Single-family Rental Loans

Investing in a single-family rental property can be a rewarding strategy to build wealth and generate passive income. Rising interest rates have priced out many families out of buying homes and made single-family rentals a highly attractive option. This rise in demand has made single-family rental properties a must-add to any investor’s real estate portfolio. However, securing the necessary financing can be a challenge. At Insula Capital Group, we specialize in providing tailored single-family rental loans designed to meet your unique needs and help you achieve your investment goals.

With our single-family rental loans, you can:

– Purchase a rental property: Acquire a property that meets your investment criteria and generates consistent rental income.

– Refinance existing debt: Lower your interest rate, consolidate debt, or access cash for renovations.

– Fund renovations: Improve your property’s value and rental income by making necessary repairs or upgrades.

Our experienced team is committed to providing exceptional customer service. We’ll work with you to understand your investment strategy, assess your financial situation, and guide you through the loan application process. We’re dedicated to finding the best loan solution for your single-family rental investment, ensuring that you have the resources you need to achieve your financial goals.

Contact us today to learn more about how Insula Capital Group can help you unlock the potential of a single-family rental portfolio.

Work With a Company Dedicated to Boosting Your Single-Family Rental Portfolio

When growing your portfolio, it’s essential to collaborate with a company that understands the complexities of single-family rental financing. Our team specializes in offering tailored rental loans that cater to your investment needs, making us one of the best single-family rental loan lenders. Whether you’re expanding or acquiring new properties, we provide flexible terms and competitive rates to enhance your investment strategy.

We offer a range of single-family rental financing options, including rental investment loans and rental mortgages. Our experienced team works closely with you to understand your financial goals and streamline the lending process. From assessing single-family rental loan requirements to developing customized solutions, we are committed to supporting the growth of your portfolio.

Partner with us for reliable single-family rental property loans and maximize the potential of your investments. Call us today to learn more.

Why Invest in a Single-Family Rental Property

Steady Cash Flow and High Demand

Investing in single-family rental properties can generate a consistent stream of income. With the increasing demand for affordable housing, particularly in suburban areas, single-family rental investment loansare becoming a popular choice among real estate investors. By selecting properties in sought-after neighborhoods, investors can secure long-term tenants and minimize vacancy rates. This stability translates into reliable rental income, making single-family rental financing a smart way to grow your wealth.

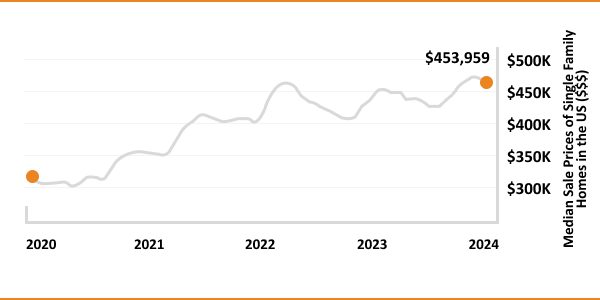

Property Appreciation and Long-Term Gains

One of the primary reasons investors opt for single-family rental property loans is the potential for property appreciation. Over time, well-located properties tend to increase in value, offering substantial returns on investment. Whether you’re financing with a single-family rental mortgage or utilizing rental portfolio financing, your property’s value can rise, allowing for significant financial gains when it’s time to sell.

Easier Management and Tax Benefits

Compared to multifamily units or commercial real estate, single-family rentals are easier to manage, making them ideal for investors looking to maintain simplicity in their portfolios. Additionally, these investments come with notable tax advantages. Expenses like mortgage interest, maintenance, and property management are often tax-deductible, making single-family rental property financing even more appealing for those seeking to optimize their financial strategy.

Secure Your Investment Today

Investing in single-family rental properties offers a balanced approach to long-term financial success. With the right single-family rental loan lenders, you can capitalize on growing market demand, consistent cash flow, and long-term property appreciation. Now is the time to expand your portfolio and secure your financial future.

Insights into Single-Family Rental Loans

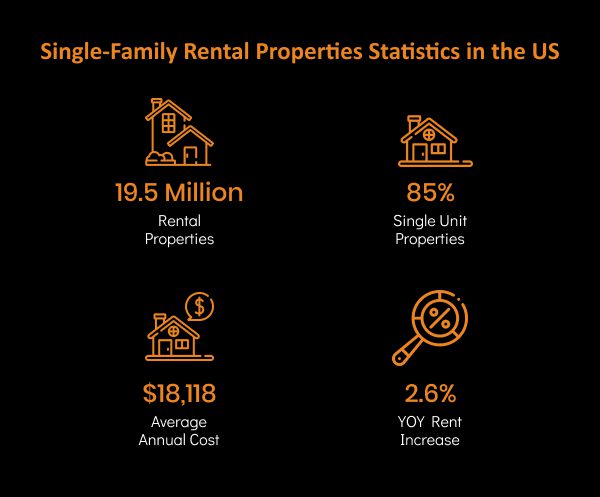

Understanding the scope of single-family rental loans is essential for investors looking to build or expand their portfolios. By comparing single-family rental mortgage lenders with other types of financing, such as traditional home loans, you can choose the right options for your investment goals. Here are some key statistics to consider:

- Total Value of Single-Family Rentals in the US: $4.5 Trillion

- Average Rent Growth for Single-Family Homes: 10.2% in 2023

- Median Income of Single-Family Landlords: $85,000

- Average ROI on Single-Family Rentals: 8%-12%

Just Funded Projects

We are a leading nationwide private lender & real estate investment company.

- Fix & Flip

- July 2022Washington, DC

| Purchase Price: | $255,000 |

| Renovation Budget: | $80,000 |

| Loan Amount: | $296,750 |

| After Repair Value: | $450,000 |

- Fix & Flip

- June 2022Weiser, ID

| Purchase Price: | $170,000 |

| Renovation Budget: | $59,000 |

| Loan Amount: | $207,000 |

| After Repair Value: | $309,000 |

- Fix & Flip

- July 2022Washington, DC

| Purchase Price: | $255,000 |

| Renovation Budget: | $80,000 |

| Loan Amount: | $296,750 |

| After Repair Value: | $450,000 |

- Fix & Flip

- June 2022Weiser, ID

| Purchase Price: | $170,000 |

| Renovation Budget: | $59,000 |

| Loan Amount: | $207,000 |

| After Repair Value: | $309,000 |

Multifamily/Mixed Use

Fix & Flip Calculator

Fix & Flip Financing

New Construction

Hard Money Loan

Residential Rental Program (Buy & Hold)

Private Lending Done Right.

A leading nationwide private lender & real estate investment company.

The Advantage of Private Single-Family Rental Loans

Flexible Loan Terms

One of the most significant advantages of single-family rental portfolio lenders is the flexibility they offer. Private lenders can tailor loan terms to fit the specific needs of an investor, providing more customization than traditional rental mortgage lenders. This flexibility is crucial for investors working on complex projects or managing multiple properties.

Faster Processing and Approvals

Private single-family rental financingoften comes with faster approval times, allowing investors to access funds quickly. This is particularly beneficial for time-sensitive opportunities where quick action is necessary to secure a property or close a deal.

Competitive Interest Rates

Private lenders can offer more competitive rates, especially for those with strong credit or valuable assets. These competitive rates make **single-family rental investment loans** more affordable, reducing long-term costs and increasing the profitability of your rental portfolio.

Personalized Service

Working with a private lender like Insula Capital Group provides a more personalized experience. Our team is dedicated to understanding your needs and providing customized solutions that help you meet your investment goals. With a focus on customer service, we stand out as one of the best single-family rental loan lenders in the market.

How to Find the Best Rates for Single-Family Rental Loans

When looking for the best rates for single-family rental property financing, it’s essential to compare offers from multiple lenders. Factors such as creditworthiness, loan-to-value ratios, and the specific property being financed all impact the rates you’ll receive. At Insula Capital Group, we take a customized approach to lending. We carefully evaluate each investor’s unique situation to provide the most competitive rates and terms available.

Our team’s experience in single-family rental financing options allows us to offer tailored solutions that fit your needs, whether you’re acquiring new properties or refinancing an existing portfolio. Contact us today to explore how we can help you secure the most favorable terms for your next investment.

Reach Out to Insula Capital Group

Ready to expand your single-family rental portfolio? Insula Capital Group is here to help you secure the financing you need.

We offer: Competitive interest rates, Flexible loan terms, No prepayment penalties, Streamlined application process

Contact us today for a personalized consultation to learn how our single-family rental loan lenders can support your investment strategy. Whether you’re new to real estate or a seasoned investor, we’ll work with you to find the perfect solution for your needs. Visit our website today to get started!

Frequently Asked Questions

We offer competitive rates, flexible terms, and fast approvals tailored to meet the needs of investors. Our expertise in single-family rental loan requirements ensures a smooth and efficient funding process.

We provide a variety of single-family rental property loan options, including portfolio financing, new acquisition loans, and refinancing for existing properties.