Single Family Rental Loans in California

California’s booming real estate market offers a wealth of opportunities for investors looking to purchase single-family rental properties. Whether you’re planning to acquire new rental properties, refinance an existing portfolio, or fund renovations, Insula Capital Group provides tailored single-family rental financing designed to meet your specific needs.

Our experienced team understands the unique landscape of California’s real estate market. From local regulations to property values and market trends, we leverage our knowledge to offer competitive financing solutions that align with your investment goals. Whether you are a seasoned investor or just starting out, our customized single-family rental loans can help you unlock new opportunities in the Golden State’s dynamic rental market.

As leading single-family rental loan lenders in California, we pride ourselves on offering flexible terms and competitive rates that can help you scale your rental property portfolio.

Get in Touch

Choose Experienced Single Family Rental Loan Lenders in California

Navigating the complex world of real estate financing requires partnering with a lender who understands both the local market and your specific investment goals. Insula Capital Group is proud to be one of the top single-family rental loan lenders in California, offering a wealth of experience and expertise in this space.

Our team is well-versed in the nuances of California’s real estate regulations and market trends. We work diligently to source the best possible single-family rental loans, negotiating favorable terms and providing personalized advice. Whether you are buying your first rental property or expanding an existing portfolio, we ensure that you have access to flexible, competitive financing that suits your needs.

At Insula Capital Group, we take pride in our hands-on approach, walking our clients through every step of the process to secure the best possible single-family rental mortgage. We are committed to your success and will work closely with you to tailor a loan that aligns with your financial goals.

The Benefits of Single Family Rental Loans in California

Investing in rental properties in California requires access to the right financial tools. With the right single-family rental loans in California, you can capitalize on the state’s thriving rental market and position yourself for long-term success.

Flexible Financing Options

Unlike traditional mortgage lenders, Insula Capital Group offers highly flexible terms for single-family rental financing. We work with you to develop loan terms that fit your specific investment strategy, whether you are seeking long-term financing or a short-term fix.

Streamlined Process and Fast Approvals

Our streamlined process means faster approvals and funding for your rental property projects. This is crucial in California’s fast-paced real estate market, where timing can make all the difference in securing the right property.

Competitive Rates

As trusted single-family rental loan lenders, we offer competitive rates that help you save on financing costs. This allows you to maximize the profitability of your rental properties while minimizing expenses.

Personalized Approach

At Insula Capital Group, we understand that every investor has unique needs. Our personalized approach to single-family rental property loans ensures that you receive financing that is tailored to your goals and the specifics of the California real estate market.

Ready to explore the opportunities provided by single-family rental mortgage financing? Contact us today to discuss your next steps.

Insights into Single Family Rentals in California

Before diving into the California rental property market, it’s important to understand the current landscape for investors:

- Median rental rates in California: $2,800 per month

- Average interest rate on single-family rental mortgages: 6.04%

- Average rental property ROI: 6.1%

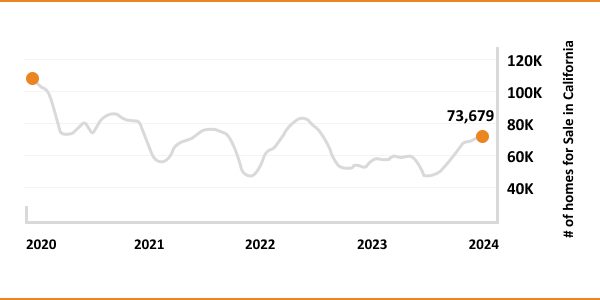

Single Family Rentals Statistics in California

$2600

Median Rent Price Per Month

$888,740

Median Single Family Home Price

$137,047

Median Small Business Owner Income

32.2

Price-To-Rent Ratio

Just Funded Projects

July 2025

Fix & Flip

Loan Amount

$1,456,100

After Repair Value$2,700,000

Purchase Price$1,200,000

Renovation Budget$376,100

Loan TypeFix & Flip

- After Repair Value$2,700,000

- Purchase Price$1,200,000

- Renovation Budget$376,100

- Loan TypeFix & Flip

Destin, FL

July 2025

Fix & Flip

Loan Amount

$400,899

After Repair Value$595,000

Purchase Price$42,500

Renovation Budget$429,147

Loan TypeFix & Flip

- After Repair Value$595,000

- Purchase Price$42,500

- Renovation Budget$429,147

- Loan TypeFix & Flip

Lawrenceville, GA

July 2025

Fix & Flip

Loan Amount

$435,260

After Repair Value$710,000

Purchase Price$62,500

Renovation Budget$397,760

Loan TypeFix & Flip

- After Repair Value$710,000

- Purchase Price$62,500

- Renovation Budget$397,760

- Loan TypeFix & Flip

Snellville, GA

June 2025

Fix & Flip

Loan Amount

$137,200

After Repair Value$231,000

Purchase Price$120,000

Renovation Budget$40,000

Loan TypeFix & Flip

- After Repair Value$231,000

- Purchase Price$120,000

- Renovation Budget$40,000

- Loan TypeFix & Flip

Albany, NY

June 2025

Fix & Flip

Loan Amount

$257,750

After Repair Value$410,000

Purchase Price$215,000

Renovation Budget$75,000

Loan TypeFix & Flip

- After Repair Value$410,000

- Purchase Price$215,000

- Renovation Budget$75,000

- Loan TypeFix & Flip

Albany, NY

June 2025

Residential Rental Program (Buy & Hold)

Loan Amount

$502,500

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Fitchburg, MA

June 2025

Fix & Flip

Loan Amount

$825,000

After Repair Value$1,100,000

Purchase Price$870,000

Renovation Budget$46,500

Loan TypeFix & Flip

- After Repair Value$1,100,000

- Purchase Price$870,000

- Renovation Budget$46,500

- Loan TypeFix & Flip

Suffolk County, NY

November 2021

Fix & Flip

Loan Amount

$209,300

After Repair Value$335,000

Purchase Price$130,000

Renovation Budget$105,300

Loan TypeFix & Flip

- After Repair Value$335,000

- Purchase Price$130,000

- Renovation Budget$105,300

- Loan TypeFix & Flip

Philidelphia, PA

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Commercial Property Loans

Commercial Property Loans

Securing Single Family Rental Loans in California

When securing single-family rental loans, it’s essential to partner with a lender who understands the nuances of the market. Insula Capital Group has a proven track record of helping investors navigate the complexities of California’s real estate landscape, offering competitive single-family rental financing that positions investors for success.

Here’s what sets us apart:

Extensive Knowledge of the California Market

Our deep expertise in California’s real estate market guarantees you receive accurate and relevant advice.

Customized Financing Plans

We collaborate closely with you to develop financing solutions tailored to your unique needs.

Attractive Interest Rates

Our strong lender connections allow us to provide highly competitive single-family rental mortgage rates in California.

Dedicated Client Support

We prioritize exceptional service, offering guidance and support throughout the entire financing journey.

Contact Insula Capital Group today to learn more about how we can assist with your single-family rental loans in California.

Contact Insula Capital Group for Single Family Rental Financing in California

Whether you’re acquiring your first rental home or expanding an already thriving portfolio, Insula Capital Group is your go-to partner for securing single-family rental property loans in California. We understand that every investor’s needs are unique, which is why we tailor our services to fit your specific goals. With us, you’re not just getting a loan; you’re gaining a team of experts who genuinely want to see your investments succeed.

Here’s what you can expect when you choose Insula Capital Group:

Flexible Terms: We’ll work with you to create loan terms that make sense for your situation—no cookie-cutter solutions here!

Competitive Rates: Why settle for average? We offer some of the most competitive single-family rental mortgage rates in California.

Fast Approvals: Time is money, especially in real estate. That’s why our approval process is designed to move quickly, getting you the funds when you need them.

Personalized Solutions: Your investment goals are unique, and so are our financing options. We’re all about crafting deals that help you win.

Ready to take your real estate ventures to the next level? Schedule a consultation today and discover how our expert single-family rental loan lenders in California can help turn your investment dreams into reality.

Ready to apply for a single family rental loan?

Frequently Asked Questions

Start by filling out our online application form to begin the process of securing your single-family rental mortgage in California.

We provide a range of hard money financing options, including: