Cash-Out Refinance Loans in New York

In the concrete jungle of New York real estate, where opportunity and competition collide, smart investors need every advantage they can get. Cash-out refinance loans offer a strategic lifeline, allowing you to tap into your property’s equity and fuel your next big move.

Whether you’re eyeing a prime Brooklyn brownstone, a lucrative Manhattan development project, or expanding your portfolio across the Empire State, a cash-out refinance loan can provide the capital infusion you need.

Insula Capital Group understands the unique pulse of the New York market. We offer competitive New York cash-out refinance rates and a variety of cash-out refinance options tailored to your specific investment goals.

Are you ready to conquer the New York real estate landscape with Insula Capital Group? Our team is a call away!

Get in Touch

Work with Qualified Cash-Out Refinance Lenders in New York

In the high-stakes arena of New York real estate, having the right financial partner can make all the difference.

When it comes to cash-out refinance loans, don’t settle for just any lender. Choose a team that speaks your language, understands your ambitions, and possesses the expertise to navigate the unique complexities of the New York market.

Insula Capital Group isn’t just another name on Wall Street. We’re a team of seasoned professionals with a deep-rooted understanding of the city’s diverse neighborhoods, its regulatory landscape, and the pulse of its ever-evolving real estate scene. We know that a brownstone in Brooklyn demands a different approach than a high-rise condo in Manhattan, and we tailor our cash-out refinance solutions accordingly.

We take the time to understand your individual investment goals, whether it’s acquiring a multi-family property in Queens, renovating a historic building in Greenwich Village, or expanding your portfolio across the boroughs. We work closely with you to structure a cash-out refinance loan that aligns with your vision.

Are you ready to transform your real estate business into an empire? Call our experts today.

Is a Cash-Out Refinance Loan Right for Me?

Could a cash-out refinance loan be your key to unlocking the next level of success? If you’re a property owner with equity built up in your New York real estate, the answer is a resounding yes.

Whether you’re considering renovating a pre-war building in Manhattan or expanding your portfolio across the boroughs, a cash-out refinance loan can provide the financial fuel you need.

Why is this a particularly compelling option for New York investors? The city’s dynamic market, with its high property values and competitive landscape, makes leveraging existing assets a smart strategy. A cash-out refinance loan allows you to capitalize on your property’s appreciation, accessing funds without having to sell your prized asset.

Furthermore, with interest rates still relatively favorable, refinancing could potentially lower your monthly payments or consolidate high-interest debts.

But it’s not just about the numbers. Insula Capital Group understands the unique needs of New York investors. We offer competitive rates, flexible terms, and personalized guidance to each investor. Our streamlined process ensures you can seize opportunities without delay, while our expertise helps you make informed decisions that align with your investment goals.

Ready to explore the possibilities?

Contact Insula Capital Group today and discover how a cash-out refinance loan can empower your New York real estate journey.

Insights into Cash-Out Refinance Loans in New York

Before you tap into your property’s equity with a cash-out refinance loan, take some time to understand the wider landscape:

- Average Cash-Out Refinance Rates in New York: The average interest rate for a 30-year fixed-rate cash-out refinance in New York is hovering around 7.35%.

- Home Equity in New York: The average homeowner in New York currently has approximately $350,000 in tappable equity.

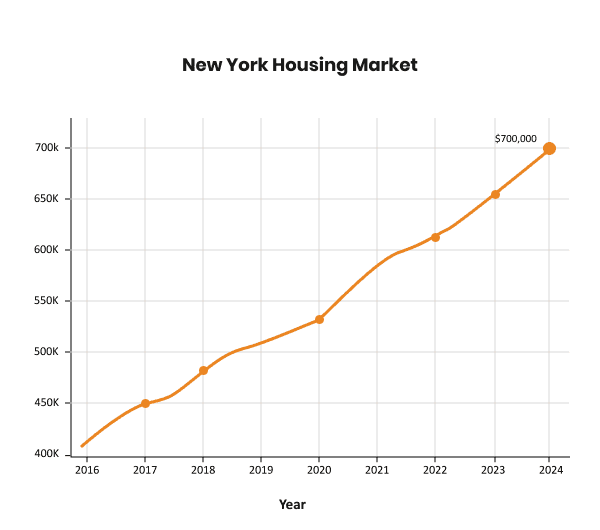

- New York Real Estate Market: The New York real estate market remains robust.Property values in many areas, particularly in New York City, continue to appreciate.

Cash-Out Refinance Statistics in the New York

7.35%

Average Cash-Out Refiance Rate(30-year fixed):

$150K - $400K

Average Cash-Out Refinance Loan Amount:

$350,000+

Average Tappable Equity per Homeowner:

$700,000 (approx.)

Median Home Price

45-50%

Percentage of Cash- Out Refinances (of Total Refinances):

640

Minimum Credit Score Requirement (Typically):

Just Funded Projects

February 2026

Fix & Flip

Loan Amount

$248,869

After Repair Value$409,000

Purchase Price$145,000

Renovation Budget$147,787

Loan TypeFix & Flip

- After Repair Value$409,000

- Purchase Price$145,000

- Renovation Budget$147,787

- Loan TypeFix & Flip

Decatur, GA

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

December 2025

Fix & Flip

Loan Amount

$171,250

After Repair Value$263,000

Purchase Price$125,000

Renovation Budget$65,000

Loan TypeFix & Flip

- After Repair Value$263,000

- Purchase Price$125,000

- Renovation Budget$65,000

- Loan TypeFix & Flip

Albany, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

How to Secure a Cash-Out Refinance Loan in New York

At Insula Capital Group, we’ve streamlined the process to empower you to access your property’s equity with ease and confidence.

Our Process:

- Personalized Consultation: We begin by understanding your unique investment goals and financial situation.

- Streamlined Application: Complete our straightforward online application, designed for efficiency.

- Expert Guidance: Our team provides personalized support and answers your questions throughout the process.

- Efficient Underwriting: We conduct a thorough yet timely review of your application and financial documents.

- Swift Closing: Once approved, we work diligently to finalize your loan and disburse funds promptly.

Contact Insula Capital Group today and let us help you secure the cash-out refinance loan you need to achieve your investment goals.You can also review our complete set of loan programs to understand what’s right for you.

Ready to apply for a Cash-Out Refinance Loans?

Frequently Asked Questions

Please fill out our online form to begin the application process.

We offer a range of loans to real estate investors across New York, including:

Secure Capital in the Capital of the World: Cash-Out Refinance Loans with Insula Capital Group

New York City. The epicenter of finance, culture, and real estate. To thrive in this competitive market, investors need a financial partner who understands the unique demands of the Big Apple.

Insula Capital Group is that partner.

Here’s how we stand out:

- NYC Savvy:We have an intimate understanding of New York’s diverse boroughs, property types, and investment landscape.

- Investor-Centric Approach:We structure our loans with your specific investment goals in mind.

- Competitive Edge:We offer competitive cash-out refinance rates in New York to ensure you have the financial leverage you need to succeed.

Schedule a consultation between 9 am and 5 pm, Monday to Friday. We’re eager to discuss your investment objectives and craft a cash-out refinance solution that empowers you to conquer the New York real estate market!

You can also explore our recently funded projects for more insights.