Private Money Lenders | Hard Money Loans in Texas

At Insula Capital Group, we understand that real estate investments often require swift and flexible financing solutions. As seasoned hard money lenders in Texas, we specialize in providing quick and reliable funding to real estate investors, developers, and business owners looking to capitalize on lucrative opportunities in the Lone Star State.

Whether your ambitions lie in the bustling cities of Houston, San Antonio, Dallas, Austin, or Fort Worth, we’re your reliable financial partner, ready to back your projects with our versatile hard money loan programs.

Insula Capital Group understands the urgency and unique requirements of real estate investments in bustling states like Texas. Our streamlined processes ensure that you can seize time-sensitive opportunities without unnecessary delays.

Recognizing the diverse needs of our clients, we offer a range of flexible loan programs tailored to different real estate projects.

Whether you’re engaging in a fix-and-flip, ground-up construction, residential rental, or seeking funds for a multifamily/mixed-use investment, we have a deep understanding of how each type of hard money loan works and can guide you through successful financial transactions.

Why Are Hard Money Loans The Best Way To Finance Real Estate Projects in Texas

Hard money loans are an ideal financing option for real estate projects in Texas due to their quick approval process, flexibility, and asset-based lending nature.

These loans provide rapid access to capital, enabling investors to capitalize on time-sensitive opportunities in the fast-paced Texas real estate market.

With customizable terms and a focus on the property’s value rather than credit history, our hard money lenders act as collaborative partners, often leveraging their local market knowledge.

The versatility of hard money loans extends to distressed properties, making them an effective choice for investors navigating the dynamic Texas real estate market.

Contact us today to discuss customized loan programs, quick approvals, and flexible terms tailored to your unique project needs.

Ready to apply for a Hard Money loan?

Get in touch with our experienced team for more details about our financing services.

Insights For Investing in the Real Estate Market of the Lone Star State

- Median Home Value: $230,024

- 1-Year Appreciation Rate: +5.8%

- Median Home Value Forecast: +10.0%

- Median Rent Price: $1,585

- Price-To-Rent Ratio: 11.5

- Average Days On Market: 52

- Population: 28,701,845

- Foreclosure Rate: 1 in every 16,325 (0.6%)

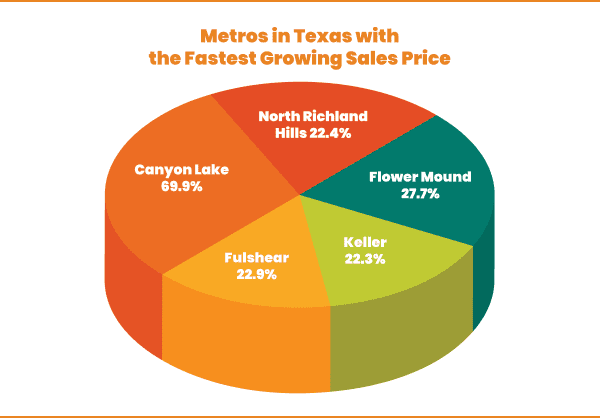

Metros in Texas with the Fastest Growing Sales Price

Just Funded Projects

February 2026

Fix & Flip

Loan Amount

$248,869

After Repair Value$409,000

Purchase Price$145,000

Renovation Budget$147,787

Loan TypeFix & Flip

- After Repair Value$409,000

- Purchase Price$145,000

- Renovation Budget$147,787

- Loan TypeFix & Flip

Decatur, GA

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

December 2025

Fix & Flip

Loan Amount

$171,250

After Repair Value$263,000

Purchase Price$125,000

Renovation Budget$65,000

Loan TypeFix & Flip

- After Repair Value$263,000

- Purchase Price$125,000

- Renovation Budget$65,000

- Loan TypeFix & Flip

Albany, NY

Testimonials

What Our Client Say

Just completed my mortgage refi with Insula, and I couldn’t be happier! Bruce, my lender, was absolutely fantastic—professional, responsive, and made the entire process smooth and stress-free. Highly recommend Insula and Bruce for anyone looking to refinance!

Beothie Josue

Sherryl Delisser

Richard Legemah

Brett Riggins

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Texas Housing Market Predictions

The Texas housing market is poised for continued growth and resilience, according to predictions for the upcoming year.

The state’s booming economy, population influx, and diverse job opportunities contribute to sustained demand for real estate.

While inventory challenges persist, particularly in major metropolitan areas, the scarcity is expected to drive property values higher.

Urban centers such as Austin, Dallas, and Houston are anticipated to experience robust growth fueled by technology-driven job markets and corporate relocations.

Suburban areas are also expected to flourish as remote work trends persist, prompting homebuyers to seek spacious and affordable options outside city limits.

Interest rates remain relatively low, further incentivizing home purchases, but affordability concerns may intensify.

The Texas housing market predictions align with a positive outlook, making it an opportune time for those considering buying or investing in real estate in the state.

If you aspire to join the flourishing real estate market in Texas, we suggest nudging our team to learn more about hard money loan options available for those looking to swiftly acquire their desired property.

Ready to apply for a Hard Money loan?

Frequently Asked Questions

At Insula Capital Group, we’re more than just a lending institution. We form partnerships with our clients, offering guidance, resources, and personalized hard money loan solutions to fuel their real estate success.

Our commitment to fair and borrower-friendly terms means you can pay off your loan early without worrying about additional charges. We value your financial success and offer a hassle-free experience with no hidden fees for responsible and prompt loan repayments.

Our hard money loans are designed to support investment in a variety of non-owner occupied properties, including but not limited to fix and flip projects, new constructions, residential rentals, and multifamily properties.

Applying for a hard money loan in Texas with Insula Capital Group involves a very straightforward process.

You will start by completing the online application form. Once submitted, the application will be reviewed by our loan experts, who will then reach out to you for a detailed consultation. Our representatives will help you choose a loan program that aligns with your financial goals and will work on tailoring the contract for you.

Once the consultation is complete, we’ll quickly process the loan so that you have access to the funds you need without any delays.

Insula Capital Group is committed to providing fast financing solutions. Once your application is received, we strive to expedite the approval process so you can swiftly proceed with your real estate project.

Top Hard Money Lenders Loan Cities in Texas

Kickstart Your Texas Real Estate Journey with Insula Capital Group Today

Stepping into Texas’s real estate landscape with Insula Capital Group means fostering a partnership with a dedicated private money lender committed to facilitating your success across Texas’s diverse cities. Discover a new realm of possibilities by browsing our recently funded projects.

Begin your remarkable real estate journey today by filling out our prequalification form. Ready to dive right in? Complete our full loan application to jumpstart your Texas real estate endeavor. For any questions or additional information, do not hesitate to schedule a consultation with our dedicated team.

Let Insula Capital Group be your trusted companion in your Texas real estate venture.