Private Money Lenders | Hard Money Loans in Ohio

Ohio is a microcosm state featuring a mix of quality of life, affordability, a sense of community, diverse industry, and natural beauty. It’s also a center of sports, innovation, economic growth, culture, and education. No wonder Ohio is known to offer the best of both worlds.

Hence, investing and buying real estate property is profitable in Ohio. While you start looking for investment properties, you should also get in touch with our private money lenders in Ohio for hard money loans. Insula Capital Group is a dependable lending firm offering flexible financing solutions to property developers, real estate investors, and homeowners looking for quick approvals and capital. Learn more about our private money lending services below.

Achieve Financial Goals with Private Money Lenders in Ohio

By securing our private money lending services, you can achieve efficient and speedy financial solutions in Ohio. Insula Capital Group is a team of highly responsive private money lenders who prioritize faster approvals and turnaround times. Hence, it’s easier for you to secure capital for your real estate project.

Our in-house team of private money lenders works closely with borrowers to curate a personalized financial plan that meets their distinct needs, enabling them to take their projects to the next level while achieving their investment goals.

Our bespoke suite of financial plans includes multifamily/mixed-use loans, fix & flip financing, residential renal loans, and new construction loans. With three decades of experience as an established private money lender, our team is well-equipped and well-versed in relieving the financial burden off your shoulders.

We offer tailored solutions to match your requirements. Hear stories from our previous clients by discovering our Just Funded Projects section.

Why Choose Hard Money Loans for A Project In Ohio?

Real estate investing can be tricky, and the one thing that makes it a lot easier is a hard money loan. These loans have some distinct advantages for borrowers and are definitely worth looking into.

For starters, you’d have rapid access to capital, and this comes with a streamlined approval process based on collateral value rather than your credit history. Needless to say, this quick turnaround is invaluable for seizing time-sensitive opportunities and executing profitable deals.

Moreover, hard money lenders like us are typically more lenient when it comes to property conditions. This makes these loans perfect for renovation or fix-and-flip projects,

Also, the flexibility in repayment structures and terms is an added bonus that can really help make your real estate venture smoother.

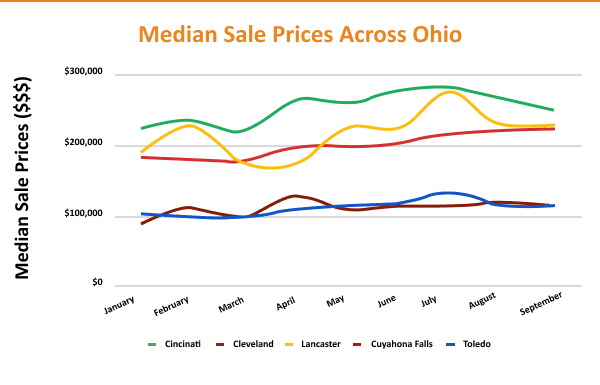

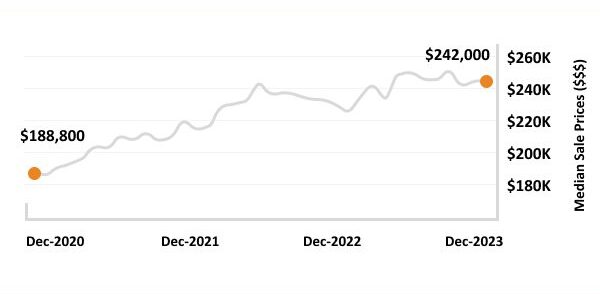

Ohio has a thriving real estate market, which is totally worth investing in. Here are some stats to keep in mind for well-informed investments:

- Population: 11.78 million

- Median Household Income: $66,990

- Ohio’s unemployment rate: 3.60%

- Migrations into Ohio 2023: 252,000

- Median Sale Price: $228,600

- Price Growth YoY: 7.5%

- Number of Homesfor Sale: 32,203

- Homes Sold Above List Price: 32.2%

- Foreclosure rate: 1 in every 2656 homes

Ready to apply for a money lenders loan?

Frequently Asked Questions

When you work with us at Insula Capital Group, you can rest assured that you’ll have the funds you need whenever you need them.

Our approval process is exceptionally efficient and responsive. You can expect a 24-hour approval turnaround, and once approved, the funding process takes only 3-5 business days. This quick and streamlined approach is designed to meet the urgent financial needs of borrowers, making sure you have a hassle-free experience.

To sum it up, the entire process should take less than a week, i.e., you will have access to the requested funds within a week of applying!

For property renovation projects, we offer fix & flip financing. This specialized loan allows you to cover 100% of the property renovation costs, providing the financial support needed to enhance and maximize the potential of your real estate investment.

Our fix-and-flip loan program can be tailored to your project’s exact requirements. Feel free to get in touch with our team of experts to discuss it all further.

Insula offers a minimum loan amount of $50,000. However, the maximum loan amount can vary based on project requirements and the borrower’s qualifications. This flexibility allows us to cater to a range of financing needs, ensuring that borrowers can access the right amount of capital for their specific projects.

Ohio’s Real Estate Market – Why Invest In It

Ohio’s real estate market is attractive to investors for a number of reasons.

First, the affordability in this state is absolutely incomparable. With the state having a lower cost of living compared to the national average, many people relocate to Ohio every year. Moreover, cities like Columbus and Cleveland offer reasonably priced housing, which attracts not only residents but also investors.

One also can’t ignore the state’s diverse economy, especially sectors like technology, healthcare, and manufacturing that contribute to job stability and population growth. These factors also positively impact the real estate market.

And, of course, there are also many urban revitalization projects and infrastructure developments that are enhancing property values across the state and resulting in excellent opportunities for investors.

Just Funded Projects

February 2026

Fix & Flip

Loan Amount

$248,869

After Repair Value$409,000

Purchase Price$145,000

Renovation Budget$147,787

Loan TypeFix & Flip

- After Repair Value$409,000

- Purchase Price$145,000

- Renovation Budget$147,787

- Loan TypeFix & Flip

Decatur, GA

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

December 2025

Fix & Flip

Loan Amount

$171,250

After Repair Value$263,000

Purchase Price$125,000

Renovation Budget$65,000

Loan TypeFix & Flip

- After Repair Value$263,000

- Purchase Price$125,000

- Renovation Budget$65,000

- Loan TypeFix & Flip

Albany, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

We Can Help!

If you’re ready to invest in your future, take a step to unlock new avenues of investment opportunities with Insula Capital Group.

At Insula Capital Group, we take pride in offering a wide range of loan programs for our clients. Each loan program is designed to help you make the most of your investments, and we can also tailor the terms of the loan to make sure it all aligns with your financial goals as well!

With us on board, you no longer have to worry about the financial aspects of your real estate project—we’ve got you!

Connect with our private money lenders in Ohio today!

Ready to apply for a Hard Money Loans?

Get in touch with our experienced team for more details about our financing services.

Top Hard Money Lenders Loan Cities in Ohio

Let’s Partner Up!

At Insula Capital Group, we strive to make investments easier for our clients. As the leading hard money lending company in the region, we want to give seasoned and rookie investors their best shot when it comes to investments in Ohio.