Fix & Flip Loans in Arizona

Incredible landscapes and national parks are not the only things Arizona is known for. The Grand Canyon State offers much more to its residents. With excellent living standards and a booming local economy, Arizona offers many investment opportunities for real estate investors.

As an aspiring property developer or investor, you need to secure an external funding source for your ambitious projects. Whether you’re flipping a distressed property or building a new one from scratch, securing a loan can be highly beneficial.

Learn how Insula Capital Group’s specialized loan programs can help you kick-start your next real estate project.

Work with Reliable Hard Money Lenders in Arizona

What Makes Hard Money Loans Great For Your Project

From quick approvals to incomparable flexibility, hard money loans stand out in many ways. Unlike traditional loans, hard money loans don’t have a lengthy approval process, and therefore, these can get you the funds you need quickly during time-sensitive projects.

Moreover, as hard money lenders, we’re more flexible than traditional institutions, and you don’t necessarily need a high credit score to qualify for a loan—we prioritize the collateral’s value.

And, of course, with a hard money loan, you can finance projects that may generally look too high-risk—they’re definitely a great way to take up opportunities that may seem out of reach.

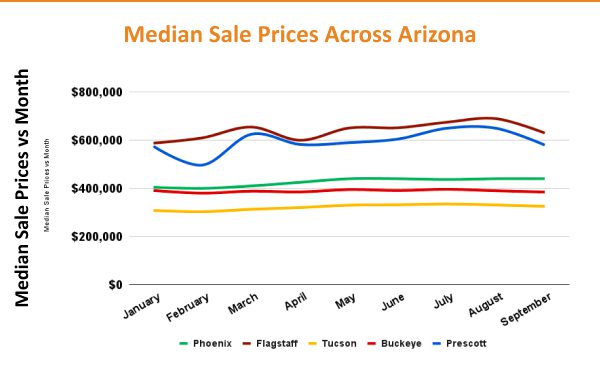

Arizona’s Real Estate Market Insights

Hoping to invest in Arizona’s real estate market soon? Keep the following statistics in mind for excellent decisions!

- Population: 7.276 million

- Median Household Income: $72,581

- Migration Rate (into Arizona): 57%

- Unemployment Rate: 3.60%

- Total Properties Listed: 31,642

- Median Sale Price: 435,500

- Annual Increase:4.6%

- Number of Homes Sold: 7339

- Average Days on Market: 41

- Number of Homes Sold Above List Price: 16.4%

- Interest Rate: 8.5%

- Sale-to-list price ratio: 98.1%

- Foreclosure rate: 1 in every 6316 homes

Just Funded Projects

We are a leading nationwide private lender & real estate investment company.

- Fix & Flip

- July 2022Washington, DC

| Purchase Price: | $255,000 |

| Renovation Budget: | $80,000 |

| Loan Amount: | $296,750 |

| After Repair Value: | $450,000 |

- Fix & Flip

- June 2022Weiser, ID

| Purchase Price: | $170,000 |

| Renovation Budget: | $59,000 |

| Loan Amount: | $207,000 |

| After Repair Value: | $309,000 |

- Fix & Flip

- July 2022Washington, DC

| Purchase Price: | $255,000 |

| Renovation Budget: | $80,000 |

| Loan Amount: | $296,750 |

| After Repair Value: | $450,000 |

- Fix & Flip

- June 2022Weiser, ID

| Purchase Price: | $170,000 |

| Renovation Budget: | $59,000 |

| Loan Amount: | $207,000 |

| After Repair Value: | $309,000 |

Multifamily/Mixed Use

Fix & Flip Calculator

Fix & Flip Financing

New Construction

Hard Money Loan

Residential Rental Program (Buy & Hold)

Private Lending Done Right.

A leading nationwide private lender & real estate investment company.

Why Invest In Arizona

It’s no secret that Arizona has a diverse and robust economy driven by the healthcare, tourism, and technology sectors. This essentially means there’s a constant influx of jobs and, therefore, people. Needless to say, these people moving into the state need a place to stay, which drives up the demand for housing!

Moreover, thanks to the great climate in Arizona, cities like Tucson and Phoenix are always attracting new residents who are looking for affordable housing. This population growth, combined with the limited housing supply, helps to swell property values and offers some incredible rental income potential.

It’s also worth keeping in mind that the state has a very pro-business environment and some amazing tax-friendly policies that further help investors, especially those investing in metropolitan areas.

And, of course, Arizona is known to be the ultimate spot for those looking to retire, and needless to say, more and more seniors are looking to buy homes in Arizona!

Frequently Asked Questions

Applying for a hard money loan in Arizona with Insula Capital Group involves a very straightforward process.

You will start by completing the online application form. Once submitted, the application will be reviewed by our loan experts, who will then reach out to you for a detailed consultation. Our representatives will help you choose a loan program that aligns with your financial goals and will work on tailoring the contract for you.

Once the consultation is complete, we’ll quickly process the loan so that you have access to the funds you need without any delays.

The interest rate for your private money loans is calculated based on several factors after our comprehensive evaluation process. From your payment history to your credit score and other factors, there are several considerations.

What’s important to keep in mind is that there are no fixed interest rates, and we evaluate each application individually to make sure the terms are fair and tailored to your financial profile. Moreover, the entire process is transparent, and the interest rates we come up with are competitive, ensuring you can reach your financial goals without any hurdles.

No, you won’t incur any prepayment penalties when settling your hard money loan with Insula Capital Group ahead of the deadline. We prioritize flexibility and transparency in our lending practices, aiming to provide borrowers with the freedom to manage their finances effectively.

Our commitment to fair and borrower-friendly terms means you can pay off your loan early without worrying about additional charges. At Insula, we value your financial success and offer a hassle-free experience with no hidden fees for responsible and prompt loan repayments.

Top Fix and Flip Loan Cities in Arizona

Get Your Hard Money Loan Approved in 24 Hours

Insula Capital Group is dedicated to providing reliable and transparent lending services. Investors across Arizona can benefit from our quick approval times and flexible loan terms any time they want. Our experts underwrite specialized loan contracts in-house, enabling them to address your specific needs within 24 hours. Feel free to go through our just-funded projectsto learn more!

You can contact our private money lenders to get started.