New Construction Loans in San Diego, CA

Finding the correct construction loan deal can be tricky if you don’t connect with an experienced hard money lender. Our team understands the significance of hard money financing, and we can help you finance your construction projects in no time.

Learn more about our new construction loan deals in San Diego, CA.

Get in Touch

Why Are Hard Money Construction Loans the Best Option for Your Projects?

A hard money construction loan is an excellent way to get the funding you require for your project. It’s a flexible, short-term loan that you can use to fund almost any kind of construction project. You don’t have to wait for traditional bank loans, as you can immediately get the cash you need with our hard money construction financing.

Get Rid Of Your Financial Problems With Our New Construction Loans In San Diego, CA

Is your construction project going over budget, and you don’t know how to finance it? If so, our team can assist you efficiently. We offer exceptional construction loan deals with competitive interest rates, flexible terms, and no junk fees.

Our loans have no pre-payment penalties, which can help you repay the loan easily. Our team will analyze your construction plan and guide you to financing options. We’ll create a customized loan deal to help you get the financing you need.

As a private hard money lender, we strive to make the lending process easier for our clients. This is why we require minimal documentation, and our underwriting team ensures your loan deal is approved as soon as possible.

Get in touch with us for more details.

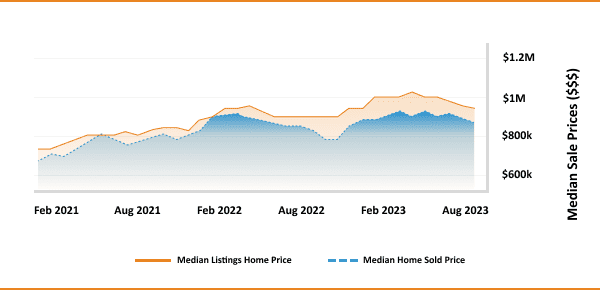

Key Statistics and Forecasts for San Diego’s Housing Market

San Diego’s real estate markets showcase a unique combination of vitality and resilience, making it an attractive environment for both buyers and sellers. The city’s vibrant culture and strong economic foundations contribute to a dynamic real estate landscape.

Here are some key statistics and forecasts to consider:

- Median Home Value: $891,746

- Median List Price: $849,667 (+4.4% year over year)

- 1-Year Appreciation Rate: 23.2%

- Median Home Value (1-Year Forecast): 16.4%

- Weeks Of Supply: 3.9 (-1.8 year over year)

- New Listings: 500.6 (-18.6% year over year)

- Active Listings: 1,992 (-42.5% year over year)

- Homes Sold: 553.7 (-10.7% year over year)

- Median Days On Market: 12 (-2.5 year over year)

- Median Rent: $2,745 (+14.8% year over year)

- Price-to-rent ratio: 25.32

- Unemployment Rate: 4.2% (latest estimate by the Bureau Of Labor Statistics)

- Population: 3,338,330 (latest estimate by the U.S. Census Bureau)

- Median Household Income: $78,980 (latest estimate by the U.S. Census Bureau)

The Real Estate Landscape In San Diego

3,338,330

Population

$960,202

Average Home Price

$891,167

Median Sale Price

23.2%

1-Year Appreciation Rate

$78,980

Median Household Income

1,992 (-42.5% year over year)

Price-To-Rent Ratio

Just Funded Projects

February 2026

Fix & Flip

Loan Amount

$248,869

After Repair Value$409,000

Purchase Price$145,000

Renovation Budget$147,787

Loan TypeFix & Flip

- After Repair Value$409,000

- Purchase Price$145,000

- Renovation Budget$147,787

- Loan TypeFix & Flip

Decatur, GA

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

December 2025

Fix & Flip

Loan Amount

$171,250

After Repair Value$263,000

Purchase Price$125,000

Renovation Budget$65,000

Loan TypeFix & Flip

- After Repair Value$263,000

- Purchase Price$125,000

- Renovation Budget$65,000

- Loan TypeFix & Flip

Albany, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Why Invest in San Diego’s Real Estate Market?

San Diego’s real estate market presents a striking opportunity for investment, combining solid economic growth with a vibrant cultural backdrop. This unique mix draws investors and new residents to this coastal city.

Economic Growth and Diverse Opportunities:

San Diego’s economy is strong and varied, anchored by sectors like biotechnology, military, and tourism. This economic diversity fuels a consistent demand for both residential and commercial real estate. The city’s job market attracts professionals, particularly in innovative and high-tech industries, further bolstering the housing demand.

Increasing Home Values:

The San Diego real estate market is particularly favorable for sellers, with a noticeable uptick in home values. As of late 2023, the median home price in San Diego stood at $939.1K, showing a year-over-year increase. This growth trend is expected to continue into 2024, providing a robust market for potential investors.

A Market of Vibrant Neighborhoods:

San Diego’s various neighborhoods offer a plethora of investment opportunities. Each area has its unique appeal, from the beachfront properties of La Jolla to the historic charm of the Gaslamp Quarter. For example, the North Park and Hillcrest areas are known for their lively dining and entertainment scenes, making them attractive for residential and commercial investments.

The Appeal of San Diego’s Lifestyle:

The city’s lifestyle is a significant draw. Known for its beautiful beaches, year-round pleasant weather, and outdoor activities, San Diego offers an enviable quality of life. This desirability supports a steady influx of new residents and maintains a strong rental market.

Long-Term Investment Potential:

Investing in San Diego’s real estate offers immediate gains and long-term growth potential. The city’s ongoing development, economic stability, and lifestyle appeal ensure a sustained demand for housing.

San Diego represents a compelling investment destination. Its blend of economic strength, cultural richness, and lifestyle appeal makes it an ideal market for both immediate and long-term real estate investments.

Ready to apply for a fix & flip loan?

Frequently Asked Questions

To secure a new construction loan in San Diego, CA, fill out our online full application form. Our team will review your application and provide a swift response, streamlining your journey toward successful project funding.

As an experienced private hard money lender, we offer a variety of hard money financing options to meet diverse investment needs. Our loan offerings include:

- Fix & flip loans,

- Residential rental programs,

- Multifamily mixed-use loans

- New construction loans

Additionally, we provide customized loan solutions tailored to unique project requirements and investment strategies.

At Insula Capital Group, we finance a broad spectrum of real estate projects. Our portfolio includes construction, fix & flip, and various other investment projects. We specialize in providing financial solutions for both short-term and long-term real estate investments. To discover the full range of our financing services and how they can benefit your specific project, visit our website.

Find Out How We Can Guide You!

At Insula Capital Group, we understand how difficult it can be for you to obtain a construction loan from your local bank, especially if you are looking for funding for your business or home renovation project.

That’s why we offer hard money loans that can help you achieve your goals without having to rely on conventional financing sources that may not be able to provide the same level of service. With over thirty years of experience in the real estate lending industry, we can help you finance a wide range of construction projects in San Diego, CA. We’ve helped countless homeowners and businesses get their construction projects up and running through our financial services.

Reach out to us for more details about our construction financing services in San Diego.