Private Money Lenders | Hard Money Loans in Philadelphia, PA

Famous as the birthplace of liberty, life, and the pursuit of happiness, and many beloved historical sites, Philadelphia offers many great opportunities for transforming your property investment dreams into success stories.

Don’t let the rising costs of buying, flipping, or constructing properties keep you from embarking on a journey to shape your real estate future in Philadelphia. Insula Capital Group can be your private money lender from start to finish. We offer custom asset-based lending solutions tailored to your unique needs.

Get Hard Money LoansWith Minimal Interest Rates In Philadelphia

It’s no secret that acquiring traditional loans can take an eternity because of the strict lending standards and hectic process. If you need quick financing, consider joining hands with our loan experts.

With our expertise, you can trust us to provide you with the most favorable terms available in the market. We’ll examine your financial condition and deliver a loan deal that’s tailored to your financial goals. Our goal is to support your real estate ventures while maximizing your return on investment.

With over three decades worth of combined experience in the local real estate market, our experts possess the knowledge necessary to guide you through the complexities of hard money lending. Our team of professionals stays up to date with market trends and regulations to provide informed financial advice.

Contact our team today for new construction loans, fix & flip financing, multifamily mixed-use loans, or residential rental loans.

Capitalize On Opportunities With Hard Money Loans In Philadelphia

Speed and Flexibility

Hard money loans provide investors unparalleled speed and flexibility, crucial elements in Philadelphia’s fast-paced real estate market.

Traditional lending institutions often have lengthy approval processes, delaying opportunities and hindering swift decision-making.

In contrast, hard money lenders offer expedited approval and funding, enabling investors to seize time-sensitive opportunities and stay ahead of the competition.

Accessibility Regardless of Credit History

Unlike traditional lenders who heavily weigh credit history in their lending decisions, hard money lenders primarily focus on the value of the property being financed.

This asset-based approach means that investors with less-than-perfect credit can still access financing, opening doors to opportunities that may have been out of reach with traditional lending avenues.

Ideal for Property Rehabilitation

Hard money loans are particularly well-suited for these types of projects, providing the necessary capital for acquisitions, renovations, and quick turnarounds.

Whether it’s restoring historic homes in Society Hill or rejuvenating properties in Fishtown, hard money loans offer the flexibility needed to undertake profitable projects.

Schedule a consultation with our team of seasoned experts for an insightful discussion about your real estate ambitions.

Philadelphia Housing Market Overview

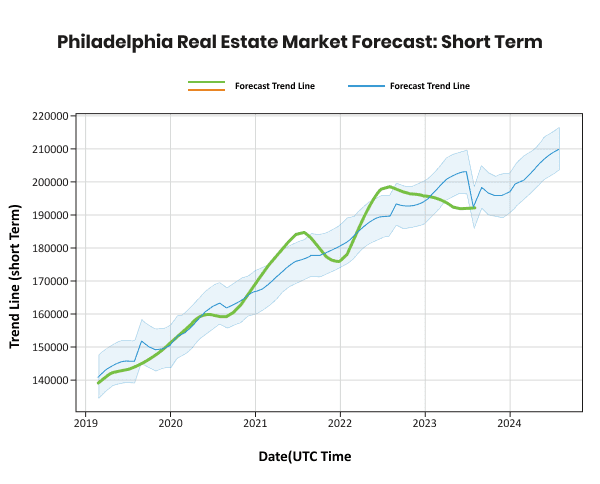

The average annual profit of property investment was 10.073% in 2019, 10.534% in 2020, 2.250% in 2021, 9.925% in 2022, 2.213% in 2023, and 0.000001% in 2024.

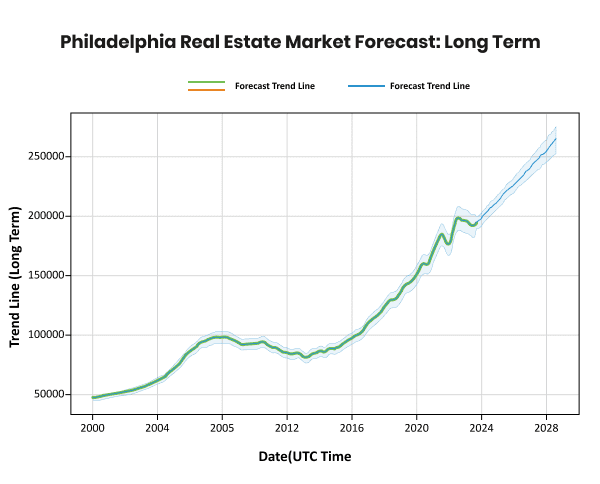

Based on our Philadelphia City real estate market research and report, the predicted sales prices will increase by 67.719% in the next ten years.

- Median Home Value: $211,224

- Annual Appreciation Rate: +6.8%

- Median Home Value: +7.8%

- Median Rent Price: $1,489

- Price-To-Rent Ratio: 12.6

- Average Days On Market: 73

- Population: 12,807,060

- Foreclosure Rate: 1 in every 12,733 (0.7%)

Philadelphia Real Estate Landscape

12,807,060

Population

$1,489

Median Rent Price

+7.8%

Median Home Value

+6.8%

Annual Appreciation Rate

$63,015

Median Household Income

12.6

Price-To-Rent Ratio

Just Funded Projects

February 2026

Fix & Flip

Loan Amount

$248,869

After Repair Value$409,000

Purchase Price$145,000

Renovation Budget$147,787

Loan TypeFix & Flip

- After Repair Value$409,000

- Purchase Price$145,000

- Renovation Budget$147,787

- Loan TypeFix & Flip

Decatur, GA

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

December 2025

Fix & Flip

Loan Amount

$171,250

After Repair Value$263,000

Purchase Price$125,000

Renovation Budget$65,000

Loan TypeFix & Flip

- After Repair Value$263,000

- Purchase Price$125,000

- Renovation Budget$65,000

- Loan TypeFix & Flip

Albany, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Investing In Philadelphia's Real Estate Market Presents A Compelling Opportunity

Steady Appreciation: Philadelphia has experienced consistent appreciation in property values over the years, making it an attractive option for long-term investors seeking capital growth.

Diverse Neighborhoods: From historic districts like Old City to up-and-coming areas like Fishtown, Philadelphia offers diverse neighborhoods, each with unique charm and investment potential.

Strong Rental Market: With a growing population and robust demand for rental properties, Philadelphia’s rental market provides investors with a steady stream of income and the potential for high occupancy rates.

Thriving Economy: Philadelphia is home to a diverse economy, with sectors such as healthcare, education, and technology driving growth. This economic diversity provides stability and resilience to the real estate market.

Proximity to Major Cities: Situated close to major cities like New York and Washington D.C., Philadelphia benefits from its strategic location, attracting local and out-of-state investors looking for opportunities in a growing market.

Affordability: Compared to other East Coast cities, Philadelphia offers relatively affordable real estate prices, making it accessible to a wide range of investors, including first-time buyers and seasoned professionals.

Historical and Cultural Significance: As one of the nation’s oldest cities, Philadelphia boasts a rich history and vibrant culture, attracting tourists and residents alike. Properties with historical significance often hold value and appeal to investors interested in preserving heritage.

Ready to apply for a Hard Money loan?

Get in touch with our experienced team for more details about our financing services.

A Step Closer to Your Real Estate Ambitions in the Heart of Pennsylvania

At Insula Capital Group, we offer tailored loan programs, quick approvals, and flexible terms. Our experienced team stands ready to provide insightful guidance, ensuring you confidently navigate your investment journey. Apply now!

Our hard money loans cater to properties intended for investment purposes. This includes opportunities in fix and flip projects, new constructions, residential rentals, and multifamily properties. For specifics on property eligibility, our team is here to assist you.

Yes! There’s no need to worry if you’ve got a low credit score since your credit history isn’t the only aspect we look at when providing loan approvals. Our team also analyzes project plans, collateral value, and real estate experience to offer loan deals. You can visit our just-funded project section to find out more about our exciting loan deals.

Join Us Today!

At Insula Capital Group, we stand at the crossroads of your real estate dreams and the thriving opportunities within Philadelphia’s vibrant markets. As experienced private money lenders, we strive to offer you the support and resources necessary to navigate the dynamic landscape of real estate investment successfully.

Our proven track record of facilitating investor triumphs illuminates our commitment and can be seen through the lens of our recently funded projects. We invite you to start your real estate investment journey by filling out our convenient prequalification form.