Private Money Lenders | Hard Money Loans in Rhode Island

One of the smallest yet most densely populated states, Rhode Island, is too industrialized for its size. This Ocean State has, therefore, become the hottest place for investors and developers alike. Every year, the state experiences a 13.3% rise in property valuation.

Don’t let the small size of this state fool you, and find distressed properties and ground-up ventures to grow your portfolio. Pick up your phone and call us to learn how our hard money lenders help you navigate the funding aspects of real estate investment in Rhode Island.

Why Choose Insula Capital Group?

Insula Capital Group empowers investors to benefit from profitable new construction, property flipping, and acquisition projects by offering speedy and convenient private money loans.

With our vast experience of 30 years collaborating with experienced private money lenders, we fully grasp the dynamic nature of Rhode Island’s real estate industry. This understanding equips us to offer our clients timely approvals, competitive rates, and tailored loan programs.

We guide investors in property investment endeavors of diverse nature, including new construction loans, fix & flip financing, multifamily/mixed-use loans, and residential rental loans.

To enjoy a stress-free loan process, fill out our prequalification form. If you need more information, explore our previously funded projects to witness the dreams we have helped bring to life.

Why Consider a Hard Money Loan for Real Estate Investments in Rhode Island

Speed of Funding

Time is of the essence in real estate transactions, and hard money lenders understand this urgency.

Unlike traditional lenders, which may take weeks or even months to approve and fund a loan, hard money lenders can provide financing in a matter of days.

We strive for rapid turnaround time so investors can seize time-sensitive opportunities, such as purchasing distressed properties at auction or closing on lucrative deals before competitors.

Flexible Approval Criteria

Traditional lenders typically rely heavily on the borrower’s creditworthiness and income stability when evaluating loan applications.

In contrast, hard money lenders at Insula Capital Group focus primarily on the value of the underlying property, making them more inclined to approve loans for investors with less-than-perfect credit or unconventional income sources.

This flexibility in approval criteria allows a broader range of investors to access financing for their real estate projects.

Collateral-Based Lending

Hard money loans are secured by the value of the property being purchased or renovated rather than the borrower’s credit history or income. This collateral-based lending approach mitigates risk for the lender and provides added security for investors.

Even if the borrower encounters financial difficulties, the lender can recoup their investment by foreclosing on the property and selling it to recover the outstanding loan balance.

Customizable Loan Terms

Our hard money lenders understand that every real estate investment project is unique, and they offer customizable loan terms to meet the specific needs of individual borrowers.

Whether you’re interested in new construction loans, fix & flip financing, multifamily mixed-use loans, or residential rental loans, our hard money lenders can tailor loan terms to align with your investment strategy and financial objectives.

Complete our online application now to streamline the capital you need to achieve your real estate investment goals.

Essential Market Insights For Rhode Islands

- Population: 177,994

- Current Median Home Price: $309156

- Annual Appreciation Rate: 6.0%

- Unemployment Rate: 6.3%

Rhode Islands Real Estate Landscape

177,994

Population

$309156

Current Median Home Price

6.0%

Annual Appreciation Rate

6.3%

Unemployment Rate

Just Funded Projects

February 2026

Fix & Flip

Loan Amount

$248,869

After Repair Value$409,000

Purchase Price$145,000

Renovation Budget$147,787

Loan TypeFix & Flip

- After Repair Value$409,000

- Purchase Price$145,000

- Renovation Budget$147,787

- Loan TypeFix & Flip

Decatur, GA

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

December 2025

Fix & Flip

Loan Amount

$171,250

After Repair Value$263,000

Purchase Price$125,000

Renovation Budget$65,000

Loan TypeFix & Flip

- After Repair Value$263,000

- Purchase Price$125,000

- Renovation Budget$65,000

- Loan TypeFix & Flip

Albany, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Why Invest in Rhode Island Real Estate

Rhode Island, the smallest state in the United States, may not be the first place that comes to mind when considering real estate investments. However, this hidden gem offers numerous advantages and opportunities for savvy investors.

Location and Accessibility

Rhode Island’s strategic location along the East Coast makes it highly accessible to major metropolitan areas such as Boston and New York City. Its proximity to these economic hubs enhances its appeal for commuters and businesses alike.

With well-connected transportation infrastructure including highways, railways, and airports, Rhode Island offers ease of travel and logistics, facilitating commerce and trade.

Strong Rental Market

Rhode Island’s rental market is buoyed by a steady demand for housing, driven in part by its large student population and workforce.

The presence of several colleges and universities, including Brown University and the University of Rhode Island, ensures a consistent demand for rental properties, making it an attractive option for buy-and-hold investors.

Potential for Appreciation

Rhode Island’s real estate market has shown resilience and steady appreciation over the years, offering investors the potential for long-term capital appreciation.

With careful research, due diligence, and strategic investment decisions, investors can capitalize on emerging neighborhoods, revitalization projects, and growth opportunities within the state.

Excited to make your real estate investment dreams come true? Contact us to capitalize on time-sensitive opportunities with our wide range of hard money loans.

Ready to apply for a Hard Money loan?

Get in touch with our experienced team for more details about our financing services.

Frequently Asked Questions

While prior real estate experience can give you an edge, it is not a stringent requirement when working with our private money lenders. Although having three projects in your name or some relevant experience is beneficial, we also prioritize other factors, such as the overall plan, the value of the collateral property, and exit strategy over income verification and credit history.

Our initial loan term is 12 months, but we can extend the term if the nature of your plan requires it.

Connect With Highly Rated Private Money Lenders in Rhode Island

Whether you’re an experienced investor or borrowing for the first time, the experienced team at Insula Capital Group offers guidance to everyone in making well-informed financial decisions. We will assess your funding needs and tailor hard money loans accordingly.

Our no prepayment penalties and hidden fees policies are reflective of our transparent approach. You can expect premium customer service, speedy approvals, better rates, minimal paperwork, and low interest rates, among other benefits.

Don’t let financial constraints hinder your investment dreams! Partner with Insula Capital Group today to jumpstart your venture. Apply now by filling out our user-friendly online application.

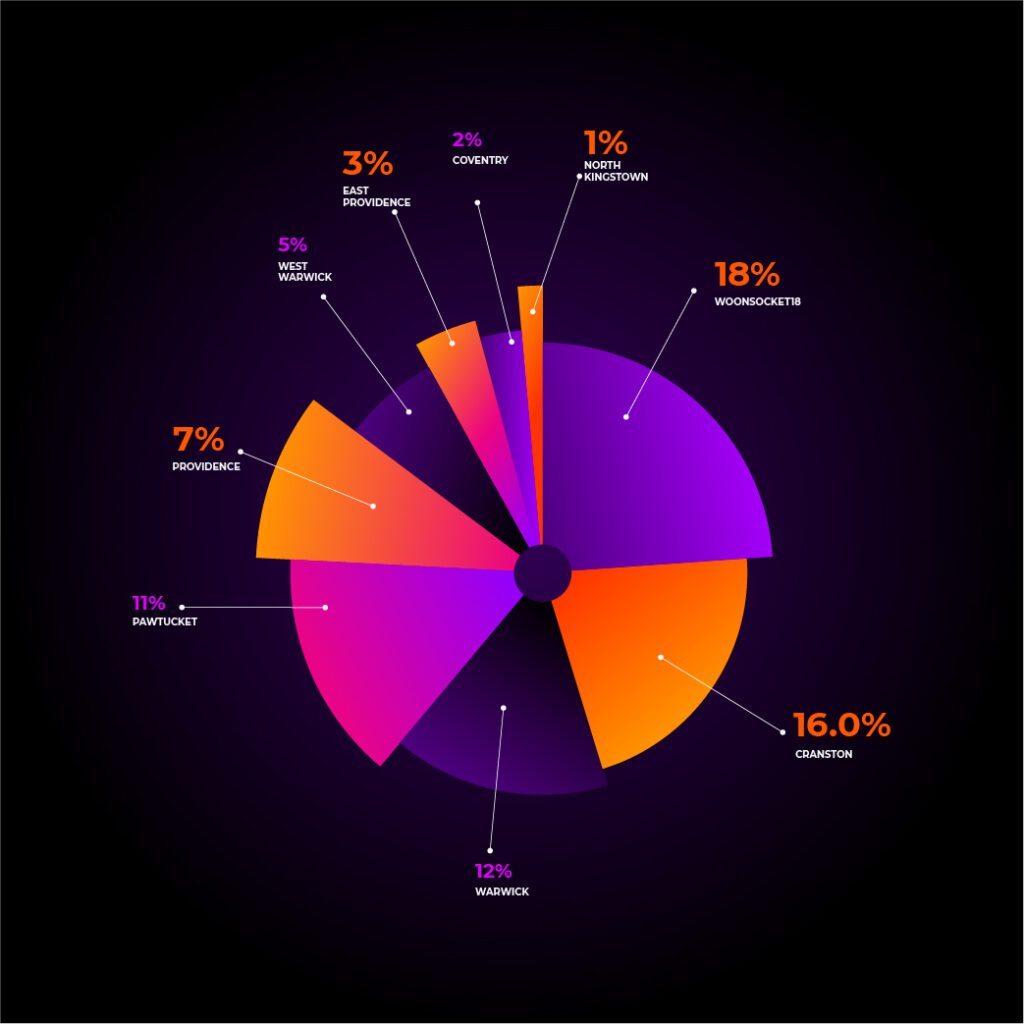

Top Hard Money Lenders Loan Cities in Rhode Island

Get Quick Loan Approvals from Insula Capital Group

Whether you’re a seasoned investor or a first-time buyer, a hard money loan can provide the financial boost needed to capitalize on these opportunities. With the ability to close deals quickly, you’ll gain a competitive edge and seize profitable investments that may not be available with conventional financing.

Start applying by completing our online application form at your convenience! You can go through our FAQs and just-funded projects to learn more about our tailored lending services.