Private Money Lenders | Hard Money Loans in Nashville, Tennessee

Insula Capital Group: Crafting Real Estate Success Stories in Nashville

Welcome to Insula Capital Group, where your real estate investment dreams transform into compelling success stories in the lively Nashville, Tennessee, market. Our comprehensive loan programs are tailored to equip you with the financial tools necessary to make a significant impact in Nashville’s real estate scene.

Get in Touch

Propelling Your Nashville Real Estate Aspirations with Tailored Loan Programs

n the vibrant real estate market of Nashville, the right financial support can make all the difference. At Insula Capital Group, we provide customized hard money loan programs to meet diverse investment needs and ambitions. From swift property transformations to pioneering new constructions, we have you covered.

1. Elevate Potential with Our Fix and Flip Loans

Discover hidden gems in Nashville’s property market and elevate their potential with our fix and flip loans. We facilitate swift transformations from distressed properties into profitable real estate investments.

2. Pioneering Nashville’s Skyline with New Construction Loans

Embrace the opportunity to shape Nashville’s cityscape with our new construction loans. From conception to completion, we provide the robust financial backbone your construction projects require.

3. Securing Stable Revenue Streams with Residential Rental Loans

Unlock a steady source of income with our residential rental loans. Dive into Nashville’s thriving rental property market and build a robust rental portfolio with our simplified loan process, which emphasizes property value over traditional credit assessments.

4. Maintaining Investment Agility with the Multifamily Bridge Loan Program

Stay agile and adaptive in the bustling multifamily property market with our multifamily bridge loan program. This program provides the necessary flexibility for short-term financing or transitional periods between real estate deals, ensuring your investment journey remains smooth and profitable.

Why Real Estate Investors Favor Hard Money Loans

Hard money loans are arguably some of the fastest financing options where credit history is less of a concern. The expeditious approval can often take a few days at max, compared to traditional loans. Traditional lenders take up more time because they consider credit scores, income history, and financial stability. All of these can be bypassed with a hard money lender.

Hard money lenders focus on the property’s value rather than the borrower’s financial profile. Investors with non-traditional income sources or imperfect credit to secure financing based on the property’s potential profitability.

When it comes to projects like fix-and-flip ventures where swift acquisition and renovation are crucial, investors don’t have many alternatives to hard money loans. Traditional loans, designed for long-term ownership, don’t often work for the rapid timelines that real estate investors operate on.

Hard money lenders pay attention to the property’s potential future value so investors can finance renovations that significantly enhance the property’s worth. Real estate investors can maximize returns by leveraging borrowed funds for value-added improvements.

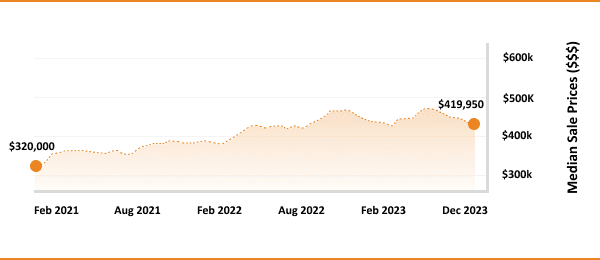

The Essential Information About the Nashville Real Estate Market

Real estate investments warrant the most research possible before making any decisions. To assist our clients in their ventures, we’ve gathered some of the most crucial details that investors need to have on their dashboards when investing

- Median Home Value:$455,304

- 1-Year Appreciation Rate:+30.7%

- Median Home Value (1-Year Forecast):+11.8%

- Median Rent Price:$1,496

- Price-To-Rent Ratio:36

- Unemployment Rate:8%

- Population:678,851

- Median Household Income:$62,087

Alabama’s Real Estate Market

678,851

Population

$1,496

Median Rent Price

+11.8%

Median Home Value (1-Year Forecast)

+30.7%

1-Year Appreciation Rate

$62,087

Median Household Income

25.36

Price-To-Rent Ratio

Just Funded Projects

June 2025

Fix & Flip

Loan Amount

$137,200

After Repair Value$231,000

Purchase Price$120,000

Renovation Budget$40,000

Loan TypeFix & Flip

- After Repair Value$231,000

- Purchase Price$120,000

- Renovation Budget$40,000

- Loan TypeFix & Flip

Albany, NY

June 2025

Fix & Flip

Loan Amount

$257,750

After Repair Value$410,000

Purchase Price$215,000

Renovation Budget$75,000

Loan TypeFix & Flip

- After Repair Value$410,000

- Purchase Price$215,000

- Renovation Budget$75,000

- Loan TypeFix & Flip

Albany, NY

June 2025

Residential Rental Program (Buy & Hold)

Loan Amount

$502,500

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Fitchburg, MA

June 2025

Fix & Flip

Loan Amount

$825,000

After Repair Value$1,100,000

Purchase Price$870,000

Renovation Budget$46,500

Loan TypeFix & Flip

- After Repair Value$1,100,000

- Purchase Price$870,000

- Renovation Budget$46,500

- Loan TypeFix & Flip

Suffolk County, NY

November 2021

Fix & Flip

Loan Amount

$209,300

After Repair Value$335,000

Purchase Price$130,000

Renovation Budget$105,300

Loan TypeFix & Flip

- After Repair Value$335,000

- Purchase Price$130,000

- Renovation Budget$105,300

- Loan TypeFix & Flip

Philidelphia, PA

November 2021

Fix & Flip

Loan Amount

$106,500

After Repair Value$176,000

Purchase Price$62,000

Renovation Budget$60,000

Loan TypeFix & Flip

- After Repair Value$176,000

- Purchase Price$62,000

- Renovation Budget$60,000

- Loan TypeFix & Flip

Philidelphia, PA

November 2021

Fix & Flip

Loan Amount

$311,750

After Repair Value$495,000

Purchase Price$310,000

Renovation Budget$32,750

Loan TypeFix & Flip

- After Repair Value$495,000

- Purchase Price$310,000

- Renovation Budget$32,750

- Loan TypeFix & Flip

North Babylon, NY

November 2021

Fix & Flip

Loan Amount

$1,577,465

After Repair Value$2,487,500

Purchase Price$1,250,000

Renovation Budget$577,465

Loan TypeFix & Flip

- After Repair Value$2,487,500

- Purchase Price$1,250,000

- Renovation Budget$577,465

- Loan TypeFix & Flip

East Hampton, NY

November 2021

Fix & Flip

Loan Amount

$848,800

After Repair Value$831,000

Purchase Price$525,000

Renovation Budget$240,650

Loan TypeFix & Flip

- After Repair Value$831,000

- Purchase Price$525,000

- Renovation Budget$240,650

- Loan TypeFix & Flip

Jersey City, NJ

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Commercial Property Loans

Commercial Property Loans

What Makes Nashville’s Real Estate Market Worth Considering?

One of the appealing aspects for investors when they consider Nashville as an investment market is the robust higher education sector. Institutes like Vanderbilt are helping forge intellectual individuals in the city, helping create a skilled workforce. Nashville has witnessed a surge in corporate relocations, with approximately 100 people moving to the city daily as of 2023.

As more people move to the region for work, real estate investors have an excellent opportunity at their fingertips. Nashville’s diversified economy spans healthcare, technology, and entertainment, providing a resilient economic base. The city’s unemployment rate is consistently below the national average, standing at 2.8%, solidifying the growing job market.

Nashville has no state income tax, making it an attractive proposition for individuals and corporations alike. The healthcare sector, in particular with businesses like HCA, have established their operations in the region for this particular reason.

Ready to apply for a Hard Money loan?

Frequently Asked Questions

We offer a wide array of tailored loan programs, quick approvals, flexible terms, and personalized support from our experienced team, which ensures you have all the resources you need to excel in your investment journey.

Absolutely! Our hard money loans are primarily based on the property’s value, making them an accessible option for borrowers with different credit backgrounds.

{“type”:”elementor”,”siteurl”:”https://insulacapitalgroup.com/wp-json/”,”elements”:[{“id”:”815507d”,”elType”:”widget”,”isInner”:false,”isLocked”:false,”settings”:{“tabs”:[{“tab_title”:”Why should I opt for a hard money loan in Orlando, FL?”,”tab_content”:”<p>A hard money loan is the perfect financing option because it offers multiple benefits like quick approvals, low interest rates, minimal requirements and much more. If you want to learn more about our hard money loan deals, we recommend <a href=\”https://insulacapitalgroup.com/just-funded-projects/\”><u>visiting our just-funded project section</u></a>. </p>”,”_id”:”9d37bc9″},{“tab_title”:” Where can I use a hard money loan in Orlando, FL?”,”tab_content”:”<p>You can use our hard money loans to finance a wide range of real estate projects. We offer specific loan programs like <a href=\”https://insulacapitalgroup.com/fix-flip-financing/\”><u>fix and flip loans</u></a>, <a href=\”https://insulacapitalgroup.com/residential-rental-program/\”><u>residential rental programs</u></a>, <a href=\”https://insulacapitalgroup.com/multifamily-mixed-use/\”><u>multifamily mixed-use loans</u></a>, and <a href=\”https://insulacapitalgroup.com/loans/new-construction/\”><u>new construction loans</u></a> to help you complete your real estate ventures without any financial hassle.</p>”,”_id”:”c55afd4″},{“tab_title”:”How to start the hard money loan application in Orlando, FL?”,”tab_content”:”<p>You can start the loan application by filling out our <a href=\”https://insulacapitalgroup.com/full-application/\”><u>online full application form</u></a> and submitting the required documents.</p>”,”_id”:”10776f4″}],”ha_advanced_tooltip_content”:”I am a tooltip”,”pa_condition_repeater”:[],”border_width”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true,”size”:0},”box_shadow_box_shadow_type”:”yes”,”box_shadow_box_shadow”:{“horizontal”:0,”vertical”:4,”blur”:40,”spread”:0,”color”:”rgba(0, 0, 0, 0.07058823529411765)”},”icon_align”:”right”,”title_typography_typography”:”custom”,”title_typography_font_family”:”Roboto”,”title_typography_font_weight”:”600″,”title_typography_font_size”:{“unit”:”px”,”size”:20,”sizes”:[]},”title_typography_font_size_mobile”:{“unit”:”px”,”size”:18,”sizes”:[]},”title_padding”:{“unit”:”px”,”top”:”20″,”right”:”14″,”bottom”:”20″,”left”:”14″,”isLinked”:false},”content_typography_typography”:”custom”,”content_typography_font_family”:”Roboto”,”content_typography_font_size_mobile”:{“unit”:”px”,”size”:16,”sizes”:[]},”content_typography_font_weight”:”400″,”_css_classes”:”faq”,”premium_tooltip_text”:”Hi, I’m a global tooltip.”,”premium_tooltip_position”:”top,bottom”,”selected_icon”:{“value”:”fas fa-arrow-down”,”library”:”fa-solid”},”selected_active_icon”:{“value”:”fas fa-arrow-up”,”library”:”fa-solid”},”space_between”:{“unit”:”px”,”size”:20,”sizes”:[]},”title_background”:”#FFFFFF”,”title_color”:”#000000″,”tab_active_color”:”#000000″,”icon_color”:”#008FD5″,”icon_active_color”:”#008FD5″,”content_background_color”:”#FFFFFF”,”content_color”:”#515151″,”content_typography_font_size”:{“unit”:”px”,”size”:20,”sizes”:[]},”_element_custom_width”:{“unit”:”%”,”size”:85,”sizes”:[]},”ha_advanced_tooltip_typography_line_height”:{“unit”:”em”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_typography_word_spacing”:{“unit”:”em”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_title_section_bg_color_gradient_position_tablet”:”center center”,”ha_advanced_tooltip_title_section_bg_color_gradient_position_mobile”:”center center”,”premium_tooltip_text_typo_line_height”:{“unit”:”em”,”size”:””,”sizes”:[]},”premium_tooltip_text_typo_word_spacing”:{“unit”:”em”,”size”:””,”sizes”:[]},”premium_tooltip_container_bg_gradient_angle_tablet”:{“unit”:”deg”},”premium_tooltip_container_bg_gradient_angle_mobile”:{“unit”:”deg”},”premium_tooltip_container_bg_gradient_position_tablet”:”center center”,”premium_tooltip_container_bg_gradient_position_mobile”:”center center”,”_background_gradient_position_tablet”:”center center”,”_background_gradient_position_mobile”:”center center”,”_background_hover_gradient_position_tablet”:”center center”,”_background_hover_gradient_position_mobile”:”center center”,”_ha_background_overlay_gradient_position_tablet”:”center center”,”_ha_background_overlay_gradient_position_mobile”:”center center”,”_ha_background_overlay_hover_gradient_position_tablet”:”center center”,”_ha_background_overlay_hover_gradient_position_mobile”:”center center”,”content_width”:”full”,”title_html_tag”:”div”,”faq_schema”:””,”border_color”:””,”space_between_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”space_between_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”box_shadow_box_shadow_position”:” “,”title_typography_font_size_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”title_typography_text_transform”:””,”title_typography_font_style”:””,”title_typography_text_decoration”:””,”title_typography_line_height”:{“unit”:”px”,”size”:””,”sizes”:[]},”title_typography_line_height_tablet”:{“unit”:”em”,”size”:””,”sizes”:[]},”title_typography_line_height_mobile”:{“unit”:”em”,”size”:””,”sizes”:[]},”title_typography_letter_spacing”:{“unit”:”px”,”size”:””,”sizes”:[]},”title_typography_letter_spacing_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”title_typography_letter_spacing_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”title_typography_word_spacing”:{“unit”:”px”,”size”:””,”sizes”:[]},”title_typography_word_spacing_tablet”:{“unit”:”em”,”size”:””,”sizes”:[]},”title_typography_word_spacing_mobile”:{“unit”:”em”,”size”:””,”sizes”:[]},”title_shadow_text_shadow_type”:””,”title_shadow_text_shadow”:{“horizontal”:0,”vertical”:0,”blur”:10,”color”:”rgba(0,0,0,0.3)”},”title_padding_tablet”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”title_padding_mobile”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”icon_space”:{“unit”:”px”,”size”:””,”sizes”:[]},”icon_space_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”icon_space_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”content_typography_font_size_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”content_typography_text_transform”:””,”content_typography_font_style”:””,”content_typography_text_decoration”:””,”content_typography_line_height”:{“unit”:”px”,”size”:””,”sizes”:[]},”content_typography_line_height_tablet”:{“unit”:”em”,”size”:””,”sizes”:[]},”content_typography_line_height_mobile”:{“unit”:”em”,”size”:””,”sizes”:[]},”content_typography_letter_spacing”:{“unit”:”px”,”size”:””,”sizes”:[]},”content_typography_letter_spacing_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”content_typography_letter_spacing_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”content_typography_word_spacing”:{“unit”:”px”,”size”:””,”sizes”:[]},”content_typography_word_spacing_tablet”:{“unit”:”em”,”size”:””,”sizes”:[]},”content_typography_word_spacing_mobile”:{“unit”:”em”,”size”:””,”sizes”:[]},”content_shadow_text_shadow_type”:””,”content_shadow_text_shadow”:{“horizontal”:0,”vertical”:0,”blur”:10,”color”:”rgba(0,0,0,0.3)”},”content_padding”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”content_padding_tablet”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”content_padding_mobile”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_title”:””,”_margin”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_margin_tablet”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_margin_mobile”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_padding”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_padding_tablet”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_padding_mobile”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_element_width”:””,”_element_width_tablet”:””,”_element_width_mobile”:””,”_element_custom_width_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_element_custom_width_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_flex_align_self”:””,”_flex_align_self_tablet”:””,”_flex_align_self_mobile”:””,”_flex_order”:””,”_flex_order_tablet”:””,”_flex_order_mobile”:””,”_flex_order_custom”:””,”_flex_order_custom_tablet”:””,”_flex_order_custom_mobile”:””,”_flex_size”:””,”_flex_size_tablet”:””,”_flex_size_mobile”:””,”_flex_grow”:1,”_flex_grow_tablet”:””,”_flex_grow_mobile”:””,”_flex_shrink”:1,”_flex_shrink_tablet”:””,”_flex_shrink_mobile”:””,”_element_vertical_align”:””,”_element_vertical_align_tablet”:””,”_element_vertical_align_mobile”:””,”_position”:””,”_offset_orientation_h”:”start”,”_offset_x”:{“unit”:”px”,”size”:0,”sizes”:[]},”_offset_x_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_offset_x_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_offset_x_end”:{“unit”:”px”,”size”:0,”sizes”:[]},”_offset_x_end_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_offset_x_end_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_offset_orientation_v”:”start”,”_offset_y”:{“unit”:”px”,”size”:0,”sizes”:[]},”_offset_y_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_offset_y_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_offset_y_end”:{“unit”:”px”,”size”:0,”sizes”:[]},”_offset_y_end_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_offset_y_end_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_z_index”:””,”_z_index_tablet”:””,”_z_index_mobile”:””,”_element_id”:””,”e_display_conditions”:””,”ha_floating_fx”:””,”ha_floating_fx_translate_toggle”:””,”ha_floating_fx_translate_x”:{“unit”:”px”,”size”:””,”sizes”:{“from”:0,”to”:5}},”ha_floating_fx_translate_y”:{“unit”:”px”,”size”:””,”sizes”:{“from”:0,”to”:5}},”ha_floating_fx_translate_duration”:{“unit”:”px”,”size”:1000,”sizes”:[]},”ha_floating_fx_translate_delay”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_floating_fx_rotate_toggle”:””,”ha_floating_fx_rotate_x”:{“unit”:”px”,”size”:””,”sizes”:{“from”:0,”to”:45}},”ha_floating_fx_rotate_y”:{“unit”:”px”,”size”:””,”sizes”:{“from”:0,”to”:45}},”ha_floating_fx_rotate_z”:{“unit”:”px”,”size”:””,”sizes”:{“from”:0,”to”:45}},”ha_floating_fx_rotate_duration”:{“unit”:”px”,”size”:1000,”sizes”:[]},”ha_floating_fx_rotate_delay”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_floating_fx_scale_toggle”:””,”ha_floating_fx_scale_x”:{“unit”:”px”,”size”:””,”sizes”:{“from”:1,”to”:1.2}},”ha_floating_fx_scale_y”:{“unit”:”px”,”size”:””,”sizes”:{“from”:1,”to”:1.2}},”ha_floating_fx_scale_duration”:{“unit”:”px”,”size”:1000,”sizes”:[]},”ha_floating_fx_scale_delay”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_element_link”:{“url”:””,”is_external”:””,”nofollow”:””,”custom_attributes”:””},”ha_transform_fx”:””,”ha_transform_fx_translate_toggle”:””,”ha_transform_fx_translate_x”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_translate_x_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_translate_x_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_translate_y”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_translate_y_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_translate_y_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_rotate_toggle”:””,”ha_transform_fx_rotate_mode”:”loose”,”ha_transform_fx_rotate_x”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_rotate_x_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_rotate_x_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_rotate_y”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_rotate_y_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_rotate_y_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_rotate_z”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_rotate_z_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_rotate_z_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_scale_toggle”:””,”ha_transform_fx_scale_mode”:”loose”,”ha_transform_fx_scale_x”:{“unit”:”px”,”size”:1,”sizes”:[]},”ha_transform_fx_scale_x_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_scale_x_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_scale_y”:{“unit”:”px”,”size”:1,”sizes”:[]},”ha_transform_fx_scale_y_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_scale_y_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_skew_toggle”:””,”ha_transform_fx_skew_x”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_skew_x_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_skew_x_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_skew_y”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_skew_y_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_skew_y_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_translate_toggle_hover”:””,”ha_transform_fx_translate_x_hover”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_translate_x_hover_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_translate_x_hover_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_translate_y_hover”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_translate_y_hover_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_translate_y_hover_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_rotate_toggle_hover”:””,”ha_transform_fx_rotate_mode_hover”:”loose”,”ha_transform_fx_rotate_x_hover”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_rotate_x_hover_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_rotate_x_hover_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_rotate_y_hover”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_rotate_y_hover_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_rotate_y_hover_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_rotate_z_hover”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_rotate_z_hover_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_rotate_z_hover_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_scale_toggle_hover”:””,”ha_transform_fx_scale_mode_hover”:”loose”,”ha_transform_fx_scale_x_hover”:{“unit”:”px”,”size”:1,”sizes”:[]},”ha_transform_fx_scale_x_hover_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_scale_x_hover_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_scale_y_hover”:{“unit”:”px”,”size”:1,”sizes”:[]},”ha_transform_fx_scale_y_hover_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_scale_y_hover_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_skew_toggle_hover”:””,”ha_transform_fx_skew_x_hover”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_skew_x_hover_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_skew_x_hover_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_skew_y_hover”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_skew_y_hover_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_skew_y_hover_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_transform_fx_transition_duration”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_enable”:””,”ha_advanced_tooltip_position”:”top”,”ha_advanced_tooltip_position_tablet”:””,”ha_advanced_tooltip_position_mobile”:””,”ha_advanced_tooltip_animation”:””,”ha_advanced_tooltip_duration”:1000,”ha_advanced_tooltip_arrow”:”true”,”ha_advanced_tooltip_trigger”:”hover”,”ha_advanced_tooltip_distance”:{“unit”:”px”,”size”:”0″,”sizes”:[]},”ha_advanced_tooltip_distance_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_distance_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_align”:”center”,”ha_advanced_tooltip_align_tablet”:””,”ha_advanced_tooltip_align_mobile”:””,”ha_advanced_tooltip_width”:{“unit”:”px”,”size”:”120″,”sizes”:[]},”ha_advanced_tooltip_width_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_width_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_arrow_size”:{“unit”:”px”,”size”:”5″,”sizes”:[]},”ha_advanced_tooltip_arrow_size_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_arrow_size_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_typography_typography”:”yes”,”ha_advanced_tooltip_typography_font_family”:”Nunito”,”ha_advanced_tooltip_typography_font_size”:{“unit”:”px”,”size”:”14″,”sizes”:[]},”ha_advanced_tooltip_typography_font_size_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_typography_font_size_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_typography_font_weight”:”500″,”ha_advanced_tooltip_typography_text_transform”:””,”ha_advanced_tooltip_typography_font_style”:””,”ha_advanced_tooltip_typography_text_decoration”:””,”ha_advanced_tooltip_typography_line_height_tablet”:{“unit”:”em”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_typography_line_height_mobile”:{“unit”:”em”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_typography_letter_spacing”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_typography_letter_spacing_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_typography_letter_spacing_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_typography_word_spacing_tablet”:{“unit”:”em”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_typography_word_spacing_mobile”:{“unit”:”em”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_title_section_bg_color_background”:””,”ha_advanced_tooltip_title_section_bg_color_color”:””,”ha_advanced_tooltip_title_section_bg_color_color_stop”:{“unit”:”%”,”size”:0,”sizes”:[]},”ha_advanced_tooltip_title_section_bg_color_color_stop_tablet”:{“unit”:”%”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_title_section_bg_color_color_stop_mobile”:{“unit”:”%”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_title_section_bg_color_color_b”:”#f2295b”,”ha_advanced_tooltip_title_section_bg_color_color_b_stop”:{“unit”:”%”,”size”:100,”sizes”:[]},”ha_advanced_tooltip_title_section_bg_color_color_b_stop_tablet”:{“unit”:”%”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_title_section_bg_color_color_b_stop_mobile”:{“unit”:”%”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_title_section_bg_color_gradient_type”:”linear”,”ha_advanced_tooltip_title_section_bg_color_gradient_angle”:{“unit”:”deg”,”size”:180,”sizes”:[]},”ha_advanced_tooltip_title_section_bg_color_gradient_angle_tablet”:{“unit”:”deg”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_title_section_bg_color_gradient_angle_mobile”:{“unit”:”deg”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_title_section_bg_color_gradient_position”:”center center”,”ha_advanced_tooltip_title_section_bg_color_image”:{“url”:””,”id”:””,”size”:””},”ha_advanced_tooltip_title_section_bg_color_image_tablet”:{“url”:””,”id”:””,”size”:””},”ha_advanced_tooltip_title_section_bg_color_image_mobile”:{“url”:””,”id”:””,”size”:””},”ha_advanced_tooltip_title_section_bg_color_position”:””,”ha_advanced_tooltip_title_section_bg_color_position_tablet”:””,”ha_advanced_tooltip_title_section_bg_color_position_mobile”:””,”ha_advanced_tooltip_title_section_bg_color_xpos”:{“unit”:”px”,”size”:0,”sizes”:[]},”ha_advanced_tooltip_title_section_bg_color_xpos_tablet”:{“unit”:”px”,”size”:0,”sizes”:[]},”ha_advanced_tooltip_title_section_bg_color_xpos_mobile”:{“unit”:”px”,”size”:0,”sizes”:[]},”ha_advanced_tooltip_title_section_bg_color_ypos”:{“unit”:”px”,”size”:0,”sizes”:[]},”ha_advanced_tooltip_title_section_bg_color_ypos_tablet”:{“unit”:”px”,”size”:0,”sizes”:[]},”ha_advanced_tooltip_title_section_bg_color_ypos_mobile”:{“unit”:”px”,”size”:0,”sizes”:[]},”ha_advanced_tooltip_title_section_bg_color_attachment”:””,”ha_advanced_tooltip_title_section_bg_color_repeat”:””,”ha_advanced_tooltip_title_section_bg_color_repeat_tablet”:””,”ha_advanced_tooltip_title_section_bg_color_repeat_mobile”:””,”ha_advanced_tooltip_title_section_bg_color_size”:””,”ha_advanced_tooltip_title_section_bg_color_size_tablet”:””,”ha_advanced_tooltip_title_section_bg_color_size_mobile”:””,”ha_advanced_tooltip_title_section_bg_color_bg_width”:{“unit”:”%”,”size”:100,”sizes”:[]},”ha_advanced_tooltip_title_section_bg_color_bg_width_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_title_section_bg_color_bg_width_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”ha_advanced_tooltip_title_section_bg_color_video_link”:””,”ha_advanced_tooltip_title_section_bg_color_video_start”:””,”ha_advanced_tooltip_title_section_bg_color_video_end”:””,”ha_advanced_tooltip_title_section_bg_color_play_once”:””,”ha_advanced_tooltip_title_section_bg_color_play_on_mobile”:””,”ha_advanced_tooltip_title_section_bg_color_privacy_mode”:””,”ha_advanced_tooltip_title_section_bg_color_video_fallback”:{“url”:””,”id”:””,”size”:””},”ha_advanced_tooltip_title_section_bg_color_slideshow_gallery”:[],”ha_advanced_tooltip_title_section_bg_color_slideshow_loop”:”yes”,”ha_advanced_tooltip_title_section_bg_color_slideshow_slide_duration”:5000,”ha_advanced_tooltip_title_section_bg_color_slideshow_slide_transition”:”fade”,”ha_advanced_tooltip_title_section_bg_color_slideshow_transition_duration”:500,”ha_advanced_tooltip_title_section_bg_color_slideshow_background_size”:””,”ha_advanced_tooltip_title_section_bg_color_slideshow_background_size_tablet”:””,”ha_advanced_tooltip_title_section_bg_color_slideshow_background_size_mobile”:””,”ha_advanced_tooltip_title_section_bg_color_slideshow_background_position”:””,”ha_advanced_tooltip_title_section_bg_color_slideshow_background_position_tablet”:””,”ha_advanced_tooltip_title_section_bg_color_slideshow_background_position_mobile”:””,”ha_advanced_tooltip_title_section_bg_color_slideshow_lazyload”:””,”ha_advanced_tooltip_title_section_bg_color_slideshow_ken_burns”:””,”ha_advanced_tooltip_title_section_bg_color_slideshow_ken_burns_zoom_direction”:”in”,”ha_advanced_tooltip_background_color”:”#000000″,”ha_advanced_tooltip_color”:”#ffffff”,”ha_advanced_tooltip_border_border”:””,”ha_advanced_tooltip_border_width”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”ha_advanced_tooltip_border_width_tablet”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”ha_advanced_tooltip_border_width_mobile”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”ha_advanced_tooltip_border_color”:””,”ha_advanced_tooltip_border_radius”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”ha_advanced_tooltip_border_radius_tablet”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”ha_advanced_tooltip_border_radius_mobile”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”ha_advanced_tooltip_padding”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”ha_advanced_tooltip_padding_tablet”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”ha_advanced_tooltip_padding_mobile”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”ha_advanced_tooltip_box_shadow_box_shadow_type”:””,”ha_advanced_tooltip_box_shadow_box_shadow”:{“horizontal”:0,”vertical”:0,”blur”:10,”spread”:0,”color”:”rgba(0,0,0,0.5)”},”ha_advanced_tooltip_box_shadow_box_shadow_position”:” “,”eael_wrapper_link_switch”:””,”eael_wrapper_link”:{“url”:””,”is_external”:””,”nofollow”:””,”custom_attributes”:””},”eael_wrapper_link_disable_traditional”:””,”eael_hover_effect_switch”:””,”eael_hover_effect_enable_live_changes”:””,”eael_hover_effect_opacity_popover”:””,”eael_hover_effect_opacity”:{“unit”:”px”,”size”:0.8,”sizes”:[]},”eael_hover_effect_filter_popover”:””,”eael_hover_effect_blur_is_on”:””,”eael_hover_effect_blur”:{“unit”:”px”,”size”:1,”sizes”:[]},”eael_hover_effect_contrast_is_on”:””,”eael_hover_effect_contrast”:{“unit”:”px”,”size”:80,”sizes”:[]},”eael_hover_effect_grayscale_is_on”:””,”eael_hover_effect_grayscal”:{“unit”:”px”,”size”:40,”sizes”:[]},”eael_hover_effect_invert_is_on”:””,”eael_hover_effect_invert”:{“unit”:”px”,”size”:70,”sizes”:[]},”eael_hover_effect_saturate_is_on”:””,”eael_hover_effect_saturate”:{“unit”:”px”,”size”:50,”sizes”:[]},”eael_hover_effect_sepia_is_on”:””,”eael_hover_effect_sepia”:{“unit”:”px”,”size”:50,”sizes”:[]},”eael_hover_effect_offset_popover”:””,”eael_hover_effect_offset_left”:{“unit”:”px”,”size”:5,”sizes”:[]},”eael_hover_effect_offset_left_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_offset_left_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_offset_top”:{“unit”:”px”,”size”:5,”sizes”:[]},”eael_hover_effect_offset_top_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_offset_top_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_transform_popover”:””,”eael_hover_effect_rotate_is_on”:””,”eael_hover_effect_transform_rotatex”:{“unit”:”px”,”size”:0,”sizes”:[]},”eael_hover_effect_transform_rotatex_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_transform_rotatex_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_transform_rotatey”:{“unit”:”px”,”size”:0,”sizes”:[]},”eael_hover_effect_transform_rotatey_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_transform_rotatey_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_transform_rotatez”:{“unit”:”px”,”size”:5,”sizes”:[]},”eael_hover_effect_transform_rotatez_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_transform_rotatez_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_scale_is_on”:””,”eael_hover_effect_transform_scalex”:{“unit”:”px”,”size”:0.9,”sizes”:[]},”eael_hover_effect_transform_scalex_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_transform_scalex_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_transform_scaley”:{“unit”:”px”,”size”:0.9,”sizes”:[]},”eael_hover_effect_transform_scaley_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_transform_scaley_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_skew_is_on”:””,”eael_hover_effect_transform_skewx”:{“unit”:”px”,”size”:5,”sizes”:[]},”eael_hover_effect_transform_skewx_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_transform_skewx_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_transform_skewy”:{“unit”:”px”,”size”:5,”sizes”:[]},”eael_hover_effect_transform_skewy_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_transform_skewy_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_general_settings_duration”:{“unit”:”px”,”size”:1000,”sizes”:[]},”eael_hover_effect_general_settings_delay”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_general_settings_easing”:”ease”,”eael_hover_effect_opacity_popover_hover”:””,”eael_hover_effect_opacity_hover”:{“unit”:”px”,”size”:1,”sizes”:[]},”eael_hover_effect_filter_hover_popover”:””,”eael_hover_effect_blur_hover_is_on”:””,”eael_hover_effect_blur_hover”:{“unit”:”px”,”size”:0,”sizes”:[]},”eael_hover_effect_contrast_hover_is_on”:””,”eael_hover_effect_contrast_hover”:{“unit”:”%”,”size”:100,”sizes”:[]},”eael_hover_effect_grayscale_hover_is_on”:””,”eael_hover_effect_grayscal_hover”:{“unit”:”%”,”size”:0,”sizes”:[]},”eael_hover_effect_invert_hover_is_on”:””,”eael_hover_effect_invert_hover”:{“unit”:”%”,”size”:0,”sizes”:[]},”eael_hover_effect_saturate_hover_is_on”:””,”eael_hover_effect_saturate_hover”:{“unit”:”%”,”size”:100,”sizes”:[]},”eael_hover_effect_sepia_hover_is_on”:””,”eael_hover_effect_sepia_hover”:{“unit”:”px”,”size”:1,”sizes”:[]},”eael_hover_effect_offset_hover_popover”:””,”eael_hover_effect_offset_hover_left”:{“unit”:”px”,”size”:0,”sizes”:[]},”eael_hover_effect_offset_hover_left_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_offset_hover_left_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_offset_hover_top”:{“unit”:”px”,”size”:0,”sizes”:[]},”eael_hover_effect_offset_hover_top_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_offset_hover_top_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_transform_hover_popover”:””,”eael_hover_effect_rotate_hover_is_on”:””,”eael_hover_effect_transform_hover_rotatex”:{“unit”:”px”,”size”:0,”sizes”:[]},”eael_hover_effect_transform_hover_rotatex_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_transform_hover_rotatex_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_transform_hover_rotatey”:{“unit”:”px”,”size”:0,”sizes”:[]},”eael_hover_effect_transform_hover_rotatey_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_transform_hover_rotatey_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_transform_hover_rotatez”:{“unit”:”px”,”size”:0,”sizes”:[]},”eael_hover_effect_transform_hover_rotatez_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_transform_hover_rotatez_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_scale_hover_is_on”:””,”eael_hover_effect_transform_hover_scalex”:{“unit”:”px”,”size”:1,”sizes”:[]},”eael_hover_effect_transform_hover_scalex_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_transform_hover_scalex_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_transform_hover_scaley”:{“unit”:”px”,”size”:0,”sizes”:[]},”eael_hover_effect_transform_hover_scaley_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_transform_hover_scaley_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_skew_hover_is_on”:””,”eael_hover_effect_transform_hover_skewx”:{“unit”:”px”,”size”:0,”sizes”:[]},”eael_hover_effect_transform_hover_skewx_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_transform_hover_skewx_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_transform_hover_skewy”:{“unit”:”px”,”size”:0,”sizes”:[]},”eael_hover_effect_transform_hover_skewy_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_transform_hover_skewy_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_general_settings_hover_duration”:{“unit”:”px”,”size”:1000,”sizes”:[]},”eael_hover_effect_general_settings_hover_delay”:{“unit”:”px”,”size”:””,”sizes”:[]},”eael_hover_effect_general_settings_hover_easing”:”ease”,”eael_hover_effect_hover_tilt”:””,”pa_display_conditions_switcher”:””,”pa_display_action”:”show”,”pa_display_when”:”any”,”premium_fe_switcher”:””,”premium_fe_target”:””,”premium_fe_translate_switcher”:””,”premium_fe_Xtranslate”:{“unit”:”px”,”size”:””,”sizes”:{“from”:0,”to”:5}},”premium_fe_Xtranslate_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_fe_Xtranslate_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_fe_Ytranslate”:{“unit”:”px”,”size”:””,”sizes”:{“from”:0,”to”:5}},”premium_fe_Ytranslate_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_fe_Ytranslate_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_fe_trans_duration”:{“unit”:”px”,”size”:1000,”sizes”:[]},”premium_fe_trans_delay”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_fe_rotate_switcher”:””,”premium_fe_Xrotate”:{“unit”:”deg”,”size”:””,”sizes”:{“from”:0,”to”:45}},”premium_fe_Xrotate_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_fe_Xrotate_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_fe_Yrotate”:{“unit”:”deg”,”size”:””,”sizes”:{“from”:0,”to”:45}},”premium_fe_Yrotate_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_fe_Yrotate_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_fe_Zrotate”:{“unit”:”deg”,”size”:””,”sizes”:{“from”:0,”to”:45}},”premium_fe_Zrotate_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_fe_Zrotate_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_fe_rotate_duration”:{“unit”:”px”,”size”:1000,”sizes”:[]},”premium_fe_rotate_delay”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_fe_scale_switcher”:””,”premium_fe_Xscale”:{“unit”:”px”,”size”:””,”sizes”:{“from”:1,”to”:1.2}},”premium_fe_Xscale_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_fe_Xscale_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_fe_Yscale”:{“unit”:”px”,”size”:””,”sizes”:{“from”:1,”to”:1.2}},”premium_fe_Yscale_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_fe_Yscale_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_fe_scale_duration”:{“unit”:”px”,”size”:1000,”sizes”:[]},”premium_fe_scale_delay”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_fe_skew_switcher”:””,”premium_fe_Xskew”:{“unit”:”deg”,”size”:””,”sizes”:{“from”:0,”to”:20}},”premium_fe_Xskew_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_fe_Xskew_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_fe_Yskew”:{“unit”:”deg”,”size”:””,”sizes”:{“from”:0,”to”:20}},”premium_fe_Yskew_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_fe_Yskew_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_fe_skew_duration”:{“unit”:”px”,”size”:1000,”sizes”:[]},”premium_fe_skew_delay”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_fe_opacity_switcher”:””,”premium_fe_bg_color_switcher”:””,”premium_fe_blur_switcher”:””,”premium_fe_contrast_switcher”:””,”premium_fe_gScale_switcher”:””,”premium_fe_hue_switcher”:””,”premium_fe_brightness_switcher”:””,”premium_fe_saturate_switcher”:””,”premium_fe_direction”:”alternate”,”premium_fe_loop”:”default”,”premium_fe_loop_number”:3,”premium_fe_easing”:”easeInOutSine”,”premium_fe_ease_step”:5,”premium_fe_disable_safari”:””,”premium_tooltip_switcher”:””,”pa_tooltip_target”:””,”premium_tooltip_type”:”text”,”premium_tooltip_icon_switcher”:””,”premium_tooltip_icon”:{“value”:”fas fa-star”,”library”:”fa-solid”},”premium_tooltip_lottie_url”:””,”premium_tooltip_lottie_loop”:”true”,”premium_tooltip_lottie_reverse”:””,”hide_tooltip_on”:[],”premium_tooltip_text_color”:””,”premium_tooltip_text_typo_typography”:””,”premium_tooltip_text_typo_font_family”:””,”premium_tooltip_text_typo_font_size”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_tooltip_text_typo_font_size_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_tooltip_text_typo_font_size_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_tooltip_text_typo_font_weight”:””,”premium_tooltip_text_typo_text_transform”:””,”premium_tooltip_text_typo_font_style”:””,”premium_tooltip_text_typo_text_decoration”:””,”premium_tooltip_text_typo_line_height_tablet”:{“unit”:”em”,”size”:””,”sizes”:[]},”premium_tooltip_text_typo_line_height_mobile”:{“unit”:”em”,”size”:””,”sizes”:[]},”premium_tooltip_text_typo_letter_spacing”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_tooltip_text_typo_letter_spacing_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_tooltip_text_typo_letter_spacing_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_tooltip_text_typo_word_spacing_tablet”:{“unit”:”em”,”size”:””,”sizes”:[]},”premium_tooltip_text_typo_word_spacing_mobile”:{“unit”:”em”,”size”:””,”sizes”:[]},”premium_tooltip_text_shadow_text_shadow_type”:””,”premium_tooltip_text_shadow_text_shadow”:{“horizontal”:0,”vertical”:0,”blur”:10,”color”:”rgba(0,0,0,0.3)”},”premium_tooltip_icon_color”:””,”premium_tooltip_icon_size”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_tooltip_icon_size_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_tooltip_icon_size_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_tooltip_icon_shadow_text_shadow_type”:””,”premium_tooltip_icon_shadow_text_shadow”:{“horizontal”:0,”vertical”:0,”blur”:10,”color”:”rgba(0,0,0,0.3)”},”premium_tooltip_img_size”:{“unit”:”px”,”size”:100,”sizes”:[]},”premium_tooltip_img_size_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_tooltip_img_size_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_tooltip_img_fit”:”cover”,”premium_tooltip_img_fit_tablet”:””,”premium_tooltip_img_fit_mobile”:””,”premium_tooltip_container_bg_background”:””,”premium_tooltip_container_bg_color”:””,”premium_tooltip_container_bg_color_stop”:{“unit”:”%”,”size”:0,”sizes”:[]},”premium_tooltip_container_bg_color_stop_tablet”:{“unit”:”%”,”size”:””,”sizes”:[]},”premium_tooltip_container_bg_color_stop_mobile”:{“unit”:”%”,”size”:””,”sizes”:[]},”premium_tooltip_container_bg_color_b”:”#f2295b”,”premium_tooltip_container_bg_color_b_stop”:{“unit”:”%”,”size”:100,”sizes”:[]},”premium_tooltip_container_bg_color_b_stop_tablet”:{“unit”:”%”,”size”:””,”sizes”:[]},”premium_tooltip_container_bg_color_b_stop_mobile”:{“unit”:”%”,”size”:””,”sizes”:[]},”premium_tooltip_container_bg_gradient_type”:”linear”,”premium_tooltip_container_bg_gradient_angle”:{“unit”:”deg”,”size”:180,”sizes”:[]},”premium_tooltip_container_bg_gradient_position”:”center center”,”premium_tooltip_container_bg_image”:{“url”:””,”id”:””,”size”:””},”premium_tooltip_container_bg_image_tablet”:{“url”:””,”id”:””,”size”:””},”premium_tooltip_container_bg_image_mobile”:{“url”:””,”id”:””,”size”:””},”premium_tooltip_container_bg_position”:””,”premium_tooltip_container_bg_position_tablet”:””,”premium_tooltip_container_bg_position_mobile”:””,”premium_tooltip_container_bg_xpos”:{“unit”:”px”,”size”:0,”sizes”:[]},”premium_tooltip_container_bg_xpos_tablet”:{“unit”:”px”,”size”:0,”sizes”:[]},”premium_tooltip_container_bg_xpos_mobile”:{“unit”:”px”,”size”:0,”sizes”:[]},”premium_tooltip_container_bg_ypos”:{“unit”:”px”,”size”:0,”sizes”:[]},”premium_tooltip_container_bg_ypos_tablet”:{“unit”:”px”,”size”:0,”sizes”:[]},”premium_tooltip_container_bg_ypos_mobile”:{“unit”:”px”,”size”:0,”sizes”:[]},”premium_tooltip_container_bg_attachment”:””,”premium_tooltip_container_bg_repeat”:””,”premium_tooltip_container_bg_repeat_tablet”:””,”premium_tooltip_container_bg_repeat_mobile”:””,”premium_tooltip_container_bg_size”:””,”premium_tooltip_container_bg_size_tablet”:””,”premium_tooltip_container_bg_size_mobile”:””,”premium_tooltip_container_bg_bg_width”:{“unit”:”%”,”size”:100,”sizes”:[]},”premium_tooltip_container_bg_bg_width_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_tooltip_container_bg_bg_width_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_tooltip_container_bg_video_link”:””,”premium_tooltip_container_bg_video_start”:””,”premium_tooltip_container_bg_video_end”:””,”premium_tooltip_container_bg_play_once”:””,”premium_tooltip_container_bg_play_on_mobile”:””,”premium_tooltip_container_bg_privacy_mode”:””,”premium_tooltip_container_bg_video_fallback”:{“url”:””,”id”:””,”size”:””},”premium_tooltip_container_bg_slideshow_gallery”:[],”premium_tooltip_container_bg_slideshow_loop”:”yes”,”premium_tooltip_container_bg_slideshow_slide_duration”:5000,”premium_tooltip_container_bg_slideshow_slide_transition”:”fade”,”premium_tooltip_container_bg_slideshow_transition_duration”:500,”premium_tooltip_container_bg_slideshow_background_size”:””,”premium_tooltip_container_bg_slideshow_background_size_tablet”:””,”premium_tooltip_container_bg_slideshow_background_size_mobile”:””,”premium_tooltip_container_bg_slideshow_background_position”:””,”premium_tooltip_container_bg_slideshow_background_position_tablet”:””,”premium_tooltip_container_bg_slideshow_background_position_mobile”:””,”premium_tooltip_container_bg_slideshow_lazyload”:””,”premium_tooltip_container_bg_slideshow_ken_burns”:””,”premium_tooltip_container_bg_slideshow_ken_burns_zoom_direction”:”in”,”premium_tooltip_container_border_border”:””,”premium_tooltip_container_border_width”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”premium_tooltip_container_border_width_tablet”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”premium_tooltip_container_border_width_mobile”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”premium_tooltip_container_border_color”:””,”premium_tooltip_container_border_radius”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_tooltip_container_box_shadow_box_shadow_type”:””,”premium_tooltip_container_box_shadow_box_shadow”:{“horizontal”:0,”vertical”:0,”blur”:10,”spread”:0,”color”:”rgba(0,0,0,0.5)”},”premium_tooltip_container_box_shadow_box_shadow_position”:” “,”premium_tooltip_container_padding”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”premium_tooltip_container_padding_tablet”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”premium_tooltip_container_padding_mobile”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”premium_tooltip_arrow_color”:””,”premium_tooltip_mouse_follow”:””,”premium_tooltip_interactive”:”yes”,”premium_tooltip_arrow”:””,”premium_tooltip_trigger”:”hover”,”premium_tooltip_distance_position”:6,”premium_tooltip_min_width”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_tooltip_min_width_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_tooltip_min_width_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_tooltip_max_width”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_tooltip_max_width_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_tooltip_max_width_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_tooltip_height”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_tooltip_height_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_tooltip_height_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”premium_tooltip_anime”:”fade”,”premium_tooltip_anime_dur”:350,”premium_tooltip_delay”:10,”pa_tooltip_zindex”:””,”premium_wrapper_link_switcher”:””,”premium_wrapper_link_selection”:”url”,”premium_wrapper_link”:{“url”:””,”is_external”:””,”nofollow”:””,”custom_attributes”:””},”premium_wrapper_existing_link”:””,”motion_fx_motion_fx_scrolling”:””,”motion_fx_translateY_effect”:””,”motion_fx_translateY_direction”:””,”motion_fx_translateY_speed”:{“unit”:”px”,”size”:4,”sizes”:[]},”motion_fx_translateY_affectedRange”:{“unit”:”%”,”size”:””,”sizes”:{“start”:0,”end”:100}},”motion_fx_translateX_effect”:””,”motion_fx_translateX_direction”:””,”motion_fx_translateX_speed”:{“unit”:”px”,”size”:4,”sizes”:[]},”motion_fx_translateX_affectedRange”:{“unit”:”%”,”size”:””,”sizes”:{“start”:0,”end”:100}},”motion_fx_opacity_effect”:””,”motion_fx_opacity_direction”:”out-in”,”motion_fx_opacity_level”:{“unit”:”px”,”size”:10,”sizes”:[]},”motion_fx_opacity_range”:{“unit”:”%”,”size”:””,”sizes”:{“start”:20,”end”:80}},”motion_fx_blur_effect”:””,”motion_fx_blur_direction”:”out-in”,”motion_fx_blur_level”:{“unit”:”px”,”size”:7,”sizes”:[]},”motion_fx_blur_range”:{“unit”:”%”,”size”:””,”sizes”:{“start”:20,”end”:80}},”motion_fx_rotateZ_effect”:””,”motion_fx_rotateZ_direction”:””,”motion_fx_rotateZ_speed”:{“unit”:”px”,”size”:1,”sizes”:[]},”motion_fx_rotateZ_affectedRange”:{“unit”:”%”,”size”:””,”sizes”:{“start”:0,”end”:100}},”motion_fx_scale_effect”:””,”motion_fx_scale_direction”:”out-in”,”motion_fx_scale_speed”:{“unit”:”px”,”size”:4,”sizes”:[]},”motion_fx_scale_range”:{“unit”:”%”,”size”:””,”sizes”:{“start”:20,”end”:80}},”motion_fx_transform_origin_x”:”center”,”motion_fx_transform_origin_y”:”center”,”motion_fx_devices”:[“desktop”,”tablet”,”mobile”],”motion_fx_range”:””,”motion_fx_motion_fx_mouse”:””,”motion_fx_mouseTrack_effect”:””,”motion_fx_mouseTrack_direction”:””,”motion_fx_mouseTrack_speed”:{“unit”:”px”,”size”:1,”sizes”:[]},”motion_fx_tilt_effect”:””,”motion_fx_tilt_direction”:””,”motion_fx_tilt_speed”:{“unit”:”px”,”size”:4,”sizes”:[]},”sticky”:””,”sticky_on”:[“desktop”,”tablet”,”mobile”],”sticky_offset”:0,”sticky_offset_tablet”:””,”sticky_offset_mobile”:””,”sticky_effects_offset”:0,”sticky_effects_offset_tablet”:””,”sticky_effects_offset_mobile”:””,”sticky_parent”:””,”_animation”:””,”_animation_tablet”:””,”_animation_mobile”:””,”animation_duration”:””,”_animation_delay”:””,”_transform_rotate_popover”:””,”_transform_rotateZ_effect”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_rotateZ_effect_tablet”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_rotateZ_effect_mobile”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_rotate_3d”:””,”_transform_rotateX_effect”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_rotateX_effect_tablet”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_rotateX_effect_mobile”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_rotateY_effect”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_rotateY_effect_tablet”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_rotateY_effect_mobile”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_perspective_effect”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_perspective_effect_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_perspective_effect_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_translate_popover”:””,”_transform_translateX_effect”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_translateX_effect_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_translateX_effect_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_translateY_effect”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_translateY_effect_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_translateY_effect_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scale_popover”:””,”_transform_keep_proportions”:”yes”,”_transform_scale_effect”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scale_effect_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scale_effect_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scaleX_effect”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scaleX_effect_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scaleX_effect_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scaleY_effect”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scaleY_effect_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scaleY_effect_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_skew_popover”:””,”_transform_skewX_effect”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_skewX_effect_tablet”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_skewX_effect_mobile”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_skewY_effect”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_skewY_effect_tablet”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_skewY_effect_mobile”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_flipX_effect”:””,”_transform_flipY_effect”:””,”_transform_rotate_popover_hover”:””,”_transform_rotateZ_effect_hover”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_rotateZ_effect_hover_tablet”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_rotateZ_effect_hover_mobile”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_rotate_3d_hover”:””,”_transform_rotateX_effect_hover”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_rotateX_effect_hover_tablet”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_rotateX_effect_hover_mobile”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_rotateY_effect_hover”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_rotateY_effect_hover_tablet”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_rotateY_effect_hover_mobile”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_perspective_effect_hover”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_perspective_effect_hover_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_perspective_effect_hover_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_translate_popover_hover”:””,”_transform_translateX_effect_hover”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_translateX_effect_hover_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_translateX_effect_hover_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_translateY_effect_hover”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_translateY_effect_hover_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_translateY_effect_hover_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scale_popover_hover”:””,”_transform_keep_proportions_hover”:”yes”,”_transform_scale_effect_hover”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scale_effect_hover_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scale_effect_hover_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scaleX_effect_hover”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scaleX_effect_hover_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scaleX_effect_hover_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scaleY_effect_hover”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scaleY_effect_hover_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scaleY_effect_hover_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_skew_popover_hover”:””,”_transform_skewX_effect_hover”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_skewX_effect_hover_tablet”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_skewX_effect_hover_mobile”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_skewY_effect_hover”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_skewY_effect_hover_tablet”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_skewY_effect_hover_mobile”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_flipX_effect_hover”:””,”_transform_flipY_effect_hover”:””,”_transform_transition_hover”:{“unit”:”px”,”size”:””,”sizes”:[]},”motion_fx_transform_x_anchor_point”:””,”motion_fx_transform_x_anchor_point_tablet”:””,”motion_fx_transform_x_anchor_point_mobile”:””,”motion_fx_transform_y_anchor_point”:””,”motion_fx_transform_y_anchor_point_tablet”:””,”motion_fx_transform_y_anchor_point_mobile”:””,”_background_background”:””,”_background_color”:””,”_background_color_stop”:{“unit”:”%”,”size”:0,”sizes”:[]},”_background_color_stop_tablet”:{“unit”:”%”,”size”:””,”sizes”:[]},”_background_color_stop_mobile”:{“unit”:”%”,”size”:””,”sizes”:[]},”_background_color_b”:”#f2295b”,”_background_color_b_stop”:{“unit”:”%”,”size”:100,”sizes”:[]},”_background_color_b_stop_tablet”:{“unit”:”%”,”size”:””,”sizes”:[]},”_background_color_b_stop_mobile”:{“unit”:”%”,”size”:””,”sizes”:[]},”_background_gradient_type”:”linear”,”_background_gradient_angle”:{“unit”:”deg”,”size”:180,”sizes”:[]},”_background_gradient_angle_tablet”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_background_gradient_angle_mobile”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_background_gradient_position”:”center center”,”_background_image”:{“url”:””,”id”:””,”size”:””},”_background_image_tablet”:{“url”:””,”id”:””,”size”:””},”_background_image_mobile”:{“url”:””,”id”:””,”size”:””},”_background_position”:””,”_background_position_tablet”:””,”_background_position_mobile”:””,”_background_xpos”:{“unit”:”px”,”size”:0,”sizes”:[]},”_background_xpos_tablet”:{“unit”:”px”,”size”:0,”sizes”:[]},”_background_xpos_mobile”:{“unit”:”px”,”size”:0,”sizes”:[]},”_background_ypos”:{“unit”:”px”,”size”:0,”sizes”:[]},”_background_ypos_tablet”:{“unit”:”px”,”size”:0,”sizes”:[]},”_background_ypos_mobile”:{“unit”:”px”,”size”:0,”sizes”:[]},”_background_attachment”:””,”_background_repeat”:””,”_background_repeat_tablet”:””,”_background_repeat_mobile”:””,”_background_size”:””,”_background_size_tablet”:””,”_background_size_mobile”:””,”_background_bg_width”:{“unit”:”%”,”size”:100,”sizes”:[]},”_background_bg_width_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_background_bg_width_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_background_video_link”:””,”_background_video_start”:””,”_background_video_end”:””,”_background_play_once”:””,”_background_play_on_mobile”:””,”_background_privacy_mode”:””,”_background_video_fallback”:{“url”:””,”id”:””,”size”:””},”_background_slideshow_gallery”:[],”_background_slideshow_loop”:”yes”,”_background_slideshow_slide_duration”:5000,”_background_slideshow_slide_transition”:”fade”,”_background_slideshow_transition_duration”:500,”_background_slideshow_background_size”:””,”_background_slideshow_background_size_tablet”:””,”_background_slideshow_background_size_mobile”:””,”_background_slideshow_background_position”:””,”_background_slideshow_background_position_tablet”:””,”_background_slideshow_background_position_mobile”:””,”_background_slideshow_lazyload”:””,”_background_slideshow_ken_burns”:””,”_background_slideshow_ken_burns_zoom_direction”:”in”,”_background_hover_background”:””,”_background_hover_color”:””,”_background_hover_color_stop”:{“unit”:”%”,”size”:0,”sizes”:[]},”_background_hover_color_stop_tablet”:{“unit”:”%”,”size”:””,”sizes”:[]},”_background_hover_color_stop_mobile”:{“unit”:”%”,”size”:””,”sizes”:[]},”_background_hover_color_b”:”#f2295b”,”_background_hover_color_b_stop”:{“unit”:”%”,”size”:100,”sizes”:[]},”_background_hover_color_b_stop_tablet”:{“unit”:”%”,”size”:””,”sizes”:[]},”_background_hover_color_b_stop_mobile”:{“unit”:”%”,”size”:””,”sizes”:[]},”_background_hover_gradient_type”:”linear”,”_background_hover_gradient_angle”:{“unit”:”deg”,”size”:180,”sizes”:[]},”_background_hover_gradient_angle_tablet”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_background_hover_gradient_angle_mobile”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_background_hover_gradient_position”:”center center”,”_background_hover_image”:{“url”:””,”id”:””,”size”:””},”_background_hover_image_tablet”:{“url”:””,”id”:””,”size”:””},”_background_hover_image_mobile”:{“url”:””,”id”:””,”size”:””},”_background_hover_position”:””,”_background_hover_position_tablet”:””,”_background_hover_position_mobile”:””,”_background_hover_xpos”:{“unit”:”px”,”size”:0,”sizes”:[]},”_background_hover_xpos_tablet”:{“unit”:”px”,”size”:0,”sizes”:[]},”_background_hover_xpos_mobile”:{“unit”:”px”,”size”:0,”sizes”:[]},”_background_hover_ypos”:{“unit”:”px”,”size”:0,”sizes”:[]},”_background_hover_ypos_tablet”:{“unit”:”px”,”size”:0,”sizes”:[]},”_background_hover_ypos_mobile”:{“unit”:”px”,”size”:0,”sizes”:[]},”_background_hover_attachment”:””,”_background_hover_repeat”:””,”_background_hover_repeat_tablet”:””,”_background_hover_repeat_mobile”:””,”_background_hover_size”:””,”_background_hover_size_tablet”:””,”_background_hover_size_mobile”:””,”_background_hover_bg_width”:{“unit”:”%”,”size”:100,”sizes”:[]},”_background_hover_bg_width_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_background_hover_bg_width_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_background_hover_video_link”:””,”_background_hover_video_start”:””,”_background_hover_video_end”:””,”_background_hover_play_once”:””,”_background_hover_play_on_mobile”:””,”_background_hover_privacy_mode”:””,”_background_hover_video_fallback”:{“url”:””,”id”:””,”size”:””},”_background_hover_slideshow_gallery”:[],”_background_hover_slideshow_loop”:”yes”,”_background_hover_slideshow_slide_duration”:5000,”_background_hover_slideshow_slide_transition”:”fade”,”_background_hover_slideshow_transition_duration”:500,”_background_hover_slideshow_background_size”:””,”_background_hover_slideshow_background_size_tablet”:””,”_background_hover_slideshow_background_size_mobile”:””,”_background_hover_slideshow_background_position”:””,”_background_hover_slideshow_background_position_tablet”:””,”_background_hover_slideshow_background_position_mobile”:””,”_background_hover_slideshow_lazyload”:””,”_background_hover_slideshow_ken_burns”:””,”_background_hover_slideshow_ken_burns_zoom_direction”:”in”,”_background_hover_transition”:{“unit”:”px”,”size”:””,”sizes”:[]},”_ha_background_overlay_cls_added”:”overlay”,”_ha_background_overlay_background”:””,”_ha_background_overlay_color”:””,”_ha_background_overlay_color_stop”:{“unit”:”%”,”size”:0,”sizes”:[]},”_ha_background_overlay_color_stop_tablet”:{“unit”:”%”,”size”:””,”sizes”:[]},”_ha_background_overlay_color_stop_mobile”:{“unit”:”%”,”size”:””,”sizes”:[]},”_ha_background_overlay_color_b”:”#f2295b”,”_ha_background_overlay_color_b_stop”:{“unit”:”%”,”size”:100,”sizes”:[]},”_ha_background_overlay_color_b_stop_tablet”:{“unit”:”%”,”size”:””,”sizes”:[]},”_ha_background_overlay_color_b_stop_mobile”:{“unit”:”%”,”size”:””,”sizes”:[]},”_ha_background_overlay_gradient_type”:”linear”,”_ha_background_overlay_gradient_angle”:{“unit”:”deg”,”size”:180,”sizes”:[]},”_ha_background_overlay_gradient_angle_tablet”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_ha_background_overlay_gradient_angle_mobile”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_ha_background_overlay_gradient_position”:”center center”,”_ha_background_overlay_image”:{“url”:””,”id”:””,”size”:””},”_ha_background_overlay_image_tablet”:{“url”:””,”id”:””,”size”:””},”_ha_background_overlay_image_mobile”:{“url”:””,”id”:””,”size”:””},”_ha_background_overlay_position”:””,”_ha_background_overlay_position_tablet”:””,”_ha_background_overlay_position_mobile”:””,”_ha_background_overlay_xpos”:{“unit”:”px”,”size”:0,”sizes”:[]},”_ha_background_overlay_xpos_tablet”:{“unit”:”px”,”size”:0,”sizes”:[]},”_ha_background_overlay_xpos_mobile”:{“unit”:”px”,”size”:0,”sizes”:[]},”_ha_background_overlay_ypos”:{“unit”:”px”,”size”:0,”sizes”:[]},”_ha_background_overlay_ypos_tablet”:{“unit”:”px”,”size”:0,”sizes”:[]},”_ha_background_overlay_ypos_mobile”:{“unit”:”px”,”size”:0,”sizes”:[]},”_ha_background_overlay_attachment”:””,”_ha_background_overlay_repeat”:””,”_ha_background_overlay_repeat_tablet”:””,”_ha_background_overlay_repeat_mobile”:””,”_ha_background_overlay_size”:””,”_ha_background_overlay_size_tablet”:””,”_ha_background_overlay_size_mobile”:””,”_ha_background_overlay_bg_width”:{“unit”:”%”,”size”:100,”sizes”:[]},”_ha_background_overlay_bg_width_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_ha_background_overlay_bg_width_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_ha_background_overlay_video_link”:””,”_ha_background_overlay_video_start”:””,”_ha_background_overlay_video_end”:””,”_ha_background_overlay_play_once”:””,”_ha_background_overlay_play_on_mobile”:””,”_ha_background_overlay_privacy_mode”:””,”_ha_background_overlay_video_fallback”:{“url”:””,”id”:””,”size”:””},”_ha_background_overlay_slideshow_gallery”:[],”_ha_background_overlay_slideshow_loop”:”yes”,”_ha_background_overlay_slideshow_slide_duration”:5000,”_ha_background_overlay_slideshow_slide_transition”:”fade”,”_ha_background_overlay_slideshow_transition_duration”:500,”_ha_background_overlay_slideshow_background_size”:””,”_ha_background_overlay_slideshow_background_size_tablet”:””,”_ha_background_overlay_slideshow_background_size_mobile”:””,”_ha_background_overlay_slideshow_background_position”:””,”_ha_background_overlay_slideshow_background_position_tablet”:””,”_ha_background_overlay_slideshow_background_position_mobile”:””,”_ha_background_overlay_slideshow_lazyload”:””,”_ha_background_overlay_slideshow_ken_burns”:””,”_ha_background_overlay_slideshow_ken_burns_zoom_direction”:”in”,”_ha_background_overlay_opacity”:{“unit”:”px”,”size”:0.5,”sizes”:[]},”_ha_css_filters_css_filter”:””,”_ha_css_filters_blur”:{“unit”:”px”,”size”:0,”sizes”:[]},”_ha_css_filters_brightness”:{“unit”:”px”,”size”:100,”sizes”:[]},”_ha_css_filters_contrast”:{“unit”:”px”,”size”:100,”sizes”:[]},”_ha_css_filters_saturate”:{“unit”:”px”,”size”:100,”sizes”:[]},”_ha_css_filters_hue”:{“unit”:”px”,”size”:0,”sizes”:[]},”_ha_overlay_blend_mode”:””,”_ha_background_overlay_hover_background”:””,”_ha_background_overlay_hover_color”:””,”_ha_background_overlay_hover_color_stop”:{“unit”:”%”,”size”:0,”sizes”:[]},”_ha_background_overlay_hover_color_stop_tablet”:{“unit”:”%”,”size”:””,”sizes”:[]},”_ha_background_overlay_hover_color_stop_mobile”:{“unit”:”%”,”size”:””,”sizes”:[]},”_ha_background_overlay_hover_color_b”:”#f2295b”,”_ha_background_overlay_hover_color_b_stop”:{“unit”:”%”,”size”:100,”sizes”:[]},”_ha_background_overlay_hover_color_b_stop_tablet”:{“unit”:”%”,”size”:””,”sizes”:[]},”_ha_background_overlay_hover_color_b_stop_mobile”:{“unit”:”%”,”size”:””,”sizes”:[]},”_ha_background_overlay_hover_gradient_type”:”linear”,”_ha_background_overlay_hover_gradient_angle”:{“unit”:”deg”,”size”:180,”sizes”:[]},”_ha_background_overlay_hover_gradient_angle_tablet”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_ha_background_overlay_hover_gradient_angle_mobile”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_ha_background_overlay_hover_gradient_position”:”center center”,”_ha_background_overlay_hover_image”:{“url”:””,”id”:””,”size”:””},”_ha_background_overlay_hover_image_tablet”:{“url”:””,”id”:””,”size”:””},”_ha_background_overlay_hover_image_mobile”:{“url”:””,”id”:””,”size”:””},”_ha_background_overlay_hover_position”:””,”_ha_background_overlay_hover_position_tablet”:””,”_ha_background_overlay_hover_position_mobile”:””,”_ha_background_overlay_hover_xpos”:{“unit”:”px”,”size”:0,”sizes”:[]},”_ha_background_overlay_hover_xpos_tablet”:{“unit”:”px”,”size”:0,”sizes”:[]},”_ha_background_overlay_hover_xpos_mobile”:{“unit”:”px”,”size”:0,”sizes”:[]},”_ha_background_overlay_hover_ypos”:{“unit”:”px”,”size”:0,”sizes”:[]},”_ha_background_overlay_hover_ypos_tablet”:{“unit”:”px”,”size”:0,”sizes”:[]},”_ha_background_overlay_hover_ypos_mobile”:{“unit”:”px”,”size”:0,”sizes”:[]},”_ha_background_overlay_hover_attachment”:””,”_ha_background_overlay_hover_repeat”:””,”_ha_background_overlay_hover_repeat_tablet”:””,”_ha_background_overlay_hover_repeat_mobile”:””,”_ha_background_overlay_hover_size”:””,”_ha_background_overlay_hover_size_tablet”:””,”_ha_background_overlay_hover_size_mobile”:””,”_ha_background_overlay_hover_bg_width”:{“unit”:”%”,”size”:100,”sizes”:[]},”_ha_background_overlay_hover_bg_width_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_ha_background_overlay_hover_bg_width_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_ha_background_overlay_hover_video_link”:””,”_ha_background_overlay_hover_video_start”:””,”_ha_background_overlay_hover_video_end”:””,”_ha_background_overlay_hover_play_once”:””,”_ha_background_overlay_hover_play_on_mobile”:””,”_ha_background_overlay_hover_privacy_mode”:””,”_ha_background_overlay_hover_video_fallback”:{“url”:””,”id”:””,”size”:””},”_ha_background_overlay_hover_slideshow_gallery”:[],”_ha_background_overlay_hover_slideshow_loop”:”yes”,”_ha_background_overlay_hover_slideshow_slide_duration”:5000,”_ha_background_overlay_hover_slideshow_slide_transition”:”fade”,”_ha_background_overlay_hover_slideshow_transition_duration”:500,”_ha_background_overlay_hover_slideshow_background_size”:””,”_ha_background_overlay_hover_slideshow_background_size_tablet”:””,”_ha_background_overlay_hover_slideshow_background_size_mobile”:””,”_ha_background_overlay_hover_slideshow_background_position”:””,”_ha_background_overlay_hover_slideshow_background_position_tablet”:””,”_ha_background_overlay_hover_slideshow_background_position_mobile”:””,”_ha_background_overlay_hover_slideshow_lazyload”:””,”_ha_background_overlay_hover_slideshow_ken_burns”:””,”_ha_background_overlay_hover_slideshow_ken_burns_zoom_direction”:”in”,”_ha_background_overlay_hover_opacity”:{“unit”:”px”,”size”:0.5,”sizes”:[]},”_ha_css_filters_hover_css_filter”:””,”_ha_css_filters_hover_blur”:{“unit”:”px”,”size”:0,”sizes”:[]},”_ha_css_filters_hover_brightness”:{“unit”:”px”,”size”:100,”sizes”:[]},”_ha_css_filters_hover_contrast”:{“unit”:”px”,”size”:100,”sizes”:[]},”_ha_css_filters_hover_saturate”:{“unit”:”px”,”size”:100,”sizes”:[]},”_ha_css_filters_hover_hue”:{“unit”:”px”,”size”:0,”sizes”:[]},”_ha_background_overlay_hover_transition”:{“unit”:”px”,”size”:0.3,”sizes”:[]},”_border_border”:””,”_border_width”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_border_width_tablet”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_border_width_mobile”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_border_color”:””,”_border_radius”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_border_radius_tablet”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_border_radius_mobile”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_box_shadow_box_shadow_type”:””,”_box_shadow_box_shadow”:{“horizontal”:0,”vertical”:0,”blur”:10,”spread”:0,”color”:”rgba(0,0,0,0.5)”},”_box_shadow_box_shadow_position”:” “,”_border_hover_border”:””,”_border_hover_width”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_border_hover_width_tablet”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_border_hover_width_mobile”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_border_hover_color”:””,”_border_radius_hover”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_border_radius_hover_tablet”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_border_radius_hover_mobile”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_box_shadow_hover_box_shadow_type”:””,”_box_shadow_hover_box_shadow”:{“horizontal”:0,”vertical”:0,”blur”:10,”spread”:0,”color”:”rgba(0,0,0,0.5)”},”_box_shadow_hover_box_shadow_position”:” “,”_border_hover_transition”:{“unit”:”px”,”size”:””,”sizes”:[]},”_mask_switch”:””,”_mask_shape”:”circle”,”_mask_image”:{“url”:””,”id”:””,”size”:””},”_mask_notice”:””,”_mask_size”:”contain”,”_mask_size_tablet”:””,”_mask_size_mobile”:””,”_mask_size_scale”:{“unit”:”%”,”size”:100,”sizes”:[]},”_mask_size_scale_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_mask_size_scale_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_mask_position”:”center center”,”_mask_position_tablet”:””,”_mask_position_mobile”:””,”_mask_position_x”:{“unit”:”%”,”size”:0,”sizes”:[]},”_mask_position_x_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_mask_position_x_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_mask_position_y”:{“unit”:”%”,”size”:0,”sizes”:[]},”_mask_position_y_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_mask_position_y_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_mask_repeat”:”no-repeat”,”_mask_repeat_tablet”:””,”_mask_repeat_mobile”:””,”hide_desktop”:””,”hide_tablet”:””,”hide_mobile”:””,”_attributes”:””,”custom_css”:””},”defaultEditSettings”:{“defaultEditRoute”:”content”},”elements”:[],”widgetType”:”toggle”,”htmlCache”:”\t\t<div class=\”elementor-widget-container\”>\n\t\t\t\t\t<div class=\”elementor-toggle\”>\n\t\t\t\t\t\t\t<div class=\”elementor-toggle-item\”>\n\t\t\t\t\t<div id=\”elementor-tab-title-4221\” class=\”elementor-tab-title\” data-tab=\”1\” role=\”button\” aria-controls=\”elementor-tab-content-4221\” aria-expanded=\”false\”>\n\t\t\t\t\t\t\t\t\t\t\t\t<span class=\”elementor-toggle-icon elementor-toggle-icon-right\” aria-hidden=\”true\”>\n\t\t\t\t\t\t\t\t\t\t\t\t\t\t\t<span class=\”elementor-toggle-icon-closed\”><i class=\”fas fa-arrow-down\”></i></span>\n\t\t\t\t\t\t\t\t<span class=\”elementor-toggle-icon-opened\”><i class=\”elementor-toggle-icon-opened fas fa-arrow-up\”></i></span>\n\t\t\t\t\t\t\t\t\t\t\t\t\t</span>\n\t\t\t\t\t\t\t\t\t\t\t\t<a class=\”elementor-toggle-title\” tabindex=\”0\”>Why should I opt for a hard money loan in Orlando, FL?</a>\n\t\t\t\t\t</div>\n\n\t\t\t\t\t<div id=\”elementor-tab-content-4221\” class=\”elementor-tab-content elementor-clearfix elementor-inline-editing\” data-tab=\”1\” role=\”region\” aria-labelledby=\”elementor-tab-title-4221\” data-elementor-setting-key=\”tabs.0.tab_content\” data-elementor-inline-editing-toolbar=\”advanced\”><p>A hard money loan is the perfect financing option because it offers multiple benefits like quick approvals, low interest rates, minimal requirements and much more. If you want to learn more about our hard money loan deals, we recommend <a href=\”https://insulacapitalgroup.com/just-funded-projects/\”><u>visiting our just-funded project section</u></a>. </p></div>\n\t\t\t\t</div>\n\t\t\t\t\t\t\t<div class=\”elementor-toggle-item\”>\n\t\t\t\t\t<div id=\”elementor-tab-title-4222\” class=\”elementor-tab-title\” data-tab=\”2\” role=\”button\” aria-controls=\”elementor-tab-content-4222\” aria-expanded=\”false\”>\n\t\t\t\t\t\t\t\t\t\t\t\t<span class=\”elementor-toggle-icon elementor-toggle-icon-right\” aria-hidden=\”true\”>\n\t\t\t\t\t\t\t\t\t\t\t\t\t\t\t<span class=\”elementor-toggle-icon-closed\”><i class=\”fas fa-arrow-down\”></i></span>\n\t\t\t\t\t\t\t\t<span class=\”elementor-toggle-icon-opened\”><i class=\”elementor-toggle-icon-opened fas fa-arrow-up\”></i></span>\n\t\t\t\t\t\t\t\t\t\t\t\t\t</span>\n\t\t\t\t\t\t\t\t\t\t\t\t<a class=\”elementor-toggle-title\” tabindex=\”0\”> Where can I use a hard money loan in Orlando, FL?</a>\n\t\t\t\t\t</div>\n\n\t\t\t\t\t<div id=\”elementor-tab-content-4222\” class=\”elementor-tab-content elementor-clearfix elementor-inline-editing\” data-tab=\”2\” role=\”region\” aria-labelledby=\”elementor-tab-title-4222\” data-elementor-setting-key=\”tabs.1.tab_content\” data-elementor-inline-editing-toolbar=\”advanced\”><p>You can use our hard money loans to finance a wide range of real estate projects. We offer specific loan programs like <a href=\”https://insulacapitalgroup.com/fix-flip-financing/\”><u>fix and flip loans</u></a>, <a href=\”https://insulacapitalgroup.com/residential-rental-program/\”><u>residential rental programs</u></a>, <a href=\”https://insulacapitalgroup.com/multifamily-mixed-use/\”><u>multifamily mixed-use loans</u></a>, and <a href=\”https://insulacapitalgroup.com/loans/new-construction/\”><u>new construction loans</u></a> to help you complete your real estate ventures without any financial hassle.</p></div>\n\t\t\t\t</div>\n\t\t\t\t\t\t\t<div class=\”elementor-toggle-item\”>\n\t\t\t\t\t<div id=\”elementor-tab-title-4223\” class=\”elementor-tab-title\” data-tab=\”3\” role=\”button\” aria-controls=\”elementor-tab-content-4223\” aria-expanded=\”false\”>\n\t\t\t\t\t\t\t\t\t\t\t\t<span class=\”elementor-toggle-icon elementor-toggle-icon-right\” aria-hidden=\”true\”>\n\t\t\t\t\t\t\t\t\t\t\t\t\t\t\t<span class=\”elementor-toggle-icon-closed\”><i class=\”fas fa-arrow-down\”></i></span>\n\t\t\t\t\t\t\t\t<span class=\”elementor-toggle-icon-opened\”><i class=\”elementor-toggle-icon-opened fas fa-arrow-up\”></i></span>\n\t\t\t\t\t\t\t\t\t\t\t\t\t</span>\n\t\t\t\t\t\t\t\t\t\t\t\t<a class=\”elementor-toggle-title\” tabindex=\”0\”>How to start the hard money loan application in Orlando, FL?</a>\n\t\t\t\t\t</div>\n\n\t\t\t\t\t<div id=\”elementor-tab-content-4223\” class=\”elementor-tab-content elementor-clearfix elementor-inline-editing\” data-tab=\”3\” role=\”region\” aria-labelledby=\”elementor-tab-title-4223\” data-elementor-setting-key=\”tabs.2.tab_content\” data-elementor-inline-editing-toolbar=\”advanced\”><p>You can start the loan application by filling out our <a href=\”https://insulacapitalgroup.com/full-application/\”><u>online full application form</u></a> and submitting the required documents.</p></div>\n\t\t\t\t</div>\n\t\t\t\t\t\t\t\t</div>\n\t\t\t\t</div>\n\t\t”,”editSettings”:{“defaultEditRoute”:”content”,”panel”:{“activeTab”:”content”,”activeSection”:”section_toggle”},”activeItemIndex”:1}}]}Our hard money loans are suitable for non-owner-occupied properties intended for investment, which can include properties for fixing and flipping, new constructions, residential rentals, and multifamily properties.

Insula Capital Group: Fueling Your Real Estate Ambitions in Nashville

At Insula Capital Group, we don’t just offer loans; we help craft your real estate success story in Nashville, Tennessee. As your committed private money lender, we empower you to make a mark on Nashville’s vibrant real estate scene. Our recently funded projects bear testament to our relentless dedication to fueling investor dreams.

Ready to ignite your real estate journey in Nashville? Begin by completing our quick prequalification form, or dive deeper with our comprehensive full loan application. To discuss your unique needs and learn more about how we can support your aspirations, feel free to contact us and schedule a consultation. Your real estate future in Nashville starts with Insula Capital Group!