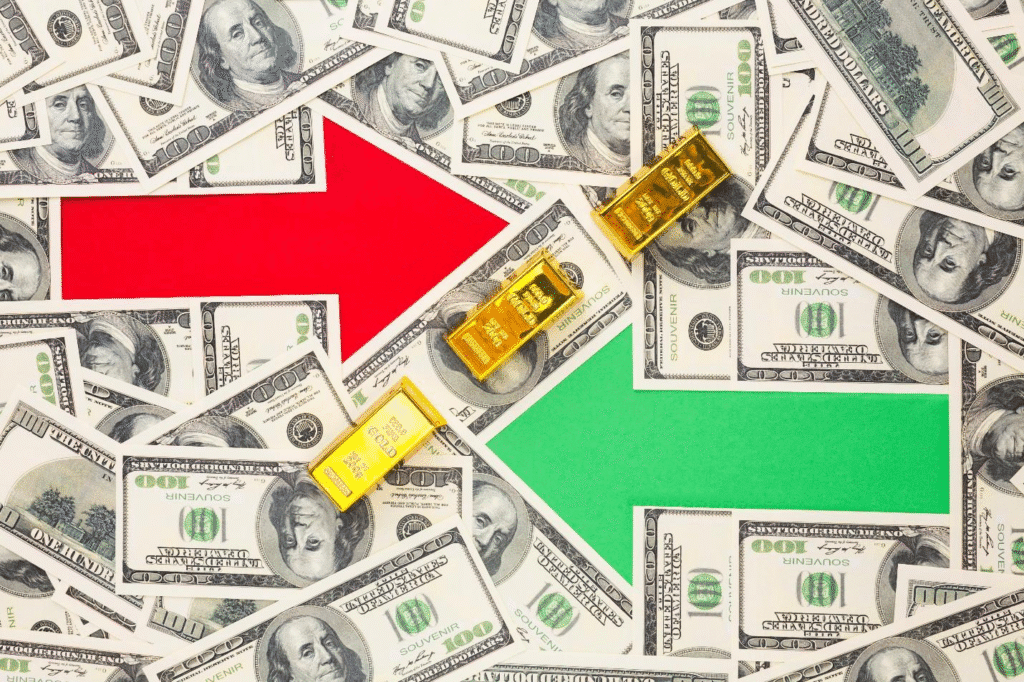

How to Qualify for a Cash-Out Refi—Even With Average Credit

In a world of rising expenses and mounting credit card debt, many homeowners are seeking smarter ways to access funds without taking on high-interest loans. One increasingly popular solution is a cash-out refinance with an average credit score. While great credit can open more doors, you don’t need perfect financials to qualify. With the right […]

How to Qualify for a Cash-Out Refi—Even With Average Credit Read More »