Private Money Lenders | Hard Money Loans in Nebraska

Every real estate investor requires funding to execute their investment projects, and Insula Capital Group offers hard money lending services in Nebraska to fill this crucial need. As a highly sought-after lending firm, Insula Capital Group specializes in providing real estate investors with quick and reliable access to short-term financing solutions.

Our hard money lenders possess extensive knowledge and expertise in the real estate sector, allowing them to evaluate investment opportunities accurately. If you’re in Nebraska looking for reliable and flexible financing options for your real estate investment project, look no further than Insula Capital Group.

Get in Touch

Expand Your Portfolio in Nebraska with Insula Capital Group!

Our hard money lenders have 30 years of experience in the market, making us one of the most trusted and reputable sources of financing for real estate investors. We have worked with several investors, developers, builders, and homeowners in Nebraska and helped them attain their investment objectives. We have seen many clients expand their portfolios in the state’s real estate market with our support and guidance.

The loan programs we offer are designed to cater to the unique needs and circumstances of each investor. They’re custom-tailored to ensure that investors have access to the right funding options and can achieve their investment goals efficiently. Our hard money lenders will approve your loans within 24 hours. They can provide funding within 4 to 5 days, ensuring that you don’t miss out on any lucrative investment opportunities in Nebraska’s fast-paced real estate market.

The Pros of Working with Private Money Lenders in Nebraska

Private money lenders provide real estate investors with several distinct advantages. If you’re looking to acquire capital quickly to act swiftly on lucrative opportunities, hard money lenders in Nebraska are your best option. Unlike traditional bank loans, hard money loans typically have shorter approval times, allowing investors to secure financing in a matter of days rather than weeks.

Hard money lenders are less concerned with borrowers’ credit scores and financial histories, prioritizing the value of the underlying property instead. Hard money loans can be given to investors who have less-than-perfect credit or those who may not receive conventional financing.

Working with hard money lenders is generally easier as hard money loan terms offer flexibility in terms of repayment structures. Investors can negotiate terms that align with their investment strategy, such as interest-only payments or balloon payments at the end of the loan term.

Hard money loans can be used for various real estate investment purposes, such as fix and flip loans and new construction loans in Nebraska and similar markets. For investors looking to diversify their portfolios and capitalize on opportunities in the real estate market, these can open up various doors.

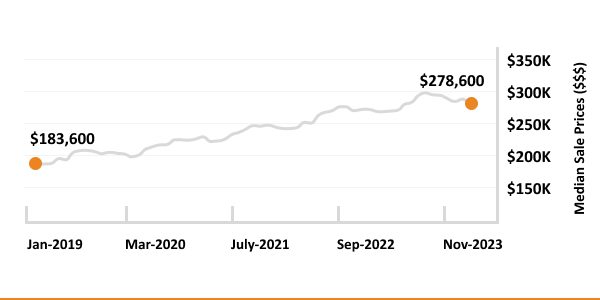

The Important Facts About Nebraska’s Real Estate

At Insula Capital Group, we prioritize detailed research into the real estate market and recommend investors working with us to do their due diligence in the investing process. Being aware of the various aspects of the dynamic market of Nebraska will help you make informed decisions. To help in the processes, we’ve gathered some vital facts that investors tend to look at first off:

- Median Home Value:$237,840

- 1-Year Appreciation Rate:+12.9%

- Median Rent Price:$1,006

- Price-To-Rent Ratio:70

- Unemployment Rate:9%

- Population:1,963,692

- Foreclosure Rate: 1 in every 6,920

- Median Household Income: $63,015

Real Estate Statistics for Nebraska

1,963,692

Population

$1,006

Median Rent Price

$237,840

Median Home Value

+12.9%

1-Year Appreciation Rate

$63,015

Median Household Income

19.70

Price-To-Rent Ratio

Just Funded Projects

February 2026

Fix & Flip

Loan Amount

$248,869

After Repair Value$409,000

Purchase Price$145,000

Renovation Budget$147,787

Loan TypeFix & Flip

- After Repair Value$409,000

- Purchase Price$145,000

- Renovation Budget$147,787

- Loan TypeFix & Flip

Decatur, GA

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

December 2025

Fix & Flip

Loan Amount

$171,250

After Repair Value$263,000

Purchase Price$125,000

Renovation Budget$65,000

Loan TypeFix & Flip

- After Repair Value$263,000

- Purchase Price$125,000

- Renovation Budget$65,000

- Loan TypeFix & Flip

Albany, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

How Nebraska Shaped Itself as A Contender for Real Estate Investments

The real estate market in Nebraska has seen an improvement thanks to the development of various institutes for education, business, and healthcare. Nebraska’s educational system, with institutions like the University of Nebraska, has led to a lot of people considering the region for getting an education. The state’s education system is ranked among the top in the nation, with high school graduation rates consistently exceeding the national average.

Nebraska also offers a favorable environment for investment with respect to the business sector. The state is home to a diverse range of industries, including agriculture, manufacturing, and technology. Additionally, Nebraska boasts a business-friendly regulatory environment, with low corporate taxes and a relatively low cost of living compared to many other states.

Healthcare infrastructure in Nebraska is also respectable, with numerous hospitals and healthcare facilities providing quality care to residents. This includes renowned institutions such as the Nebraska Medical Center in Omaha, which is recognized for its expertise in various medical specialties.

Although Nebraska may not experience the same level of population growth as some coastal states, it still attracts a steady influx of newcomers seeking affordable living and a high quality of life. This steady population growth contributes to the demand for housing, presenting opportunities for real estate investors seeking stable long-term investments.

Ready to apply for a Hard Money loan?

Frequently Asked Questions

We offer new construction loans, fix & flip loans, residential rental loans, or multifamily/mixed-use loans to real estate investors in Nebraska.

The interest rates are competitive and vary depending on the type of loan program you choose. Our initial loan term is 12 months; however, it can be extended further if required.

Our hard money loans are suitable for non-owner-occupied properties intended for investment, which can include properties for fixing and flipping, new constructions, residential rentals, and multifamily properties.

Top Hard Money Lenders Loan Cities in Nebraska

Join Us Today!

If our hard money loan options sound like the ideal financing solution for your real estate investment project in Nebraska, we encourage you to contact us today.

You can also fill out our application form online to get started with the loan approval process. Don’t forget to check our just-funded projects to see how private money lenders have helped other investors in Nebraska achieve their real estate investment goals and expand their portfolios.