Private Money Lenders | Hard Money Loans in Montana

The treasure state is known for more than just its breathtaking landscapes, diverse wildlife, and rich culture. Montana also offers small-town charm with a laid-back atmosphere, which is something that many people crave in this modern, fast paced world.

As a real estate investor, this is exactly the kind of place you should be investing in. Montana’s unique, profitable, and just what you need to make your portfolio stand out!

If you’re struggling to acquire hard money loans in Montana for your real estate projects, you may want to look into Insula Capital Group. Our hard money lenders have over 30 years of experience in this industry and have helped many investors, builders, homeowners, and developers in obtaining private funding for their projects.

Insula Capital Group offers flexible payment schedules, competitive interest rates, and quick funding turnaround times. You can trust our team to work closely with you to create a customized lending solution that meets your specific needs.

Get in Touch

Get Top of the Line Loans in Montana with Insula Capital Group

Whether you’re a beginner in the real estate industry or a seasoned professional, Insula Capital Group can assist you with your lending needs. Our private money lenders will consider your project’s potential, as well as your individual circumstances, to determine a suitable loan offer.

We serve a wide range of hard money loans, including residential rental loans, fix and flip loans,new construction loans, and more. We can take care of the financial aspects of your real estate investment, leaving you with the time and peace of mind to focus on building.

Here are some reasons why you should consider Insula Capital Group for your hard money loan needs in Montana:

- Swift approvals

- No junk fees

- 12-months initial term

- Minimal documentation required

- No prepayment penalties

- Low-interest rates

Why Choose Hard Money Loans in Montana?

Hard money loans have some distinct benefits that make them an excellent choice for borrowers. One of these benefits is the speed with which these loans are processed. Hard money loans have simpler applications and verification processes and are much quicker than traditional loans. They also have fewer stringent requirements and offer a lot more flexibility to the borrower.

So, for instance, if you’re a real estate investor eyeing a property to flip, you’ll need access to funds immediately, and by applying for a hard money loan, you could secure financing within mere days. Additionally, a low credit score won’t affect the chances of your loan getting approved. The loan will be approved against the asset value, and therefore your financial position will not affect it.

Montana’s Real Estate Market

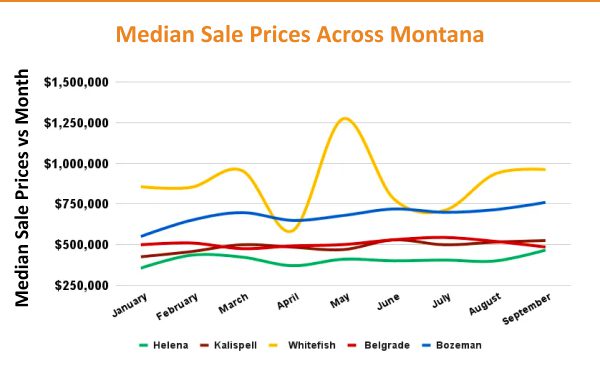

Best Cities To Invest In:

- Bozeman

- Missoula

- Kalispell

- Whitefish

- Big Sky

- Population:1,104,271

- Median Household Income: $56,539

- Unemployment Rate: 2.3%

- New Listings: An increase compared to 2023

- Average Home Prices: $758,641

- Median Home Value: $445,017

- Median Sale Price: $529,000

- 1-Year Appreciate Rate:+9.6%

- Median Rent Price: $1,313 – $1.550

- Price-To-Rent Ratio: 20-25

- Median Days On Market: 65 day

- Foreclosure Rate: 1 in every 15,075 homes

- Median Property Tax: 0.77%

- Average ROI for Hard Money Loans: 8-18%

Montana’s Real Estate Market

1,104,271

Population

$758,641

Average Home Prices

$445,017

Median Home Value

+9.6%

1-Year Appreciation Rate

$56,539

Median Household Income

2.3%

Unemployment Rate

Just Funded Projects

February 2026

Fix & Flip

Loan Amount

$248,869

After Repair Value$409,000

Purchase Price$145,000

Renovation Budget$147,787

Loan TypeFix & Flip

- After Repair Value$409,000

- Purchase Price$145,000

- Renovation Budget$147,787

- Loan TypeFix & Flip

Decatur, GA

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

December 2025

Fix & Flip

Loan Amount

$171,250

After Repair Value$263,000

Purchase Price$125,000

Renovation Budget$65,000

Loan TypeFix & Flip

- After Repair Value$263,000

- Purchase Price$125,000

- Renovation Budget$65,000

- Loan TypeFix & Flip

Albany, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Why Invest In Montana?

As a real estate investor, it can be tricky to figure out the best place to invest in, but Montana is a no-brainer. The real estate market in Montana has seen tremendous and what appears to be sustainable growth over the past few years. This factor alone makes the market an excellent opportunity for investors. Moreover, Montana is known for its excellent tax policies; not only do they have no sales tax, but also relatively low property taxes, making this as excellent choice for real estate investors looking for tax advantages.

Additionally, it’s worth keeping in mind that the investment opportunities in Montana are diverse and affordable. Montana offers incredible variety when it comes to investment options—you can find everything from holiday rentals to single-family homes to invest in. Also, the real estate here is definitely more affordable than the rest of the state, which essentially means that if you’re a beginner investor, this could be an excellent entry point for you to start building your portfolio.

Generally, Montana is great for real estate investments, but how much you can profit from it depends on the kind of risks you’re willing to take and the investment strategies you’re going to employ. Luckily, you have our team to guide you through your investment path in Montana!

Ready to apply for a Hard Money loan?

Frequently Asked Questions

At Insula Capital Group, we understand the time-sensitive nature of most transactions, and we try to keep our processes quick and efficient. The entire loan process in Montana will take somewhere between 5 to 10 business days. This duration can vary based on several factors such as property appraisals, your documentation, and whether it’s all there, and the overall complexity of the loan application.

We generally try to expedite the approval process while also ensuring thorough evaluation. But our prompt decisions depend on you doing your part of submitting all required documentation and making sure everything is accurate. This helps us give you a smoother approval timeline.

There are several key factors that affect the interest rates for hard money loans that you apply for at Insula Capital Group in Montana. For instance, the interest rate will vary based on the loan amount you’ve requested. Furthermore, the type and condition of the property being used as collateral will also influence the interest rates.

It’s also worth keeping in mind that while the loan approval will not be subject to your credit history, the credit score will play a role in determining interest rates because we will be assessing the overall perceived risk with the loan.

Generally, interest rates for hard money loans in Montana range from 7% to 15%. However, you should get in touch with our team to learn more about the competitive rates we’re offering.

Top Hard Money Lenders Loan Cities in Montana

Contact Us Today!

If you want to learn more about our hard money loans, make sure to contact us today and speak with one of our knowledgeable representatives to discuss your specific financing needs.

You can start the process by filling out our loan application and providing the necessary documentation for us to evaluate your financial situation. Don’t forget to check our funding portfolio for some inspiration on how our loans have helped various clients achieve their financial goals.