funding experience as a private money lender in Mississippi, Insula Capital Group provides customized loans to property developers, real estate investors and homeowners.

Schedule an initial meeting with us to get started. Discover our previous funded projects to get a glimpse of our financing solutions. If you already know which loan you need, fill out an online application today to jumpstart your real estate projects.