Understanding Loan-to-Value (LTV) Ratios: Managing Risk in Hard Money Loan Transactions

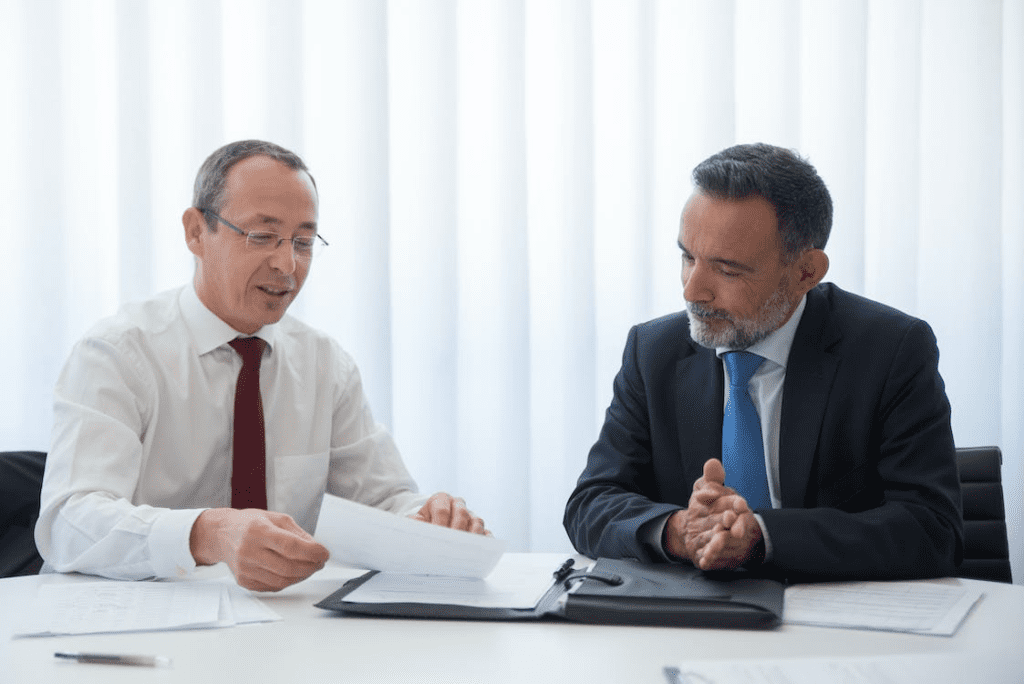

In finance, risk management is paramount. One crucial aspect of assessing risk in lending transactions, particularly hard money lending, is understanding Loan-to-Value (LTV) ratios. LTV ratios serve as a key metric for lenders to evaluate the level of risk associated with a loan. Let’s learn about LTV ratios, their significance in hard money loans, and […]

Understanding Loan-to-Value (LTV) Ratios: Managing Risk in Hard Money Loan Transactions Read More »