Private Money Lenders | Hard Money Loans in Washington

Washington is home to a thriving real estate market, with numerous opportunities for investors and developers. Whether you’re looking to purchase a residential property, invest in commercial real estate, or undertake a development project, the Washington real estate market offers endless possibilities for growth and profitability.

If you’re in need of financing for your real estate ventures, working with a hard money lender like Insula Capital Group is the way to go. Check out our loan programs to see how we can help you achieve your real estate goals.

Personalized Loans Tailored to Your Needs in Washington

At Insula Capital Group, we understand that each real estate project is unique and requires a customized financing solution. Our private money lenders take pride in offering personalized loan options tailored to your specific needs in the Washington area. Our extensive network of investors and lenders allows us to provide flexible loan terms, quick approval processes, and competitive interest rates.

You don’t have to go through the hassle of dealing with traditional banks and their strict lending criteria. The loan terms at Insula Capital Group are designed with flexibility in mind, allowing you to obtain the financing you need when you need it.

We offer fix and flip loans, residential rentals, multifamily mixed-use loans, and new construction loans to meet a variety of real estate investment needs.

The Advantages of Hard Money Loans

At Insula Capital Group, we understand the unique needs of real estate investors and the importance of having access to swift, reliable financing. Our hard money loans are crafted to provide you with a competitive edge in the fast-paced real estate market.

Here’s how partnering with us can benefit your investment strategy:

Rapid Funding to Seize Opportunities: Regarding real estate investment, timing is often the difference between securing a profitable deal and missing out. Our hard money loans are designed for quick approval and funding, ensuring you have the capital needed to act swiftly on investment opportunities.

Flexibility for Diverse Projects: We recognize that every real estate project has its own set of challenges and requirements. That’s why our loans are flexible and tailored to support a range of investment endeavors, from property flips and renovations to the acquisition of investment properties. This adaptability allows us to meet your specific financial needs, facilitating the success of your project.

Accessible Financing Solutions: Our approach centers on the value of the real estate asset rather than solely on credit history. This focus enables us to provide financing options to a broader spectrum of investors, including those who might not qualify for traditional loans due to credit challenges or the unconventional nature of their projects.

Streamlined Application Process: We value your time and investment goals, which is why our online application and approval processes are straightforward and efficient. By concentrating on the collateral—your investment property—we simplify the lending process, enabling a faster turnaround from application to funding.

Commitment to Your Success: At Insula Capital Group, your success is our priority. We’re more than just lenders; we’re your partners in real estate investment. Our team is dedicated to providing you with the financial support and expertise needed to maximize your investment’s profitability and potential.

By choosing Insula Capital Group as your hard money lending partner, you’re not just securing financing but gaining a dedicated ally committed to your real estate investment success. Explore how our hard money loans can empower your next investment project and take the first step toward realizing your real estate goals.

Ready to apply for a Hard Money loan?

Get in touch with our experienced team for more details about our financing services.

Washington’s Real Estate Market: Insights for 2024

Washington’s real estate market is poised for a year of nuanced shifts and opportunities, especially for those considering hard money lending as a strategic investment.

The market’s resilience, underscored by its robust economic underpinnings and demographic trends, presents a fertile ground for real estate investment and financing.

Market Outlook for 2024:

The Washington real estate market is expected to continue its trend of stability and gradual growth. Notable predictions for 2024 include a slight increase in home values, sustained by Washington’s tight inventory and the balance between supply and demand.

The state’s economic strengths, particularly in tech and global trade, and its natural beauty and quality of life, continue attracting residents and sustaining demand.

Is Washington a Buyer’s or Seller’s Market?

The current conditions lean toward a seller’s market, largely due to the rapid pace of sales and a median sale-to-list ratio of 1.000. However, with mortgage rates expected to stabilize and an anticipated increase in inventory, potential buyers may find more opportunities in the latter half of 2024.

Washington’s real estate market is shaping up to be dynamic, with foundational strength that offers both challenges and opportunities for investors and lenders. Staying informed on regional variations and broader economic trends will be key to navigating this landscape successfully.

Key Market Dynamics and Indicators:

- Average Home Value:$579,575

- Median Sale Price:$618,000

- 1-YearAppreciation Rate:-5.2%

- Median Days On Market:12

- Homes For Sale:21,067

- Homes Sold Above List Price:4%

- New Listings:10,519

- Months Of Supply:1

- Foreclosure Rate:One in every 10,971 households

- Population:7,785,786

- Median Household Income:$82,400

- Unemployment Rate:1%

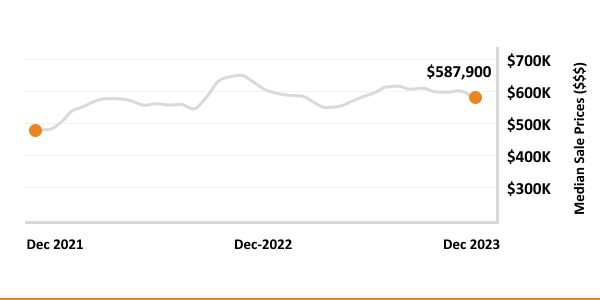

- Stable Home Values with Marginal Increases: The average home value in Washington as of late 2023 stands at $566,052, with a slight uptick of 0.1% over the previous year, suggesting a stable market environment.

- Competitive Sales Environment:Homes in Washington are moving quickly, with properties going pending in an average of just 17 days, indicating a highly competitive market.

- Inventory and Listings:The market features a substantial inventory of 17,680 homes for sale, with 5,550 new listings as of November 2023, showcasing a dynamic and active real estate landscape.

- Median Sale and List Price:The median sale price reached $550,000 by October 2023, with the median list price slightly higher at $589,833 as of November 2023, reflecting the market’s competitiveness.

- Sales Over List Price:A significant portion of sales, 33.7%, were over the list price in October 2023, while 42.0% were under, highlighting a balanced yet competitive buyer and seller dynamic.

Washington house fliping statistic

7,785,786

Population

$618,000

Median Sale Price

$579,575

Average Home Price

5.2%

1-Year Appreciation Rate

$82,400

Median Household Income

10,519

New Listings

Just Funded Projects

February 2026

Fix & Flip

Loan Amount

$248,869

After Repair Value$409,000

Purchase Price$145,000

Renovation Budget$147,787

Loan TypeFix & Flip

- After Repair Value$409,000

- Purchase Price$145,000

- Renovation Budget$147,787

- Loan TypeFix & Flip

Decatur, GA

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

December 2025

Fix & Flip

Loan Amount

$171,250

After Repair Value$263,000

Purchase Price$125,000

Renovation Budget$65,000

Loan TypeFix & Flip

- After Repair Value$263,000

- Purchase Price$125,000

- Renovation Budget$65,000

- Loan TypeFix & Flip

Albany, NY

Testimonials

What Our Client Say

Just completed my mortgage refi with Insula, and I couldn’t be happier! Bruce, my lender, was absolutely fantastic—professional, responsive, and made the entire process smooth and stress-free. Highly recommend Insula and Bruce for anyone looking to refinance!

Beothie Josue

Sherryl Delisser

Richard Legemah

Brett Riggins

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Why Washington Is a Prime Market for Real Estate Investment

Washington’s real estate market continues to exhibit robust growth and stability, making it a prime target for investment. Several factors contribute to its appeal:

- Diverse and Growing Economy: Washington’s economy thrives on a mix of traditional industries and modern sectors, including technology, aerospace, and agriculture, fostering a stable job market and driving demand for housing.

- Quality of Life: The state’s natural beauty, combined with vibrant urban centers like Seattle, offers an attractive lifestyle that continues to draw people from across the nation. This influx supports a strong demand for residential properties.

- Strategic Location: As a gateway to the Pacific Rim, Washington plays a crucial role in international trade, enhancing its commercial real estate sector. The state’s ports and technological infrastructure make it a strategic location for businesses and investors alike.

Insights into Washington’s Housing Market

- Stable Home Prices with Growth Potential:While the average home value in Washington has seen a marginal increase, the real estate landscape remains competitive, with homes going pending in just 17 days on average. This rapid turnover indicates a seller’s market, with a robust demand for homes.

- Competitive Sales Environment: The median sale price in Washington stands at $550,000, with a sale-to-list price ratio of 99.60%, showing that homes sell close to their asking prices. This competitiveness is further underscored by the fact that 33.7% of sales were over the list price, highlighting the demand in the market.

- Rental Market Diversity:The rental market in Washington offers a range of prices, reflecting the state’s economic and geographic diversity. This variation presents numerous opportunities for investors in the rental sector.

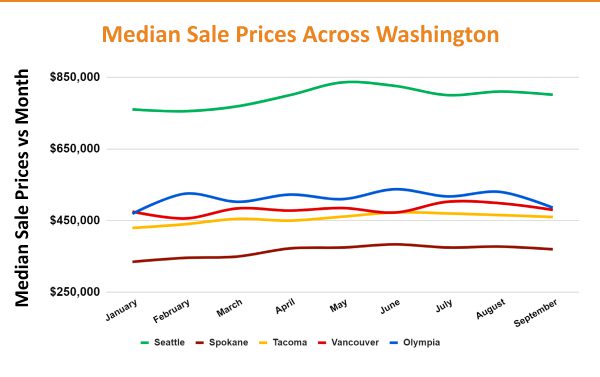

- Regional Market Variances:Washington’s real estate market is characterized by regional variances, with areas like Seattle showing signs of a seller’s market due to high demand and limited inventory. The city’s median listing home price stands at $798,000, with properties selling at approximately the asking price, emphasizing the market’s strength.

Washington’s real estate market offers a compelling mix of stability, growth potential, and investment opportunities. Whether looking to invest in residential properties or commercial real estate, Washington presents a dynamic market with the promise of long-term gains.

Ready to apply for a Hard Money loan?

Frequently Asked Questions

While our hard money loans are often associated with experienced investors, they are not exclusive to them. Our private money lenders are dedicated to helping both experienced and new investors in the Washington area. We assess each borrower’s situation and evaluate their potential for success rather than solely focusing on their experience level.

Hard money loans from Insula Capital Group typically have loan terms of 12 months but can be extended further depending on the project and borrower’s needs.

Insula Capital Group primarily offers hard money loans for investment purposes, focusing on properties intended for renovation, resale, or rental. Our loans are designed for non-owner-occupied real estate investments. If you’re looking to finance a primary residence, you might need to explore our other financing options that are more suited to residential home purchases.

Top Hard Money Lenders Loan Cities in Washington

Connect With Us Now!

Contact our private money lenders now to discuss your real estate financing needs in Washington. You can also start the application process online by filling out our simple form.

Don’t forget to check out our just-funded projects to see the successful real estate ventures that Insula Capital Group has helped fund. With our personalized loans, you are one step closer to achieving your real estate goals!

Your real estate journey is ready for takeoff, and Insula Capital Group is here to navigate you to new heights. Let’s turn those investment dreams into reality, one property at a time!