New Construction Loans in Los Angeles, CA

Are you having trouble managing the finances of your construction project? Our team can provide the financial solutions you need. We’ll assess your financial condition and promptly provide a customized construction loan deal.

Learn more about our new construction financing services in Los Angeles, CA.

New Hampshire: A Picturesque Paradise for Homeowners and Investors Alike

The Importance Of New Construction Financing For Property Developers And Homeowners In Los Angeles

If you are looking for a way to finance your construction project, there are many different options available to you. You can either spend a lifetime trying to get bank loan approvals or use the seamless hard money construction loan process to start your project quickly.

Hard money loans are one of the most popular forms of commercial financing because they offer borrowers an opportunity to obtain funding quickly and with less risk than traditional financing options.

Insula Capital Groups Offers Top-Notch Construction Loan Deals In Los Angeles

When it comes to hard money construction financing in Los Angeles, there’s no better team than Insula Capital Group. We have the expertise to help you get the financing you need for your next construction project and ensure a smooth and efficient lending process.

We can help with all aspects of your project, like evaluating its feasibility, structuring a loan, and securing the funding—we’ll work with you every step of the way to ensure the process goes off without a hitch.

Here are some of our loan features that set us apart from inexperienced private lenders:

- No junk fees

- Simplified process

- Fast loan approvals

- No pre-payment penalties

- One-year loan term

Reach out to us for more information about our loan deals, or visit our website to find out more about our previous new construction deals.

Ready to apply for a New Construction loan?

Get in touch with our experienced team for more details about our financing services.

Key Statistics and Forecasts for Los Angeles’s Housing Market

Los Angeles’s real estate market is a testament to the city’s enduring appeal, combining a strong economy with a vibrant cultural milieu. The city’s wide-ranging neighborhoods and ongoing economic growth contribute to a dynamic housing landscape, making it a key real estate investment and homeownership market.

Key Statistics for Understanding the Market:

- Average Annual Household Income:$106,931

- Price-To-Rent Ratio:25

- Unemployment Rate:2% (latest estimate by the Bureau Of Labor Statistics)

- Median Home Value:The average home value in Los Angeles-Long Beach-Anaheim is significant at $901,342, marking a 5.0% increase over the past year.

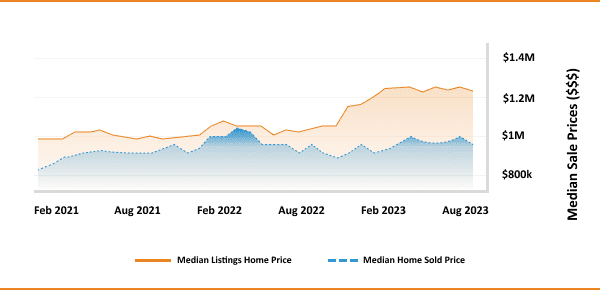

- Median Listing Home Price:As of December 2023, the median listing home price in Los Angeles was $1.2M, which represents a 16.1% increase year-over-year.

- Median Listing Home Price/Sq ft:The median listing price per square foot stood at $720.

- Median Sold Home Price:The median sold home price was $949.5K.

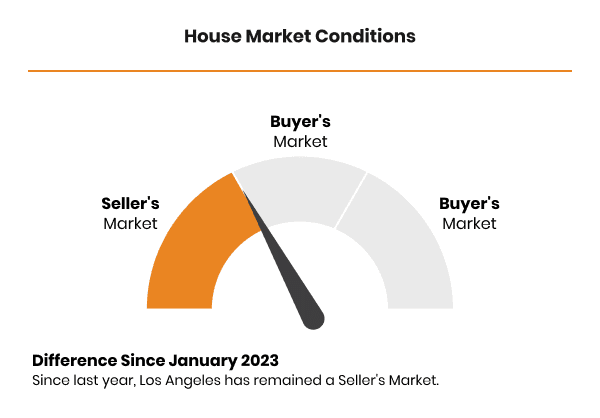

- Market Dynamics:The Los Angeles housing market is characterized as balanced, with the supply and demand of homes being about the same.

- Average Days on Market:Homes in Los Angeles sold after an average of 65 days on the market.

- Rental Market Insights:The rental market in Los Angeles is diverse, with varying prices across different neighborhoods. For instance, Santa Monica and Beverly Hills are among the most expensive cities for rentals.

Forecast and Market Trends:

- Market Forecast:The 1-year market forecast until December 31, 2023, suggests a growth of +0.7%. This indicates a market poised for gradual growth without any imminent signs of a housing market crash.

- Housing Supply Data: The months’ supply of inventory for Los Angeles County is 2.6 months, indicating a market that still sees upward pressure on home prices due to limited supply.

- Seller’s Market:The real estate market in Los Angeles County was a seller’s market in December 2023, with homes being sold for approximately the asking price.

Neighborhood Highlights:

Popular Neighborhoods: Some of the best neighborhoods in or around Los Angeles include Hollywood Hills West, Westwood, and Brentwood, each offering unique living experiences and investment opportunities.

The Real Estate Landscape In Los Angeles

3,979,576

Population

$1.2M

Average Home Price

$949.5K

Median Home Sold Price

+15.9%

1-Year Appreciation Rate

$69,778

Median Household Income

8,555 (-39.3% year over year)

Active Listings

Just Funded Projects

February 2026

Fix & Flip

Loan Amount

$248,869

After Repair Value$409,000

Purchase Price$145,000

Renovation Budget$147,787

Loan TypeFix & Flip

- After Repair Value$409,000

- Purchase Price$145,000

- Renovation Budget$147,787

- Loan TypeFix & Flip

Decatur, GA

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

December 2025

Fix & Flip

Loan Amount

$171,250

After Repair Value$263,000

Purchase Price$125,000

Renovation Budget$65,000

Loan TypeFix & Flip

- After Repair Value$263,000

- Purchase Price$125,000

- Renovation Budget$65,000

- Loan TypeFix & Flip

Albany, NY

Testimonials

What Our Client Say

Just completed my mortgage refi with Insula, and I couldn’t be happier! Bruce, my lender, was absolutely fantastic—professional, responsive, and made the entire process smooth and stress-free. Highly recommend Insula and Bruce for anyone looking to refinance!

Beothie Josue

Sherryl Delisser

Richard Legemah

Brett Riggins

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Why Invest in Los Angeles’s Real Estate Market?

Investing in Los Angeles’s real estate market opens doors to a world of opportunities, melded with a robust economic base and a rich cultural fabric. This city, known for its iconic status in entertainment, technology, and fashion, continues to attract investors and new residents alike.

Economic Growth and Diverse Opportunities:

Los Angeles stands as a powerhouse in various economic sectors, including entertainment, technology, fashion, and more. This economic vigor underpins a constant demand for residential and commercial real estate. The city’s job market is a magnet for professionals across diverse fields, bolstering the housing demand significantly.

Rising Home Values:

The Los Angeles real estate market is notably advantageous for sellers, with an upward trend in home values. The median home price in Los Angeles has been on the rise, reflecting a positive growth trajectory. This trend of increasing home values, expected to persist, offers fertile ground for investors looking for growth and stability in their investments.

Diverse and Dynamic Neighborhoods:

Los Angeles is a mosaic of diverse neighborhoods offering unique investment opportunities. From the luxurious enclaves of Beverly Hills to the eclectic streets of Venice Beach, every area presents a distinct character. Neighborhoods like Silver Lake and Echo Park are celebrated for their artistic vibe and burgeoning food scenes, attracting a mix of residential and commercial investors.

The Allure of the LA Lifestyle:

Los Angeles’s lifestyle is a significant attractor. Known for its iconic landmarks, bustling nightlife, and diverse cultural offerings, the city provides an unmatched living experience. Its blend of urban sophistication and beachside relaxation contributes to the city’s appeal, ensuring a steady flow of new residents and a robust rental market.

Long-Term Investment Prospects:

Investing in Los Angeles’s real estate is about immediate returns and long-term growth potential. The city’s continuous development, economic resilience, and lifestyle desirability assure sustained demand for housing.

With its mix of economic vitality, cultural richness, and lifestyle allure, Los Angeles presents itself as an ideal destination for immediate and long-term real estate investments. The city’s real estate market, reflecting its global appeal, offers diverse opportunities for investors to grow their portfolios.

Ready to apply for a New Construction loan?

Frequently Asked Questions

At Insula Capital Group, we focus more on the potential of the real estate project rather than solely on the credit score. While credit scores are considered, we offer flexible terms to accommodate a range of financial profiles. Contact us directly to discuss how your credit score might impact your loan options.

Once you apply for a new construction loan using our online application form, our team will examine your loan application and provide approval within twenty-four hours. This quick turnaround time helps you move forward with your real estate projects without unnecessary delays.

You can finance your projects by using our loan options, including new construction loans, fix & flip loans, residential rental programs, and multifamily mixed-use loans. Each loan is designed to cater to specific needs, ensuring you find the right financial support for your project.

Connect With a Renowned Hard Money Lender!

Can’t find a reliable private money lender in Los Angeles? You’ve come to the right place! Our team has been working with real estate clients for over thirty years, and we have the expertise to solve your financial problems. Our team will thoroughly work with you to provide excellent loan deals that meet your project requirements and budget.

If you’re interested in learning more about how we can help you get started on an exciting new construction project, or if you want more information about our financing services, contact us today!