Private Money Lenders | Hard Money Loans in California

The Golden State is known for many things, with its incredible living standards and bustling lifestyle being among the best. Millions of people flock to California in search of better opportunities every year. Real estate investors are among the many people who can benefit from California’s booming local markets.

If you are an investor wanting to undertake more real estate development projects, you’re in the right place! Thanks to lending companies like Insula Capital Group, you can quickly secure private and hard money loans in California. Learn how you can benefit from our specialized loan programs below.

Get in Touch

Close Your Deals On Time with Our Private Money Loans in California

When you have a great property development idea, you shouldn’t have to wait months to secure funding. Investors frequently undertake projects like property flips and new property constructions. They cannot close the deals for such projects unless they can prove they have the funding for it.

Our team of funding experts helps investors across California avoid such problems. Our hard and private money loan programs are quick, seamless, and tailored to your requirements. We offer new construction loans, fix & flip loans, residential rental loans, and multifamily/mixed-use loans for different projects. Apply online today and get your loan approved in one day!

Why Are Hard Money Loans The Perfect Solution?

It’s no secret that hard money loans offer distinct advantages for borrowers looking for swift and flexible financing solutions.

One of the key benefits is the expedited approval process that allows you, as the borrower, to secure funds quickly, often within days. Unlike traditional loans, hard money lenders value collateral over credit history, which makes the loans accessible to those with less-than-ideal credit scores.

Additionally, hard money loans are incredibly versatile, which means they work for a diverse range of real estate projects. From fix-and-flip projects to property acquisitions, hard money loans are the perfect choice for it all.

California’s Real Estate Market Insights

California’s real estate market is thriving, but make sure to keep the following stats in mind when investing:

- Population: 39.24 million

- Median Household Income: $91,905

- Unemployment Rate: 4.9%

- Average Home Prices: $743,435

- Average Rent Prices: $2750

- Median Days Before Sale: 31

- Median Sale Price: $793,400

- Annual Increase: 8.3%

- Homes Sold Above List Price:41.6%

- Active Listings: 76,018

- Foreclosure Rate: 0.02% increase

- Median Real Property Tax Rate: 0.71 per $1000

Just Funded Projects

June 2022

Fix & Flip

- Weiser, ID

Purchase Price

170,000

Renovation Budget

59,000

Loan Amount

207,000

After Repair Value

309,000

July 2022

Fix & Flip

- Washington, DC

Purchase Price

255,000

Renovation Budget

80,000

Loan Amount

296,750

After Repair Value

450,000

December 2021

Fix & Flip

- Centerreach, NY

Purchase Price

340,000

Renovation Budget

46,050

Loan Amount

321,300

After Repair Value

459,000

November 2021

Fix & Flip

- Hartford, CT

Purchase Price

149,000

Renovation Budget

70,000

Loan Amount

196,650

After Repair Value

290,000

November 2021

Fix & Flip

- Philidelphia, PA

Purchase Price

130,000

Renovation Budget

105,300

Loan Amount

209,300

After Repair Value

335,000

November 2021

Fix & Flip

- Philidelphia, PA

Purchase Price

62,000

Renovation Budget

60,000

Loan Amount

106,500

After Repair Value

176,000

November 2021

Fix & Flip

- North Babylon, NY

Purchase Price

310,000

Renovation Budget

32,750

Loan Amount

311,750

After Repair Value

495,000

November 2021

Fix & Flip

- East Hampton, NY

Purchase Price

1,250,000

Renovation Budget

577,465

Loan Amount

1,577,465

After Repair Value

2,487,500

November 2021

Fix & Flip

- Jersey City, NJ

Purchase Price

525,000

Renovation Budget

240,650

Loan Amount

848,800

After Repair Value

831,000

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Commercial Property Loans

Commercial Property Loans

Why Invest in California

California’s real estate market has always been considered attractive for investments due to several factors. The state boasts the world’s largest and most diverse economies and, therefore, offers a robust economic foundation, particularly in technology and entertainment hubs like San Francisco and Los Angeles.

Moreover, there are always people moving to California fueling demand for housing, potentially leading to increased property values. It’s also renowned for its innovation and tech potential, attracting skilled professionals, who in turn contribute to a strong rental market.

And, of course, the state’s desirable climate, diverse lifestyle options, and popular tourist attractions make it an appealing place to live, fostering a stable demand for housing all the time.

It’s also worth keeping in mind that with some of the top universities, there is a constant influx of students, especially international students who continue settling in the state after completing their studies—and they need homes to live.

Ready to apply for a hard money loan?

Frequently Asked Questions

Approval and experience requirements typically vary between different loan programs; each loan type has its own specific qualification criteria. We also understand that every borrower and their respective projects are unique, and our programs and their requirements reflect that and cater to a diverse range of experience levels.

So, regardless of your experience, we encourage all investors to explore our various loan programs and reach out to us for more information, especially if you’re unsure about which program aligns with your financial goals. We can discuss the experience requirements in greater detail before you find the perfect fit for you.

The interest rate on your hard money loan is calculated keeping many factors into account. At Insula Capital Group, we have a very holistic approach to this; we assess everything from your credit score to payment history and other essentials. This results in a very comprehensive evaluation that reflects your unique financial profile while keeping the interest rate competitive.

We also believe in complete transparency during this process, keeping you aware of how each factor contributes to the resulting interest rate.

At Insula Capital Group, we’ve devised an extremely efficient and streamlined funding process that we’re incredibly proud of. The process is designed to help our clients meet their financial needs with speed.

All you really need to do is reach out to our experienced team,whichwill work closely with you on the application and approval stages.

Once the application is submitted, we’ll help you obtain your contract and finalize the loan quickly. This entire process is expedited to ensure you have the funding you need without any unnecessary delays.

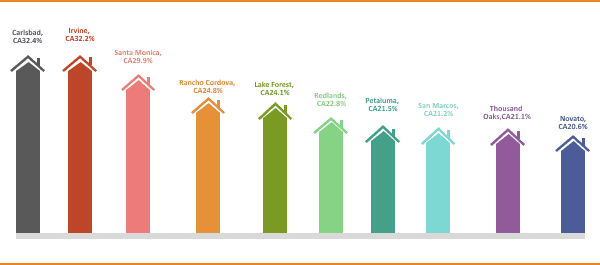

Top Hard Money Lenders Loan Cities in California

Benefit from Insula Capital Group's Seamless Approval Process

Insula Capital Group has helped US real estate investors find their ideal financing solutions for over 30 years. Our team comprises passionate and skilled lending specialists who create specialized contracts per each client’s unique project requirements. We value your time, so we approve loans within 24 hours and fund them within five business days.

If you are still hesitant about working with us, check out our just-funded projects to see how we work! You can also contact our hard/private money lenders directly for more information.