Private Money Lenders | Hard Money Loans in Pennsylvania

Pennsylvania isn’t only known as the birthplace of American democracy and the origin of Hershey’s chocolate. Picturesque landscapes, Liberty Bell, and lucrative real estate investment opportunities equally add to the uniqueness of the state located in the northeast Mid-Atlantic region of the United States.

Investors can leverage all the profitable construction, flipping, and acquisition projects with quick and convenient hard money loans acquired through Insula Capital Group.

With over three decades of experience working with seasoned private money lenders, we understand the fast-paced nature of the real estate industry. That’s why we offer speedy approvals, competitive rates, and personalized loan programs to our clients.

Work With Reliable Hard Money Lenders in Pennsylvania

Insula Capital Group is one of the leading names when it comes to hard money loans in Pennsylvania and beyond. We’ve built a solid reputation over the years by offering our clients some of the best services and loan plans.

We’ve helped investors with different types of property investment, including those associated with new construction loans, fix & flip financing, multi-family mixed-use loans, and residential rental loans.

All of our loan programs can be customized to meet your project’s unique requirements. Moreover, our processes are designed to be quick to ensure you have the funds you need without any unnecessary delays.

Get in touch with our team for a consultation and a hassle-free application process!

Why Choose Hard Money Loans For Project Success?

Hard money loans can be a smart approach when you’re looking for swift and flexible financing solutions for your real estate venture. They help you seize time-sensitive opportunities thanks to the minimal requirements and more streamlined processes.

Moreover, hard money loans are typically more versatile than traditional loans and can accommodate various types of projects, including commercial or residential ones, regardless of whether they’re new constructions or renovations.

It’s also worth keeping in mind that hard money loans typically have much more flexible repayment terms and, therefore, give you the peace of mind you need to make decisive decisions and ensure project success.

Market Insights Worth Keeping An Eye On

Pennsylvania is definitely worth investing in, but make sure to keep an eye on some of these essential stats while investing:

- Population: 12,961,683

- Median Household Income: $ 66,935

- Unemployment Rate: 7%

- Average Rent Prices: $1,551

- Median Days Before Sale: 24

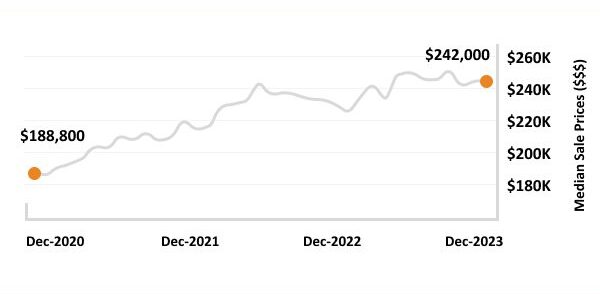

- Median Sale Price: $356,000

- Annual Increase: 2%

- Homes Sold Above List Price: 9%

- Foreclosure Rate: 28%

- Counties with highest foreclosure rates: Philadelphia, Allegheny, Luzerne

- Median Real Property Tax Rate: 37%

- Projected growth of the real estate market: moderate (2-3% annually)

- Average ROI for hard money loans: 12-18% (annualized)

- Distribution of property types financed by hard money loans:

- Single-family homes: 70%

- Multi-family homes: 15%

- Commercial properties: 15%

Georgia’s Real Estate Market

12,961,683

Population

$ 66,935

Median Household Income

$356,000

Median Sale Price

8.2%

Annual Increase

1.37%

Median Real Property Tax Rate

0.28%

Foreclosure Rate

Just Funded Projects

February 2026

Fix & Flip

Loan Amount

$248,869

After Repair Value$409,000

Purchase Price$145,000

Renovation Budget$147,787

Loan TypeFix & Flip

- After Repair Value$409,000

- Purchase Price$145,000

- Renovation Budget$147,787

- Loan TypeFix & Flip

Decatur, GA

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

December 2025

Fix & Flip

Loan Amount

$171,250

After Repair Value$263,000

Purchase Price$125,000

Renovation Budget$65,000

Loan TypeFix & Flip

- After Repair Value$263,000

- Purchase Price$125,000

- Renovation Budget$65,000

- Loan TypeFix & Flip

Albany, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Why Invest In Pennsylvania?

Pennsylvania’sreal estate market attracts investors from across the country, and for good reason. The state has a lot of potential for long-term growth and profitability.

One key factor that contributes to the growth potential directly is Pennsylvania’s incredibly stable and diverse economy supported by a mix of industries, including technology, finance, healthcare, and education. The economic potential in the state is essentially what fuels the sustained real estate demand.

It’s also worth noting that the state boasts some major metropolitan areas like Pittsburgh and Philadelphia. These areas have thriving job markets that attract residents from across the country—and needless to say, these people need homes to live in. Moreover, these vibrant cities attract businesses as well, which further keeps the real estate market up and running.

Another critical factor that should compel you to invest in Pennsylvania’s real estate is its low cost of living reflected in its low property prices. This affordability factoropens a lot of opportunities for investors, especially beginner investors with limited portfolios and relatively smaller budgets.

In general, if you’re a real estate investor, you’ve got nothing to lose by investing in Pennsylvania; however, you do stand to gain a great deal of profit!

Ready to apply for a money lenders loan?

Get in touch with our experienced team for more details about our financing services.

Frequently Asked Questions

Having prior real estate experience can be very advantageous, but it’s not a strict requirement if you’re working with us here at Insula Capital Group. Having three projects under your belt or some sort of relevant experience is preferred. While traditional lenders require good credit scores and income verification, we prioritize your property value, your overall plan, and your exit strategy.

At Insula Capital Group, we typically provide hard money loans for an initial term of 12 months. However, to accommodate individual investment strategies and financial requirements, we offer flexible options for extending the loan term.

We understand that each borrower has unique needs, and our team is ready to provide personalized assistance. Feel free to reach out to us for further information and guidance on tailoring a loan solution that aligns with your specific circumstances and investment goals.

Yes absolutely! Hard money loans from Insula Capital Group can be used for a diverse range of projects in Pennsylvania, including residential and commercial ones. Whether it’s a residential development, a commercial venture, a multi-family construction or a mixed-use project you’re starting, our team of experts can help tailor a financial plan that will meet the unique requirements of your project.

We offer a versatile approach when it comes to hard money loans, which is what makes it possible for us to help you finance projects of all sizes and scope.

Top Hard Money Lenders Loan Cities in Pennsylvania

Connect With Top-Rated Hard Money Lenders in Pennsylvania

Whether you’re a seasoned investor or a first-time borrower, the seasoned team at Insula Capital Group is here to provide guidance and help you make informed financial decisions. Our team will analyze your financial needs and provide customized hard money loan deals.

With no prepayment penalties or hidden fees, our transparent approach sets us apart. Enjoy exceptional customer service, fast approvals, competitive rates, lowinterest rates, minimal paperwork, no prepayment penalties, and much more.

Don’t let financing stand in the way of your real estate investment dreams! Start working with Insula Capital Group to kickstart your venture today. Apply now through our easy online application.

Let’s Partner Up!

At Insula Capital Group, we prioritize fast approvals, competitive rates, and exceptional customer service. Our team will analyze your financial needs and provide customized hard money loan deals. Our loans have various features, including quick approvals, no junk fees, minimal paperwork, no pre-payment penalties, and much more.

Check out our loan programs and just-funded projects for better insights and inspiration!