Private Money Lenders | Hard Money Loans in Phoenix, AZ

With its thriving economy, growing population, and diverse real estate market, Phoenix offers a fertile ground for investment. Hard money lenders in Phoenix specialize in providing financing solutions tailored to facilitating transactions for investors looking to capitalize on the promising opportunities offered by the Valley of the Sun.

Whether investors want to purchase, renovate, or refinance properties, our hard money lenders offer a range of loan programs designed to meet their specific requirements.

From new construction loans to fix & flip financing, multifamily mixed-use loans, or residential rental loans, hard money lenders at Insula Capital Group offer flexibility and customization to support various investment strategies.

Contact us to capitalize on time-sensitive opportunities with our wide range of hard money loans.

Get in Touch

Why Hard Money Loans?

Accessibility Regardless of Credit History

Traditional lenders heavily emphasize credit scores and income verification when evaluating loan applications.

Hard money lenders focus primarily on the value of the underlying property. This means that even borrowers with less-than-perfect credit can still qualify for hard money loans, providing access to much-needed capital for their real estate investments.

Bridging Financing Gaps

Hard money loans also serve as a bridge for financing gaps in real estate transactions. In situations where traditional financing is unavailable, or the timeline is too tight for conventional lenders, hard money loans provide a viable alternative.

Whether investors need short-term financing to acquire a property quickly or require funds to cover renovation costs before refinancing with a traditional lender, hard money loans offer a flexible solution to bridge these financing gaps.

Mitigating Risk

Our hard money lenders in Phoenix work closely with borrowers to assess each investment opportunity’s potential risks and rewards.

By conducting thorough due diligence and evaluating the collateralized property, our hard money lenders help mitigate risk for both parties involved. This collaborative approach ensures that investments are well-underwritten and have the potential to generate positive returns for investors.

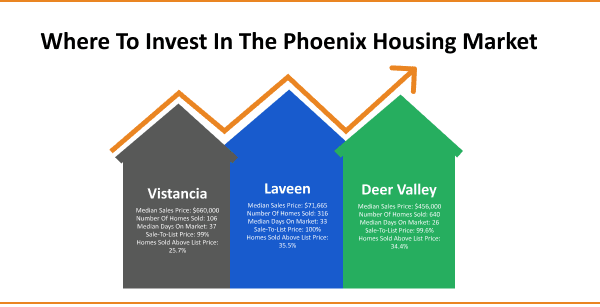

The Real Estate Scene in Phoenix, AZ

- Population: 1,624,569

- Median Home Value: $436,678

- Median List Price: $501,323

- Annual Appreciation Rate: +16.6%

- Forecasted Annual Appreciation Rate: +2.4%

- Median Days On Market: 38

- Median Rent: $1,973

- Price-To-Rent Ratio: 21.2

- Total Active Foreclosures: 372

Phoenix Real Estate Landscape

Just Funded Projects

July 2025

Fix & Flip

Loan Amount

$1,456,100

After Repair Value$2,700,000

Purchase Price$1,200,000

Renovation Budget$376,100

Loan TypeFix & Flip

- After Repair Value$2,700,000

- Purchase Price$1,200,000

- Renovation Budget$376,100

- Loan TypeFix & Flip

Destin, FL

July 2025

Fix & Flip

Loan Amount

$400,899

After Repair Value$595,000

Purchase Price$42,500

Renovation Budget$429,147

Loan TypeFix & Flip

- After Repair Value$595,000

- Purchase Price$42,500

- Renovation Budget$429,147

- Loan TypeFix & Flip

Lawrenceville, GA

July 2025

Fix & Flip

Loan Amount

$435,260

After Repair Value$710,000

Purchase Price$62,500

Renovation Budget$397,760

Loan TypeFix & Flip

- After Repair Value$710,000

- Purchase Price$62,500

- Renovation Budget$397,760

- Loan TypeFix & Flip

Snellville, GA

June 2025

Fix & Flip

Loan Amount

$137,200

After Repair Value$231,000

Purchase Price$120,000

Renovation Budget$40,000

Loan TypeFix & Flip

- After Repair Value$231,000

- Purchase Price$120,000

- Renovation Budget$40,000

- Loan TypeFix & Flip

Albany, NY

June 2025

Fix & Flip

Loan Amount

$257,750

After Repair Value$410,000

Purchase Price$215,000

Renovation Budget$75,000

Loan TypeFix & Flip

- After Repair Value$410,000

- Purchase Price$215,000

- Renovation Budget$75,000

- Loan TypeFix & Flip

Albany, NY

June 2025

Residential Rental Program (Buy & Hold)

Loan Amount

$502,500

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Fitchburg, MA

June 2025

Fix & Flip

Loan Amount

$825,000

After Repair Value$1,100,000

Purchase Price$870,000

Renovation Budget$46,500

Loan TypeFix & Flip

- After Repair Value$1,100,000

- Purchase Price$870,000

- Renovation Budget$46,500

- Loan TypeFix & Flip

Suffolk County, NY

November 2021

Fix & Flip

Loan Amount

$209,300

After Repair Value$335,000

Purchase Price$130,000

Renovation Budget$105,300

Loan TypeFix & Flip

- After Repair Value$335,000

- Purchase Price$130,000

- Renovation Budget$105,300

- Loan TypeFix & Flip

Philidelphia, PA

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Commercial Property Loans

Commercial Property Loans

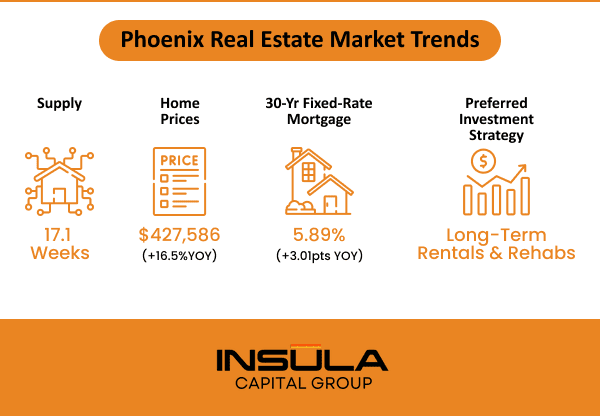

Phoenix: Is it a Seller’s or Buyer’s Market?

The real estate market in Phoenix presents favorable conditions for buyers and sellers.

However, it particularly shines as a seller’s market due to rising home prices driven by supply-demand dynamics.

With a limited inventory of houses for sale, the market is ripe for sellers to capitalize on high demand from house hunters.

As Spring approaches, more homeowners are expected to list their properties. The influx of new home listings has also attracted home shoppers who were previously hesitant to enter the market.

The increase in mortgage applications suggests that buyers are returning, including those who could not find affordable homes. This heightened demand for Phoenix houses positions sellers to dominate the market.

However, sellers may face competition from new construction homes, as builders have offered incentives to entice buyers.

Additionally, the market will see a surge in listings from new constructions, baby boomers looking to downsize, and motivated home sellers.

As a result, the inventory of properties for sale in Phoenix will increase, providing ample options for buyers across various preferences, whether it’s a condo or a single-family home.

Ready to set the stage for your prosperous real estate story in Phoenix, AZ? Contact us now!

Ready to apply for a Hard Money loan?

Frequently Asked Questions

Yes, hard money loans can be used for flipping projects. At Insula Capital Group, we offer multiple types of loan programs, including fix and flip financing. These loans can be used to purchase the initial property and cover its rehab costs.

Hard money lenders do not evaluate a borrower’s eligibility for a loan the same way banks or other traditional institutions do. We secure your loans against collateral; therefore, factors like your credit score and payment history play a minor role in the lending process.

To apply for a hard money loan in Phoenix, we suggest checking out our loan programs first and picking out the one that works best with your project type, its scope, and your financial situation. Once you know which hard money loan you’re applying for, fill out the application forms on our website, attach relevant documents, and submit it all online. Our team will get back to you once we’ve reviewed your application.

Achieve Real Estate Success with Hard Money Lenders in Phoenix, AZ

With its affordable housing market and year-round sunshine, Phoenix is full of promise and opportunities—make the most of these with Insula Capital Group!

With 30 years of experience, Insula Capital Group is easily one of the best choices as a hard money lender in Phoenix. Our extensive experience and expertise in the local market have given us an edge over the rest—an edge we can use to help you make the best investment decisions in Phoenix.

Our deep understanding of the unique dynamics and opportunities in Phoenix’s real estate landscape can make your investment successful because this knowledge allows us to offer customized financing solutions that align with your specific needs and financial situation.

With a strong focus on exceptional customer service, our team prioritizes clear communication, transparency, and responsiveness throughout the lending process. We’re your reliable partners to make your mark in Phoenix’s thriving real estate market!

Check out our just-funded projects to get inspired, and let’s get started!

If you have any more questions, feel free to contact the most cooperative private money lenders in Phoenix, AZ!