The ABCs of Hard Money Loans: What Every Investor Needs to Know

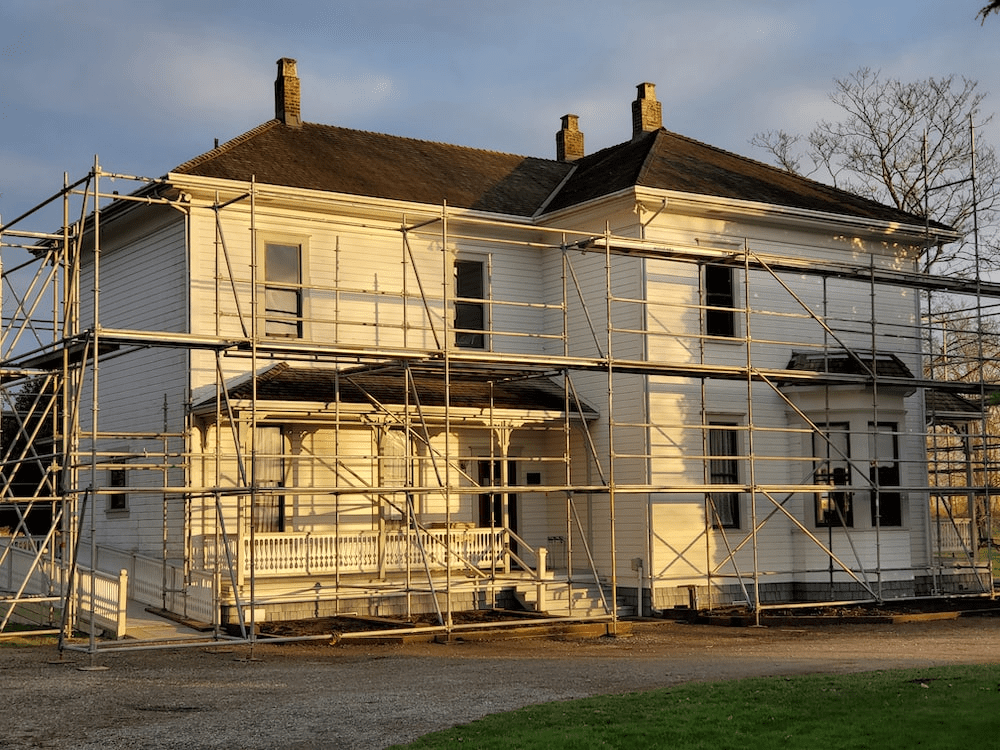

In real estate investing, securing suitable financing stands as a fundamental pillar for success. As investors navigate the path of property acquisition, renovation, or expansion, the need for accessible and efficient financing becomes paramount. Amidst the plethora of financing options available, hard money loans emerge as a compelling choice, offering a unique and agile approach. […]

The ABCs of Hard Money Loans: What Every Investor Needs to Know Read More »