Private Money Lenders | Hard Money Loans in New Hampshire

Investing in Your Real Estate Aspirations in New Hampshire

As New Hampshire’s trusted private money lender, Insula Capital Group is committed to fueling your real estate dreams. Covering key areas, including Manchester, Nashua, Merrimack, Salem, and Rochester, we offer unique financial solutions tailored to your needs. With over 30 years of industry experience, we’re well-equipped to guide you through the intricate landscape of property investment.

Get in Touch

Dynamic Financing for Property Transformation and Diversification: Fix and Flip Loans, New Construction Loans, and More

Whether you’ve spotted a property in New Hampshire ripe for transformation or you’re looking to venture into home construction, expand a rental portfolio, or diversify with multi-family mixed-use properties, we have your back. Our fix and flip loans provide swift financing, allowing you to purchase, renovate, and sell properties for a profit with flexible terms and fast approvals.

At the same time, our new construction loans, residential rental programs, and multi-family mixed-use loans offer versatile and tailored financial support to match your ambitious investment strategies. With our comprehensive lending solutions, seizing lucrative investment opportunities has never been more efficient.

We’re not just about delivering tailored lending solutions; we’re about celebrating your success. Our recently funded projects reflect our lending prowess and commitment to helping you achieve your property investment goals in New Hampshire. Each successful project fuels our drive to deliver better, faster, and more personalized financial assistance.

To make your journey smoother, we’ve streamlined our application process. Simply complete our Full Loan Application or our Prequalification Form to embark on your investment journey. Together, let’s turn property investment aspirations into tangible success stories!

How Can Hard Money Loans Can Be An Excellent Option For Your Real Estate Projects

Starting a real estate project can be an exciting prospect, but the excitement can quickly die down if you don’t have the finances to close the real estate deal. We know that opting for conventional loans can be tricky because of the strict lending criteria and the never-ending approval process. If you need quick and flexible financing options for your projects in New Hampshire, consider opting for hard money loans.

Private lenders who offer hard money loans check your collateral instead of your creditworthiness or financial history. Our underwriting team can thoroughly evaluate your financial documentation and offer approvals in no time. It can help you capitalize on excellent real estate opportunities and enhance your investment portfolio.

As a reputable private lender in New Hampshire, we’ve got an online application form that can help you apply for hard money construction and fix & flip loans from the comfort of your home or office.

Hard money loans also have flexible loan terms, which can make it easy for you to repay the loan. You can negotiate the terms with private lenders to get a hard money loan deal that matches your financial objectives.

With numerous advantages, opting for hard money loans is an excellent idea. If you need an exceptional hard money loan deal, consider reaching out to our team.

Evaluate The Growing Real Estate Market In New Hampshire

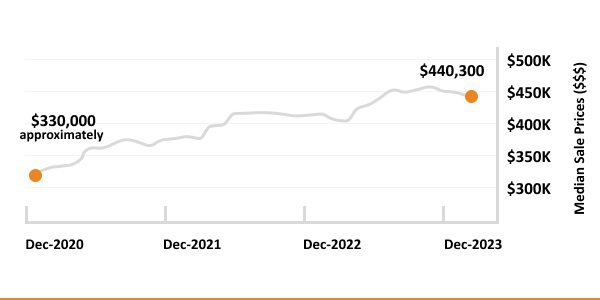

Thinking about investing in New Hampshire’s real estate market? It’s an excellent idea, but completing your investments requires thorough research. If you need help with your research, here are some of the latest statistics that might help you:

- Median Home Value:$433,627

- 1-Year Appreciation Rate:+18.8%

- Median Sales Price:$460,000

- New Listings:2,282

- Homes For Sale:2,068

- Median Days On Market:13

- Median Rent Price:$1,671

- Price-To-Rent Ratio:62

- Unemployment Rate:0%

- Population:1,388,992

- Median Household Income:$77,923

- Foreclosure Rate: One in every 9,534 households (0.06%)

The Real Estate Landscape In Miami

1,388,992

Population

$1,671

Median Rent Price

$433,627

Median Home Value

+18.8%

1-Year Appreciation Rate

$77,923

Median Household Income

21.62

Price-To-Rent Ratio

Just Funded Projects

March 2026

Fix & Flip

Loan Amount

$249,520

After Repair Value$420,000

Purchase Price$220,000

Renovation Budget$51,520

Loan TypeFix & Flip

- After Repair Value$420,000

- Purchase Price$220,000

- Renovation Budget$51,520

- Loan TypeFix & Flip

Atlanta, GA

February 2026

Fix & Flip

Loan Amount

$248,869

After Repair Value$409,000

Purchase Price$145,000

Renovation Budget$147,787

Loan TypeFix & Flip

- After Repair Value$409,000

- Purchase Price$145,000

- Renovation Budget$147,787

- Loan TypeFix & Flip

Decatur, GA

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Is Investing In The Real Estate Market In New Hampshire The Right Option For You?

Wondering if you should purchase properties in New Hampshire’s real estate market? With our expertise and flexible financing options, we can help you understand the complexities of the New Hampshire market.

It’s no secret that New Hampshire has a strong economy, a low unemployment rate, and a favorable business environment. With these factors, you can expect the property demand to rise as people move into New Hampshire from different parts of the US.

The rising real estate prices because of the high demand can present an excellent opportunity for investors to sell their properties and earn high profits.

Ready to apply for a Hard Money loan?

Frequently Asked Questions

Unlike traditional bank loans, our private money loans offer faster approvals, more flexible terms, and consideration for individuals with various credit backgrounds. We focus more on the property’s potential value and your investment plan.

Absolutely! Our multi-family mixed-use loans cover properties in all these cities, allowing you to tap into diverse real estate markets across New Hampshire.

Of course! Our fix and flip loans are designed for both seasoned investors and those new to the game. We offer competitive terms and swift funding to help you transform properties into profitable investments.

Top Hard Money Lenders Loan Cities in New Hampshire

Embarking on Your New Hampshire Real Estate Journey

Ready to embark on your real estate journey in New Hampshire? Connect with Insula Capital Group today. We’re excited to help you navigate your financing needs and realize your property investment dreams. Reach out to us, explore our full array of services, and see how we can propel your real estate ambitions. Contact us today!