Cash-Out Refinance Loans in Texas

Investors often face a common hurdle in Texas: accessing capital to seize golden opportunities without sacrificing existing assets. Traditional financing options can be slow, and rigid, not aligning with the dynamic needs of Texas investors.

Cash-out refinance loans offer a strategic advantage, allowing you to tap into the equity you’ve built in your property and transform it into liquid capital.

Imagine having the financial flexibility to acquire that prime Dallas property, renovate your Austin holdings for increased value, or expand your portfolio across the Lone Star State. Cash-out refinance loans empower you to do just that, providing the funds you need while leveraging your existing assets.

Insula Capital Group understands the unique pulse of the Texas market. We offer competitive cash-out refinance rates and a diverse range of cash-out refinance options designed specifically for investors. Our job is to provide the funds you need to transform your upcoming real estate project into a booming success.

Get in Touch

Choose a Team of Experienced Cash-Out Refinance Lenders in Texas

When it comes to overcoming the complexities of cash-out refinance loans, you need a team that knows the terrain, understands the nuances, and can guide you towards your investment goals with confidence.

At Insula Capital Group, we don’t just lend money; we provide seasoned expertise honed over years of working with Texas investors. Our team possesses an intimate knowledge of the local landscape, from the bustling urban centers of Dallas and Houston to the vibrant communities of Austin and San Antonio. We understand the unique challenges and opportunities that each region presents, allowing us to tailor solutions that align precisely with your investment strategy.

We believe that every investor’s journey is different. Whether you’re a seasoned pro with a sprawling portfolio or a rising star with ambitious goals, we take the time to understand your vision. Our team works closely with each investor to structure a cash-out refinance loan that maximizes your leverage and optimizes your cash flow.

Choose a team that doesn’t let you down; choose Insula Capital Group. Call us today to get started.

Is a Cash-Out Refinance Loan the Right Call for Me in Texas?

If you’re a Texas investor with equity built up in your property, a cash-out refinance loan could be the key to unlocking your next level of success. But is it the right call for you?

Consider this: you’ve got your eye on a prime investment property in Austin, a renovation project in Dallas that promises to skyrocket in value, or perhaps you’re simply looking to optimize your cash flow. Traditional financing can be restrictive, but a cash-out refinance allows you to tap into your existing property’s equity, transforming it into liquid capital without having to sell.

Here’s why this strategy resonates with Texas investors:

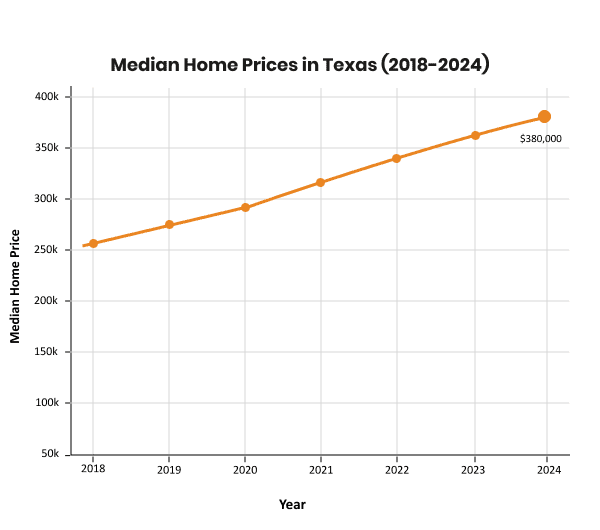

- Market Momentum: Texas boasts some of the nation’s hottest real estate markets, with property values steadily appreciating. This makes cash-out refinancing particularly attractive, as you can leverage your increased equity for further investments.

- Diversification: A cash-out refinance loan can provide the funds to diversify your portfolio, spreading your risk across different property types and locations within Texas.

- Value-Add Opportunities: Renovations and improvements can significantly boost a property’s value. A cash-out refinance loan can fuel these projects, leading to increased rental income or a higher resale price.

Insula Capital Group understands the unique needs of Texas investors. We offer competitive rates, flexible terms, and personalized guidance to help you succeed.

Let’s connect and discuss your goals.

Insights into Cash-Out Refinance Loans in Texas

Considering acash-out refinance loan in Texas? Start by understanding the current landscape:

- Average Cash-Out Refinance Rates in Texas: The average interest rate for a 30-year fixed-rate cash-out refinance in Texas hovers around 7.00%.

- Home Equity in Texas: The average homeowner in Texas has over $280,000 in tappable equity.

- Texas Real Estate Market: The Texas real estate market remains robust, with strong demand and steady appreciation in many areas. This positive trend further enhances the potential benefits of cash-out refinancing.

Cash-Out Refinance Statistics in the Texas

7.00%

Average Cash-Out Refiance Rate(30-year fixed):

$80K - $250K

Average Cash-Out Refinance Loan Amount:

$280,000+

Average Tappable Equity per Homeowner:

$385,000 (approx.)

Median Home Price

35-40%

Percentage of Cash- Out Refinances (of Total Refinances):

620

Minimum Credit Score Requirement (Typically):

Just Funded Projects

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

December 2025

Fix & Flip

Loan Amount

$171,250

After Repair Value$263,000

Purchase Price$125,000

Renovation Budget$65,000

Loan TypeFix & Flip

- After Repair Value$263,000

- Purchase Price$125,000

- Renovation Budget$65,000

- Loan TypeFix & Flip

Albany, NY

December 2025

New Construction

Loan Amount

$650,000

After Repair Value$1,200,000

Purchase Price$500,000

Renovation Budget$606,950

Loan TypeNew Construction

- After Repair Value$1,200,000

- Purchase Price$500,000

- Renovation Budget$606,950

- Loan TypeNew Construction

Fulton, NY

November 2025

Fix & Flip

Loan Amount

$331,500

After Repair Value$510,000

Purchase Price$350,000

Renovation Budget$50,000

Loan TypeFix & Flip

- After Repair Value$510,000

- Purchase Price$350,000

- Renovation Budget$50,000

- Loan TypeFix & Flip

Sarasota, FL

November 2025

Fix & Flip

Loan Amount

$208,440

After Repair Value$296,000

Purchase Price$120,000

Renovation Budget$119,700

Loan TypeFix & Flip

- After Repair Value$296,000

- Purchase Price$120,000

- Renovation Budget$119,700

- Loan TypeFix & Flip

Troy, NY

November 2025

Fix & Flip

Loan Amount

$243,000

Loan TypeFix & Flip

- Loan TypeFix & Flip

Wilmington, NC

November 2025

Residential Rental Program (Buy & Hold)

Loan Amount

$231,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Kingston, PA

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Securing Cash-Out Refinance Loans in Texas

At Insula Capital Group, we’ve streamlined the process to empower you to access your property’s equity with ease and confidence.

Here’s how it works:

- Tailored Consultation: We start by understanding your unique investment goals, financial situation, and the specifics of your Texas property.

- Simplified Application: Complete our straightforward online application, designed for efficiency and convenience.

- Expert Guidance: Our team of experienced professionals provides personalized support throughout the entire process, answering your questions and addressing your concerns.

- Efficient Underwriting: We conduct a thorough yet timely review of your application and financial documents, ensuring a smooth and efficient experience.

- Swift Closing: Once approved, we work diligently to finalize your loan and disburse funds promptly, so you can seize investment opportunities without delay.

Contact Insula Capital Group today to discuss your cash-out refinance needs in Texas. You can also explore our complete set of loan programs to develop a better understanding of which program is right for you.

Ready to apply for a Cash-Out Refinance Loans?

Frequently Asked Questions

Please fill out our online form to begin the application process.

Fuel Your Texas Real Estate Ambitions with Insula Capital Group's Cash-Out Refinance Loans

Are you ready to transform your real estate portfolio?

Here’s what sets us apart:

- Texas-Sized Flexibility: We offer tailored solutions to match your unique investment strategy and financial goals.

- Swiftness: Our streamlined processes ensure you can seize opportunities without delay.

- Competitive Rates: Access the capital you need at rates that amplify your returns.

Schedule a consultation today between 9 am and 5 pm, Monday to Friday. Our team is ready to listen to your needs, answer your questions, and craft a cash-out refinance solution that empowers you to achieve your investment objectives.

Call us nowto get started. You can also explore our recently funded projects for more insights.