Multifamily Bridge Loans in New York

Get in Touch

Why Use Multifamily Bridge Property Loans in New York?

Multifamily property bridge loans in New York provide several strategic advantages for investors looking to grow their portfolios or complete critical projects. Here’s why these loans are often the financing tool of choice for real estate investors.

1. Seize Opportunities in a Competitive Market

The New York real estate market is highly competitive, with desirable properties selling fast. Multifamily bridge loans in New York allow investors to act quickly and secure properties before competitors can. Whether you’re purchasing a distressed property, taking advantage of foreclosure, or seizing an off-market deal, bridge loans provide the financial agility needed to stay ahead.

2. Rehabilitate and Stabilize Properties

Many multifamily properties in New York may require significant rehabilitation or stabilization before they qualify for permanent financing. Multifamily bridge loans allow investors to finance the necessary repairs, upgrades, or tenant repositioning efforts, improving the property’s cash flow and overall value.

3. Avoid Financial Gaps

In some cases, a property may be under contract for purchase, but the investor’s permanent financing is not yet available. A multifamily bridge loan can cover this gap, allowing the deal to proceed without delays or risks to the contract.

4. Renovation and Value-Add Strategies

Investors who implement value-add strategies can use multifamily bridge financing in New York to cover the costs of renovations and upgrades. Once the property has been improved, it can generate higher rental income and qualify for better long-term financing terms.

5. Facilitate Property Flips

For investors focused on buying, renovating, and quickly selling multifamily properties, bridge loans are an ideal financing tool. The short-term nature of these loans aligns perfectly with the fast-paced timeline of property flips, allowing for quick transitions between buying, improving, and selling.

Contact our Multifamily bridge loan lenders for more information.

How Insula Capital Group’s Multifamily Bridge Loans in New York Work

The process of securing a multifamily bridge property loan with Insula Capital Group is efficient, allowing you to focus on your investment while we handle the financing.

1. Loan Application

The first step is to submit a loan application detailing the property and your investment goals. At Insula Capital Group, we offer a smooth application process that minimizes paperwork.

2. Property Evaluation

As multifamily bridge loans in New York are asset-based, the property itself is the primary focus of our evaluation. We assess the property’s current value, its potential after renovations, and the overall viability of your investment strategy.

3. Loan Terms and Approval

Once the property is evaluated, we tailor the loan terms to fit your needs. Our team will present you with a clear outline of the loan’s structure, interest rates, repayment options, and fees. If everything aligns with your investment plan, we proceed to approval.

4. Funding

After approval, funds are typically released quickly. This is one of the main advantages of working with multifamily bridge loan lenders in New York like Insula Capital Group — our funding process is designed to keep pace with the fast-moving real estate market.

5. Exit Strategy

As your project progresses, we work with you to ensure a smooth transition to your long-term financing or property sale. Whether your exit strategy involves refinancing, selling the property, or converting to a traditional loan, we are here to support you every step of the way.

Connect with our team for any questions.

Insights into Multifamily Bridge Loans in New York

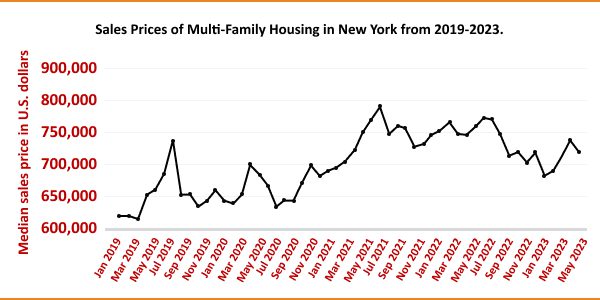

Are you considering multifamily property bridge loans in New York? Check out these statistics beforehand.

- Average Multifamily Property Price in New York: $2,144,699

- Median Rent for Multifamily Units: $3,795

- Estimated Annual Return on Investment (ROI): 9%

- Average Multifamily Bridge Loan Interest Rate: 10.79%

Key Statistics for Multifamily Bridge Loans in New York

$2,144,699

Median Multifamily Property Price

$3,795

Median Rent Price

9%

Median ROI on Multifamily Properties

13-61

Price-To-Rent Ratio

Just Funded Projects

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

December 2025

Fix & Flip

Loan Amount

$171,250

After Repair Value$263,000

Purchase Price$125,000

Renovation Budget$65,000

Loan TypeFix & Flip

- After Repair Value$263,000

- Purchase Price$125,000

- Renovation Budget$65,000

- Loan TypeFix & Flip

Albany, NY

December 2025

New Construction

Loan Amount

$650,000

After Repair Value$1,200,000

Purchase Price$500,000

Renovation Budget$606,950

Loan TypeNew Construction

- After Repair Value$1,200,000

- Purchase Price$500,000

- Renovation Budget$606,950

- Loan TypeNew Construction

Fulton, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Why Choose Insula Capital Group for Multifamily Bridge Loans in New York?

As the leading Multifamily bridge loans lender in New York, Insula Capital Group has an efficient process for borrowers seeking flexible financing solutions. Our real estate financing allows us to provide tailored loan structures that meet your specific investment goals.

1. Fast Approvals

We understand that time is valuable in real estate. Our experienced team works quickly to approve and fund multifamily bridge loans, ensuring that you have the capital you need when you need it.

2. Tailored Loan Structures

Insula Capital Group offers customized loan solutions that align with your investment strategy. Our team will work with you to structure a loan that fits your timeline and budget.

3. Expert Guidance

Navigating real estate financing can be challenging, especially in a market as competitive as New York. Our team of financial experts provides personalized guidance, helping you make informed decisions and maximize your investment returns.

4. Competitive Rates

While multifamily bridge loans in New York typically have higher interest rates than traditional loans, Insula Capital Group strives to offer competitive rates that reflect the unique needs of our clients. We’re committed to providing fair, transparent loan terms that help you achieve your financial objectives.

Ready to apply for a multi-family bridge loan?

Frequently Asked Questions

Fill out our online application form to get started on multifamily bridge financing in New York.

We provide hard money financing for the following services:

Reach Out to Us for Multifamily Bridge Property Loans in New York

At Insula Capital Group, we understand that navigating multifamily bridge financing in New York can be challenging. Our team provides personalized support to help you find the right financing solutions for your real estate investments. Whether you have questions about our loan products, need assistance with the application process, or want to discuss your unique investment strategy, we’re here to help.

Get in touch with us or visit our website to gather more information about our real estate financing across the US.